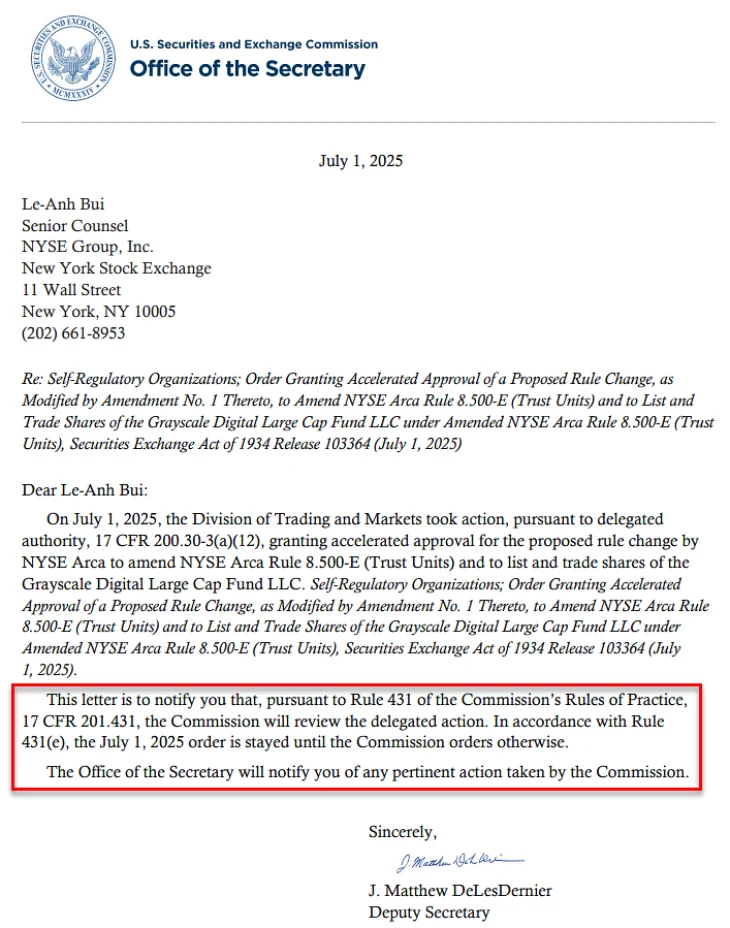

There’s a big twist in Grayscale’s multi-crypto ETF, where the U.S. Securities and Exchange Commission (SEC) put a temporary stay on the first multi-crypto ETF. The SEC has placed a temporary stay on Grayscale Investments’ plan to convert its Digital Large Cap Fund (GDLC) into a spot cryptocurrency ETF, despite yesterday’s approval of the conversion.

(Source: sec.gov)

The letter attached with approval has forced many people to scratch their heads, as the SEC provided no immediate explanation for the delay.

Approval Granted, But Launch on Hold

The SEC had officially approved Grayscale’s 19b-4 filing on July 1, just before the regulatory deadline, allowing the firm to move forward with converting its closed-end GDLC fund into an ETF. The fund would have been the first U.S. spot ETF tracking multiple cryptocurrencies, which holds Bitcoin (79.9%), Ethereum (11.3%), XRP, Solana, and Cardano.

However, the approval came with an unexpected twist: a stay order, which prevents Grayscale from actually launching the ETF. The SEC has attached a letter with approval, available on its website. included the stay without further clarification. This left industry experts scrambling for answers.

Why Did the SEC Halt Grayscale Multi-Crypto ETF Launch?

James Seyffart, a popular research analyst within Bloomberg Intelligence, has proposed two possible theories behind the SEC’s temporary stay on Grayscale’s Multi-Crypto ETF launch.

1. SEC May Be Waiting for Clear Crypto ETF Rules

The SEC has been working on establishing a regulatory framework for cryptocurrency ETFs, similar to the stablecoin bill for the GENIUS Act. James Seyffart believes that the agency does not want any new ETFs launching under the 19b-4 process until it finalizes these guidelines.

“We’ve written about this potential framework a bunch. But $GDLC’s deadline was July 2nd and I assume the SEC didn’t want to deny it but for whatever reason they aren’t ready for a launch just yet,” James Seyffart said.

2. Possible Internal SEC Disagreements

According to the analyst, the Division of Trading & Markets, which handles ETF approvals, greenlit Grayscale’s filing. However, another SEC division, such as Corporate Finance or Enforcement, may have raised concerns about GDLC’s structure, custody, or compliance risks. This conflict has resulted in a stay.

The temporary stay is a huge setback for Grayscale, which had put GDLC as a major step forward for crypto adoption. The firm had previously remarked that this ETF will provide investors with diversified, regulated exposure to the digital asset market in a single, transparent product.

James Seyffart writes, “It can’t convert *YET* but it will. We just don’t know when and we don’t exactly know why the SEC issued this ‘Stay’ order.”

Also Read: Ripple Applies for US National Banking License, CEO Confirms