Key Highlights:

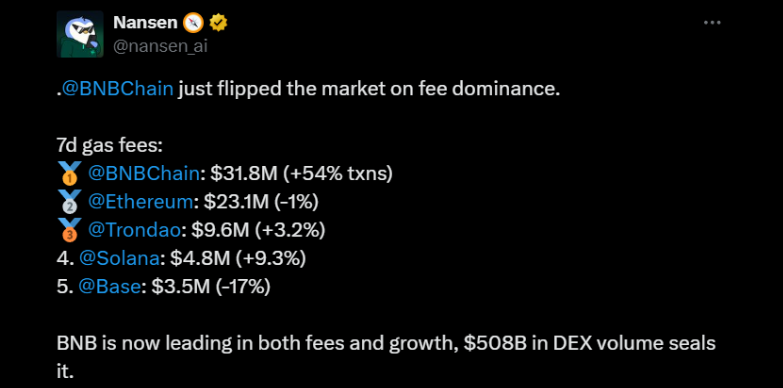

- BNB Chain leads in gas fees over a period of 7 days.

- BNB Chain records $508 billion in DEX volume.

- Justin Sun’s tweet pushed CZ to highlight BNB’s top-3 market cap and strong ecosystem.

BNB Chain has surpassed Ethereum and has taken lead in network fee dominance, which indicates a significant growth in blockchain activity and ecosystem growth. Data from Nansen indicates that BNB Chain has managed to generate $31.8 million in gas fees over the last 7 days, and with this figure it has outpaced Ethereum’s $23.1 million in gas fees.

The figure also indicates that there is a 54% increase in BNB Chain’s transaction volume from the previous week, while Ethereum has slipped by 1%. Other networks trailed behind as Tron logged $9.6 million (+3.2%), Solana $4.8 million (+9.3%), and Base $3.5 million (-17%).

These numbers simply indicate how BNB Chain is expanding its role in DeFi and smart contracts. Higher gas fees point to growing usage across decentralized exchanges, gaming, and liquidity protocols. In fact, BNB Chain processed $508 billion in DEX volume last week, which solidifies its lead in throughput and fee generation.

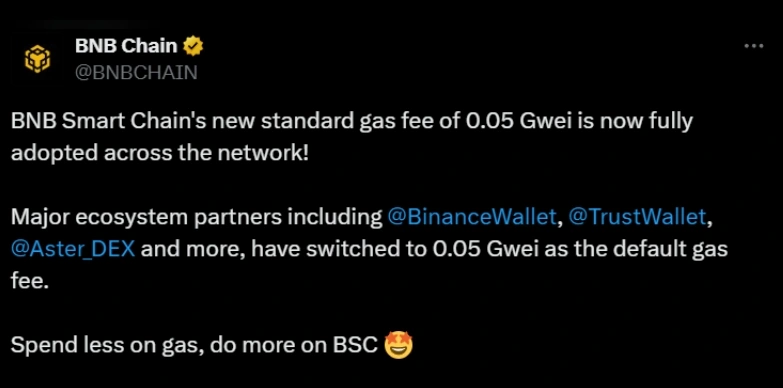

Also recently, BNB Chain lowered its gas costs, which enabled more transactions, and that surge in activity drove fees higher overall. This also indicates that BNB Chain’s scaling model and low-cost design are drawing retail and institutional users away from the rival networks.

Industry Buzz Over BNB Listing Precedes Fee Milestone

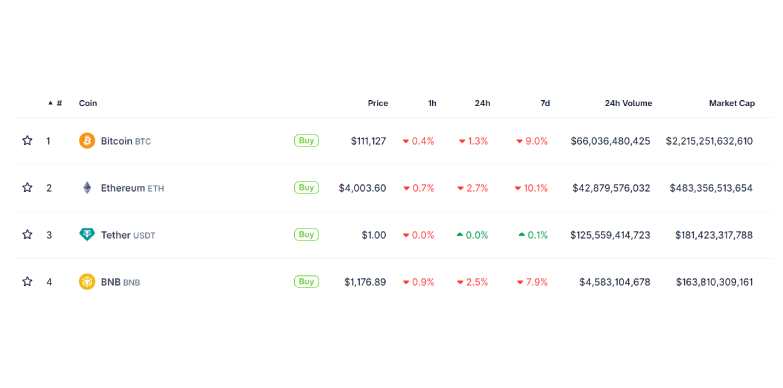

Before BNB Chain’s fee dominance announcement, a social media exchange had ignited discussion about BNB’s presence on major exchanges. Tron founder Justin Sun tweeted on X, tagging Binance CEO Changpeng Zhao (CZ): “BNB on coinbase. What do you think @cz_binance?” CZ then responded back appreciatively and tweeted back with the picture of Justin Sun’s tweet: “Woke up to this. Thanks for the support from industry peers. Listing a 3rd largest market cap crypto should be a no-brainer. Excellent liquidity, volume and ecosystem. Not listing it is a loss for the exchange themselves. #BNB, keep building!”

At the time, BNB was the third-largest cryptocurrency by market capitalization, exceeding $85 billion. The combination of this market position and the heightened public disclosure likely contributed to the subsequent surge in BNB Chain’s network fee dominance. At press time, it is the fourth-largest capitalization with a market cap exceeding $160 billion as per CoinGecko.

Ecosystem Implications and Market Reaction

The rise in fees carries several implications. High network fees indicate that the user activity on the blockchain is strong and demand for block space, which is a sign of a healthy network economy. For BNB Chain, this points to sustained engagement across decentralized applications, especially in DEXs and GameFi, which have grown steadily in 2025.

It is also notable that BNB’s DEX volume was $508 billion in the past 7 days, which shows a strong market resilience amid market volatility and reflects liquidity moving to low-cost networks that handle high-frequency transactions efficiently.

Ethereum still leads in the total value locked (TVL), but a gap is observed in user activity with BNB Chain. Tron and Solana, on the other hand, remain competitive all because of cross-border stablecoin use and fast transaction speeds.

Overall, Nansen’s data shows a maturing multi-chain ecosystem where performance, cost efficiency, and liquidity matter more than brand legacy. BNB Chain’s top spot in fee and volume metrics cements its status as one of the most actively used blockchains worldwide.

Also Read: Coinbase Prepares for BNB Integration Amid Market Correction