Despite the cryptocurrency market’s prevailing uncertainty, XRP remains a closely watched digital asset, with investors and analysts eagerly anticipating its next move. As the market continues to fluctuate, the XRP crypto has shown resilience, recently breaking out above the 200-day exponential moving average (EMA), sparking speculations of a potential bull run.

Recent developments within the blockchain ecosystem and technical indicators have significantly influenced this positive sentiment. With XRP trading around $2.6, many are wondering if this could be the start of a wider rally in November.

In this article, we’ll explore the key reasons why the XRP price could skyrocket in November. Let’s unveil expert predictions and the potential targets of the Ripple coin.

XRP Price Rebounds

The XRP price has been experiencing a negative trend since the crypto crash on October 11, when it plummeted to a low of $2.3. Although it briefly recovered to $2.6 in the following days, it soon slumped to another low of $2.21. Since the 1011 crash, Ripple’s token traded in the negative zone, showing little signs of recovery.

However, XRP displayed an uptrend, surging and reaching a high of $2.60 once more, sparking widespread optimism. As of press time, the altcoin is trading at $2.63, marking notable upticks of 1.5% in a day and 7% in a week, but with a 5.4% dip in a month.

Interestingly, the surprising recovery of the cryptocurrency has caught the attention of the XRP community. This is evident in the rising community engagement and the surging 24-hour trading volume, which is currently at $4.43 billion, up 18.4%.

Why XRP Could Be the Next Big Thing in Crypto?

In a recent X post, analyst Cryptoinsightuk drew the community’s attention to why he is highly bullish on the XRP price. He highlighted several factors to consider. Firstly, the Ripple token has virtually no downside liquidity, which means that while price fluctuations are possible, it’s likely that the value will eventually be pushed higher into areas with deeper liquidity. These liquidity zones are where exchanges and market makers typically generate profits.

Additionally, the recent liquidation event doesn’t appear as severe when viewed on a weekly chart. Although higher timeframes are generally more reliable, examining the 3-month chart also presents a positive outlook. A fractal analysis suggests that a measure move could be in store for XRP, similar to the pattern observed after the last time the daily RSI entered oversold territory.

Technical Analysis

Notably, the recent movement of Ripple’s native token has been remarkable, with a significant push from the $2.45 support zone, which has served as a crucial defensive line during the October correction. Currently trading at around $2.6, XRP has broken above the 200-day EMA, a technical crossover that historically signals the end of the midterm bearish phases and frequently precedes times of faster price growth.

With the RSI near the neutral 50 zone, there’s still room for growth before the asset reaches overbought territory. A gradual increase in market participation, indicated by expanding volume patterns, is key to sustaining the upward momentum. The next significant targets are close to $2.77 and $3.00.

XRP November 2025 Forecast

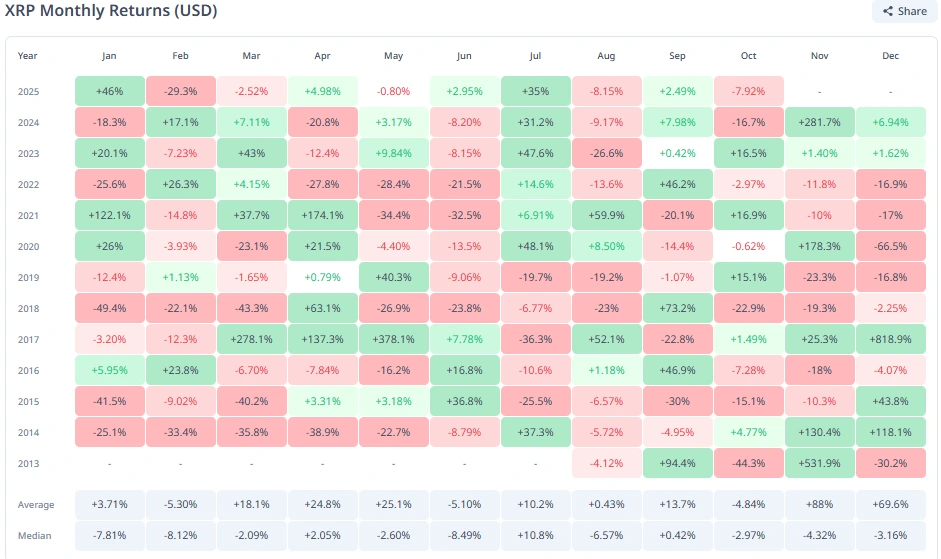

Historical data reveal that November has been a highly volatile month for XRP, with a mix of large gains and losses over the years. While the average return stands at an impressive 88%, the highest among all years since 2013. Year-by-year data highlights the significant variability, with returns ranging from a staggering 531.9% in 2013 to a low of -23.3% in 2019. Notably, the most recent November of 2024 saw a remarkable return of 281.7%, leaving investors optimistic about this month’s potential.

As per expert XRP prediction, the altcoin is poised to hit $3 in November. If the rally continues, the Ripple coin could reach new all-time highs, surpassing leading players.