XRP has officially broken free from months of downward pressure, blasting past a major resistance trendline and igniting bullish momentum across the board. The breakout happened just above $2.29—a key Fibonacci retracement level—and the rally has since driven the price to $2.41, marking a sharp 4%+ daily surge.

The current move positions XRP firmly in bullish territory. The price is now heading straight into a key supply zone between $2.54 and $2.65, where sellers might attempt to slow the rally. But if buying pressure continues, the next major upside target is $3.01, aligning with the 0.786 Fibonacci level. A stretch goal? The $3.40 mark, where the full retracement of the previous downtrend sits waiting.

XRP Price Chart (Source: TradingView)

Momentum indicators are also backing the bulls. The Directional Movement Index (DMI) shows the +DI line rising strongly above 31.86, while the -DI has dropped to 15.96—a clear sign buyers have taken the lead. Even the ADX, which measures trend strength, is ticking upward at 14.86, hinting that this rally has room to run.

Before this breakout, the token was stuck in a tight range, bouncing between support at $1.61 and resistance near $2.50. But that sideways chop is now in the rearview mirror. The clean break above the multi-month trendline, followed by consecutive strong green candles, signals a new phase of bullish control.

As the cryptocurrency marches deeper into the supply zone, the big question is whether this momentum can carry the price to test the psychological $3 level—and possibly even higher. One thing’s clear: XRP has awakened, and bulls are charging ahead with $3.40 in their sights.

On-Chain Data Hints at a Possible XRP Supply Squeeze

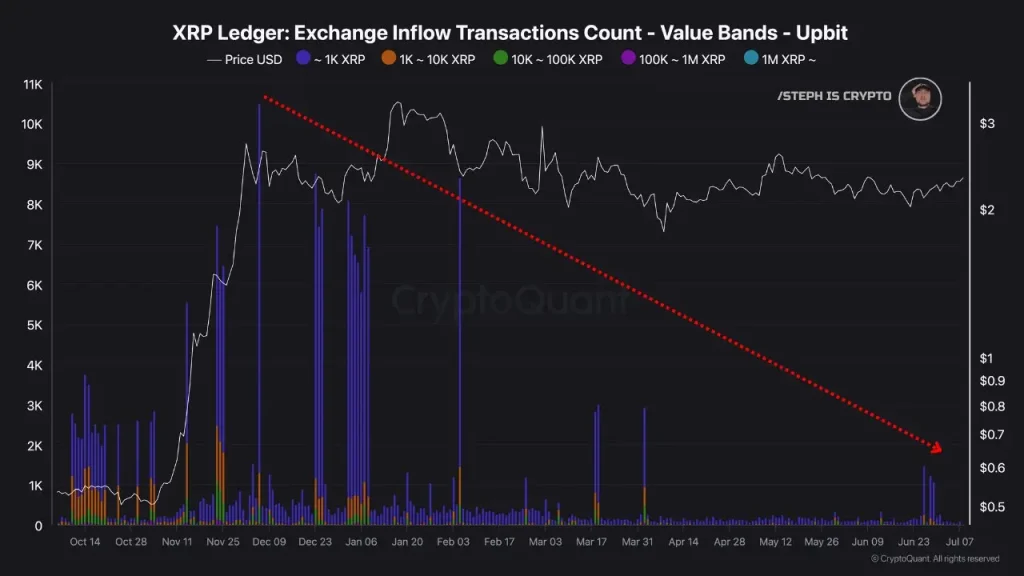

According to fresh on-chain data from CryptoQuant, exchange inflow transactions on Upbit have taken a steep nosedive, especially from smaller wallets holding around 1,000 XRP. What used to be regular waves of inflows exceeding 9,000 transactions have now slowed to a near trickle.

This significant drop gives a clearer picture: sellers are retreating, and mighty hands are taking charge. As the flow of tokens to exchanges declines, supply is becoming scarcer, a classic indicator of increasing hoarding and diminishing sell pressure.

XRP Exchange Inflow Transactions Count (Source: X Post)

The largest downgrade is observed in under 1K XRP, which was once the most active cohort. These players are no longer selling but are instead holding on tight, further supporting the mindset across the markets. In simple terms, the cryptocurrency is drying out on the exchanges as the broader market bulls gain momentum.

Considering that the price of XRP trades above the mark of 2.30 and acquires upward momentum, this on-chain sign contributes to a bullish story. Besides, the falling inflows match the accumulation behavior, which is often a precursor to a blow-up price action. Consequently, the impending huge leg up may no longer be a matter of “if” but “when.”