Amidst the uncertainty and volatility of the crypto market, investors and traders are constantly on the lookout for assets that can deliver consistent returns. Monero (XMR), with its strong focus on privacy and security, has been a popular choice among those seeking to protect their assets from surveillance and censorship.

Despite the broader market correction that has seen many altcoins struggle to maintain their footing, Monero has demonstrated remarkable resilience, ranking among the top performers in the top 100. This impressive showing has caught the attention of both institutional and retail traders, who are increasingly drawn to the privacy coin’s robust fundamentals and technical momentum.

As investors seek safe havens and secure ways to protect their assets in the highly volatile market, Monero’s advanced privacy protocols and robust network have positioned it for potential growth. But can Monero’s price movements match the explosive surge seen in Zcash?

Monero Price Shows Resilience

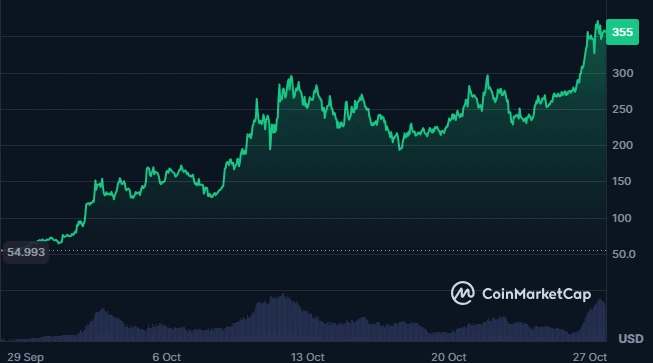

The Monero price journey since its launch in 2014 has been marked by significant fluctuations. Initially, it traded around the $2.3 level before experiencing a surge to an all-time high of $413. However, this was followed by a sharp decline to around $50.

The privacy coin later reached a new all-time high of $453 in 2021, only to plummet again. The downtrend continued until it reached $125 and maintained the level for a period. A notable rebound occurred in May 2025, when the token price surged to $371.

Recently, despite experiencing fluctuations, Monero’s price has shown an overwhelmingly positive trend, reaching a monthly high of $350 yesterday. As of press time, the crypto is valued at $340.82, marking a marginal decline of 0.69% despite notable weekly and monthly gains. While XMR surged by around 8% over the past week, it saw a notable uptick of 18% over the last month. The Monero market cap is currently at $629 billion, positioning the crypto at the 21st spot on CoinMarketCap.

Driven by this bullish reversal, the community is increasingly engaging with XMR, which is clearly visible in its 24-hour trading volume. Currently, the volume is at $187 million, up 11%.

Monero vs Zcash

The recent price action of Zcash (ZEC) has been nothing short of spectacular, with the token experiencing a tremendous journey despite the recent crypto market crash. With notable surges and bullish indicators, ZEC has been making headlines and sparking interest among investors for future Zcash predictions.

As of press time, ZEC is valued at $358.52, up 7.12% surge in a day, 40% hike in a week, and a massive 558% in a month. The volume has also increased, now at $1.36 billion, up 68%.

While both Monero and Zcash dominate the privacy coin segment, they have distinct approaches to achieving transaction privacy. Zcash’s use of zk-SNARKs provides optional transaction privacy, whereas Monero’s protocol enforces privacy by default across its entire network. Despite these differences, both cryptocurrencies have garnered significant attention and investment from the crypto community.

In terms of price action, Monero’s chart pattern shows similarities to Zcash’s pre-rally pattern, with a consolidation range and higher lows.

Will XMR Price Hit $500 and Beyond?

Significantly, XMR’s 4-hour chart shows a steady uptrend within an ascending channel, indicating gradual buying pressure. However, the price has consistently faced resistance near the $350 level at the upper boundary.

The Monero price is poised to break the channel’s upper trendline, potentially triggering a short-term rally to the next resistance zone. Key indicators such as Money Flow Index (MFI) at 71.51 and the positive Awesome Oscillator (AO) confirm growing buying pressure and a shift in momentum favouring the bulls. If this momentum sustains, XMR’s price may attempt a breakout above $400 soon.

At the same time, on the daily chart, the Monero crypto has found support at $292.73, and the MACD’s recent bullish crossover suggests a potential breakthrough above the $365.47 resistance level. If this happens, Monero price’s next target could be $419.90, with a possible surge to $577 if the bullish market sentiment persists. However, a failure to hold support could signal a weakening momentum and lead to a retracement.