Avalanche (AVAX) has been making waves in the cryptocurrency market with its impressive technology and growing ecosystem. Especially following Grayscale’s recent ETF application, the token is gaining increased attention.

As investors and traders look to capitalize on the next big move, market experts share their optimistic perspective on the token, with short-term targets heading up to $46. However, a major barrier stands in its way- a critical resistance level that the token needs to break through first.

This article will take a closer look at AVAX’s current price dynamics, the resistance level it needs to overcome, and its potential trajectory. We’ll also explore the fundamental factors that lead to Avalanche’s possible bullish resurgence.

The Road to $46: AVAX Price Faces Crucial Test

Over the past few months, the Avalanche token has been facing significant hurdles to escape from its bearish zone. While the AVAX cryptocurrency hit an all-time high of $123 in its first year, the remaining years were marred by a significant downturn, leaving investors wondering about its future.

After reaching a yearly high of $54 in 2024, the AVAX coin slipped to severe lows and is now trading at $24. Since February 2025, the price of AVAX has been trading between $17 and $25.

At press time, AVAX price is trading at $24.62, down 0.09% in a day. Despite a 2% monthly fall, the token has seen a notable surge of 6% over the past week, sparking optimism. There is also a 23% hike in the 24-hour trading volume, currently at $752 million. With a market cap of $10.39 billion, Avalanche is securely positioned at the 18th spot on CoinMarketCap.

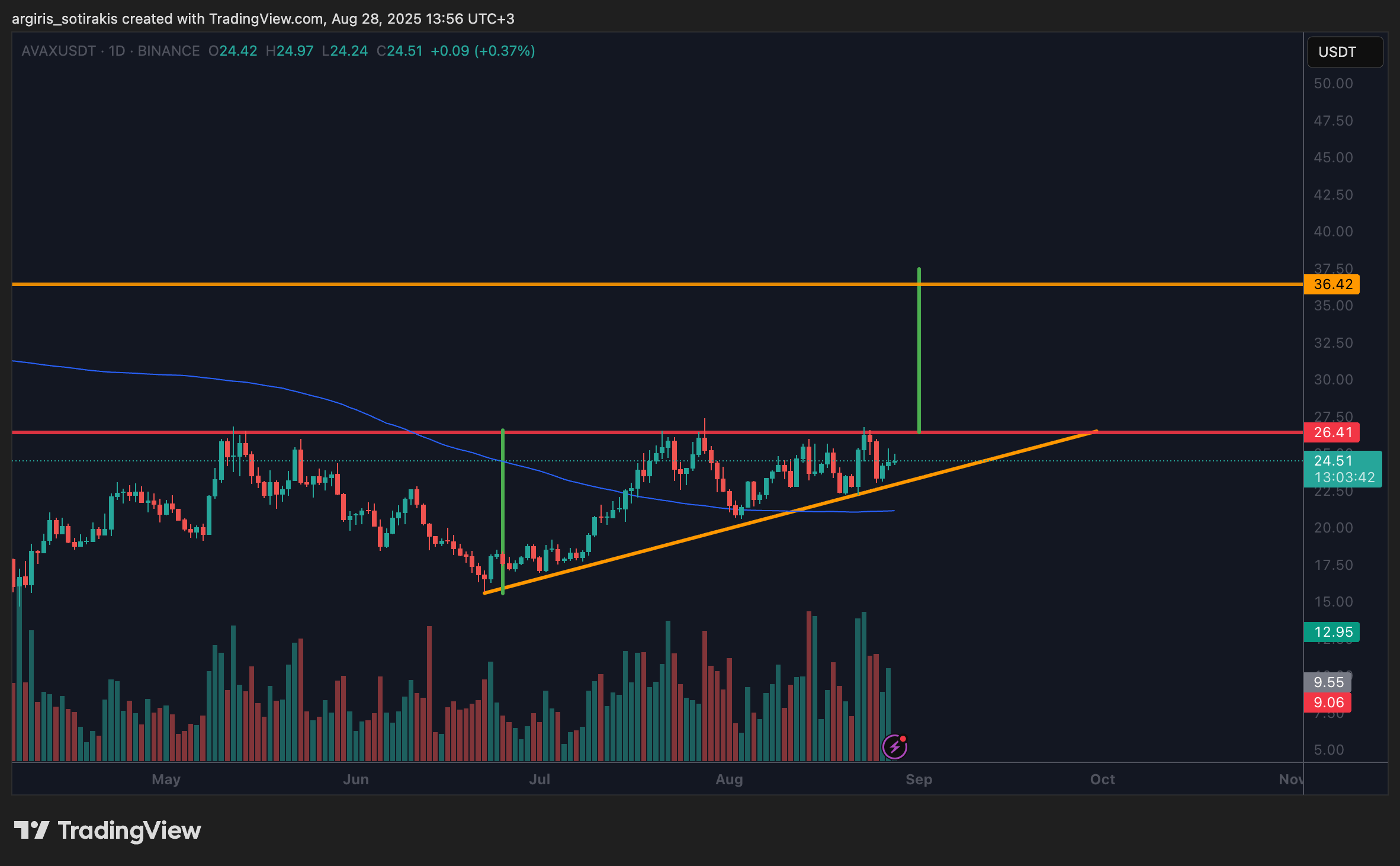

In an optimistic development, analyst AltCryptoGems shared a bold prediction for Avalanche. According to his analysis, AVAX price has been consolidating below the crucial resistance level of $25 since February and had tested it four times already. He cautioned that resistance remains in place until it’s broken, but a breakout could be imminent. If the level is successfully flipped into support, it would likely lead to a significant upward push, with the price finally hitting $46.

Another analyst, Cryptominder, identified the formation of an ascending triangle pattern in the AVAX price chart. The chart indicates the cryptocurrency’s bullish breakout after potentially breaking past the $25 level.

Avalanche ETFs to Change the Game

Adding to this positive momentum, investor giant Grayscale has filed for an Avalanche exchange-traded fund. The asset manager filed an S-1 form with the US Securities and Exchange Commission (SEC) as the initial step to launch the Avalanche ETF. With this move, Grayscale intends to convert its existing Avalanche Trust into a publicly traded ETF. If approved by the SEC, the ETF will trade under the ticker AVAX.

Interestingly, Grayscale’s ETF filing comes on the heels of another investment behemoth, VanEck’s similar filing to list the fund. In March 2025, the asset manager filed for the VanEck Avalanche ETF, seeking to offer investors direct exposure to the AVAX token. The proposed fund will hold AVAX crypto and will “value its Shares daily based on the reported MarketVector Avalanche Benchmark Rate.”

Following Grayscale’s submission of the S-1 form, market expert WONDAR WEB3 expressed his excitement about the development. The analyst asserted that AVAX could potentially reach $40 if the SEC approves the ETF. However, the SEC’s recent delays in the decision on multiple ETFs have cast a shadow over the imminent approval of the Avalanche ETF.