- The BNB price shows potential for a continued correction trend amid the formation of a double top pattern.

- A recent rebound in open interest associated with Binance coin futures signals a renewed speculative force in this asset.

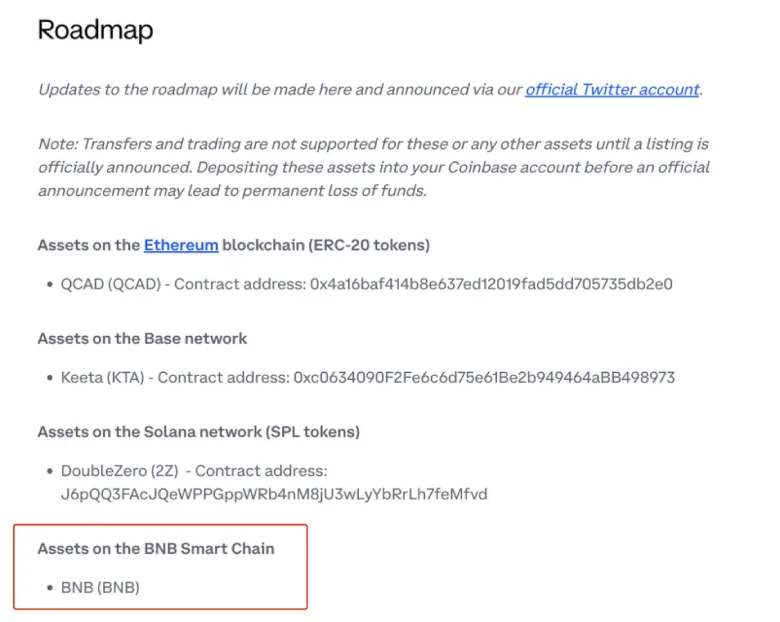

- Cryptocurrency exchange Coinbase has added the BNB coin to its roadmap for potential listing.

BNB, the native cryptocurrency of the BNB chain, fell over 3.8% during Wednesday’s U.S. market hours to trade at $1,160. The selling pressure aligns with the broader market pullback, signaling continued correction momentum after the market witnessed its largest liquidation event in history last Friday. The declining price of Binance coin is poised for a breakdown below the support of a trading reversal pattern, reinforcing the bearish narrative. However, the recently announced potential listing of the BNB coin on Coinbase could significantly boost the asset’s demand and visibility.

Will the price take a rebound?

Coinbase Signals BNB Support While Traders Pile Into Futures

Coinbase has added Binance Coin to its official asset roadmap as a sign of plans to extend support for the BNB Smart Chain. The update is listed on the exchange’s roadmap page, which shows the upcoming tokens for various blockchains, including Ethereum, Base, and Solana.

The roadmap states that deposits, transfers, or trades for the mentioned assets will be disabled until there is an official launch confirmed. According to the company, the final decision to turn on the trading for BNB will be based on the technical readiness of the platform and the overall market conditions.

If trading eventually goes live, it could increase the accessibility of BNB to U.S.-based users and potentially help make it more liquid on the market once the listing is active.

Despite this early hint, the Binance coin price remained bearish in the intraday session and plunged to $1,166. Consequently, the asset’s market cap fell to $162.39 billion.

According to Coinglass data, BNB futures open interest rose sharply from $1.83 billion to $2.4 billion—an impressive increase of 31%—but then slowed slightly for a short period. Such a move is usually an indication of a new wave of leveraged activity and renewed confidence of the trader in the asset.

What makes this move all the more interesting is that most of the major cryptocurrencies are still reporting sunken open interest after experiencing the largest market-wide liquidation on October 10—the biggest in crypto history.

Despite that broader slowdown, BNB’s derivatives market seems to have quickly regained momentum, suggesting traders are positioning aggressively ahead of potential catalysts.

Binance Coin Price Falls Amid Double-Top Formation?

In the last three days, the BNB price has witnessed a brief correction from its new high of $1,375 to the current rating price of $1,170, accounting for a 15% loss. The daily chart analysis shows this price drop as the second reversal from the $1,350 region within a fortnight, indicating the potential formation of a double top pattern.

This chart setup displays an M-type structure, as the two reversals indicate intense overhead supply and a risk for potential correction if the key neckline support breaks. With sustained selling, the exchange coin price is poised for another 8.5% drop and will challenge the bar neckline level at the $1,070 mark.

A potential breakdown below this support could accelerate the selling pressure and push the asset towards the $932 floor. However, a notable upswing in the daily exponential moving average (20, 50, 100, and 200) indicates the broader trend surrounding Binance Coin is strongly bullish.

Therefore, the market watchers must pay close attention at the $1,070 mark as a potential reversal could trigger a sideways action to recuperate the exhausted bullish momentum.

Also Read: Paxos Minted 300 Trillion PYUSD, Equal to Global Debt!