Key Highlights

- Bitcoin has plunged below $108,000 on Thursday after a major Bitcoin ETF outflow

- The drop comes after U.S. President Donald Trump said that the country is in a trade war with China

- However, the market is also seeing some positive developments as Trump revealed his upcoming meeting with the Russian President to resolve the conflict with Ukraine

The biggest cryptocurrency, Bitcoin (BTC), crashed below the $108,000 support level with a 1.4% crash. This fall comes a day after the U.S. President Donald Trump made a huge remark, saying that the country is in a trade war with China.

At the time of writing, Bitcoin is trading at around $108,637.15 with a market capitalization of $2.16 trillion. Despite this drop, the community sentiment on CoinMarketCap still displays 82% are still bullish on it.

Institutional Investment Slows Down as Bitcoin ETFs See Major Outflow

The substantial rally in Bitcoin’s value for much of 2025 was significantly driven by institutional investments. Investment products like exchange-traded funds, hedge funds, and corporate buyers have provided solid backing for the market.

However, data from recent weeks show that this trend of institutional investment is gradually cooling off.

One of the major signals of this change is the recent data on inflows into Bitcoin ETFs. For example, Bitcoin ETFs experienced $104.1 million in net outflows on Wednesday, according to Farside.

A portion of these institutional funds is now being redirected toward conventional safe-haven investments, including gold and government bonds.

Market sentiment has turned cautious as Bitcoin enters another period of downward pressure. A sense of unease is spreading among investors after Bitcoin fell below $108,000.

This fall has sparked concern across the community that the digital asset market may be heading toward a new phase of instability similar to 2022. This recent decline has erased billions of dollars in market value and has led to discussions of a potential “early Black Friday” event for the cryptocurrency market.

For an extended period, Bitcoin has successfully maintained its position above the crucial $112,000 support level, which has bolstered trader confidence in the continuity of the bull market.

However, a sharp sell-off that occurred earlier this week has undermined that assurance. With values falling to nearly $107,568, some market experts are raising an alarm that the foundation for a more major correction may be developing.

Major Developments in the Global Financial Market

The downturn is coming amid the major developments in the global financial markets. Apprehensions are being fueled by escalating trade disputes between the U.S. and China, concerns over potential interest rate hikes, and alerts about a possible worldwide market adjustment.

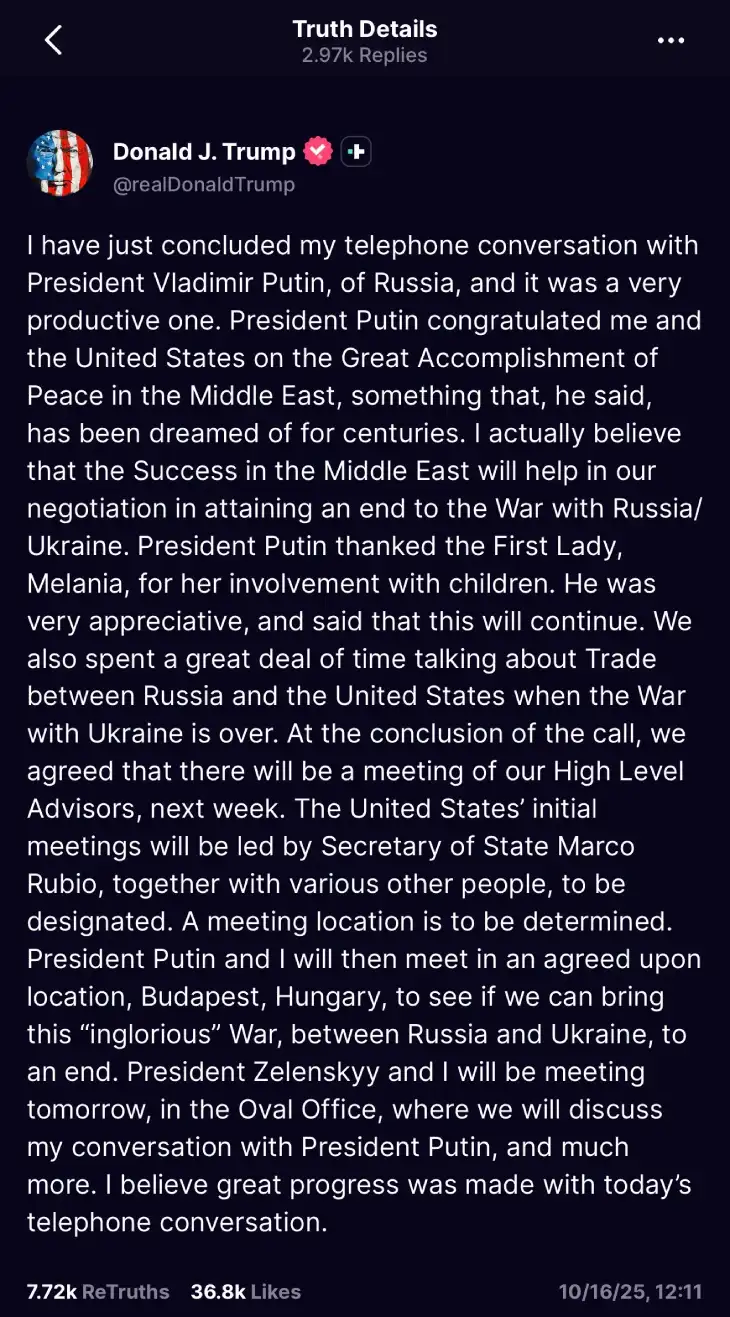

(Source: Truth Social)

On the flip side, some positive developments are also taking place. Today, U.S. President Donald Trump revealed that he is going to meet the Russian president “within two weeks or so, pretty quick” to end the long-standing war between Russia and Ukraine.

As an asset class frequently perceived as high-risk, Bitcoin has been particularly affected by this change in investor attitude.

At the same time, traders with leverage positions are facing substantial losses. The market has witnessed the liquidation of over $19 billion in cryptocurrency positions within a matter of days, initiating a chain reaction on major trading platforms.

These compulsory sales have exerted additional downward pressure on other significant digital currencies such as Ethereum, Solana, and XRP, intensifying the overall market slump.

Many crypto trading experts are comparing the current situation with the 2022 market crash. According to them, Bitcoin is currently flirting with danger.

These warnings from experts show the cryptocurrency’s highly volatile nature as it floats near critical technical thresholds. If it falls below this, it could set off a further round of selling pressure. The overall market sentiments are rapidly changing from bullish to palpable anxiety.

Despite these market uncertainties, many crypto investors are seeing the drop as a major constructive development. These investors suggest that a cooldown could provide a necessary reset for the market following an intense summer rally.