The Hyperliquid token’s recent price movements have been a tale of unfulfilled promises, as the cryptocurrency failed to sustain its bullish momentum. Despite significant developments, HYPE slipped after recently hitting an all-time high.

Significantly, asset manager 21Shares has launched the first-ever HYPE exchange-traded product. However, this major development couldn’t propel the token’s price higher or maintain the upward momentum, resulting in a loss of gains.

Hyperliquid Price Hits an All-Time High

On August 27, 2025, HYPE hit an all-time high of $49.798, marking a notable uptick of 11.77% in a day. Despite the broader crypto market volatility, the token continued to surge and broke past $50, managing to hold its momentum for a while. This marked a massive 430% from its price in April and a 15x surge from its initial price at $3.

According to DefiLlama data, Hyperliquid saw a significant surge in derivatives volume in August, reaching over $357 billion, up from $319 billion in July. It also rose by almost 10x compared to the same period last year.

Additionally, spot trading volumes hit a record high, exceeding $3 billion last week. This remarkable activity resulted in substantial revenue for the protocol, with Hyperliquid generating $105 million in trading fees in August, its highest earnings this year.

21Shares Launches Hyperliquid ETP

Earlier today, 21Shares, a prominent asset manager, launched the 21Shares Hyperliquid ETP (HYPE) on the SIX Swiss Exchange. This product offers investors institutional-grade access to Hyperliquid.

With a fee of 2.50%, the 21Shares Hyperliquide ETP provides a unique opportunity for the community to tap into HYPE’s potential. “Hyperliquid is doing for decentralized derivatives what the best ETF issuers did for traditional markets – building at the infrastructure level with a long-term vision,” said Mandy Chiu, Head of Financial Product Development at 21Shares. Chiu added,

“Its growth has been nothing short of extraordinary, and the underlying economics are among the most compelling we’ve seen in the space. With HYPE, we’re giving investors an institutional-grade way to access one of the fastest-growing corners of crypto – all through the familiar ETP structure they trust.”

HYPE Price Dips

Despite this groundbreaking development that had the potential to push the HYPE price to unprecedented levels, the token plunged to a daily low of $43.8. Though the price slightly recovered, it is still trading in the red, sparking investor concerns.

At present, Hyperliquid is valued at $44.84, down by 8% in the last 24 hours. However, the token is up by 6.75% and 4.5% over the past week and month, respectively.

Traders and investors are becoming increasingly cautious about Hyperliquid’s potential trajectory. This is reflected in the current negative sentiment as the 24-hour trading volume has dropped to $14.83 billion, with an 8% dip.

Will Hype Surge or Slump?

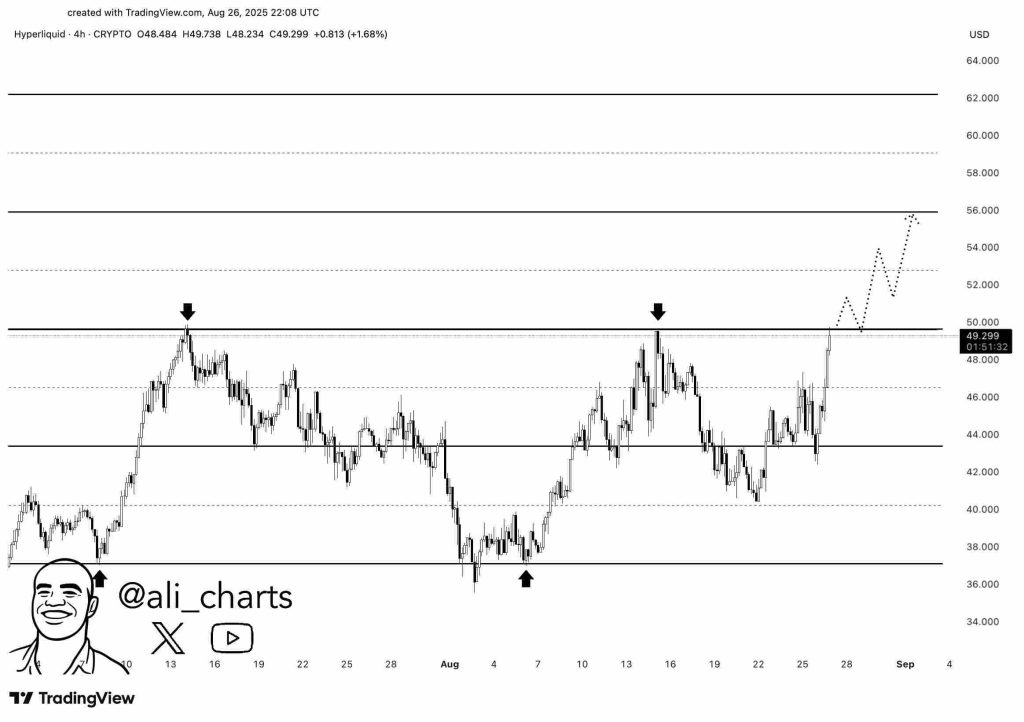

On August 27, before the token hit its ATH, analyst Ali predicted that the token is poised for a bullish resurgence. According to his analysis, Hyperliquid was expected to reach a new record high of $55 if it broke past $50. Though the cryptocurrency successfully breached the resistance level, it ultimately failed to sustain the momentum and retreated, resuming its downward trend.

Nonetheless, there optimism surrounding Hyperliquid remains palpable. Investors and traders are closely watching the token’s movements, anticipating a potential rebound. Many believe that Hyperliquid will once again demonstrate its resilience and sustainability, fueled by its strong fundamentals and growing adoption.

Read More: Cronos (CRO) Price Skyrockets After Trump Media’s $6.4B Treasury Deal