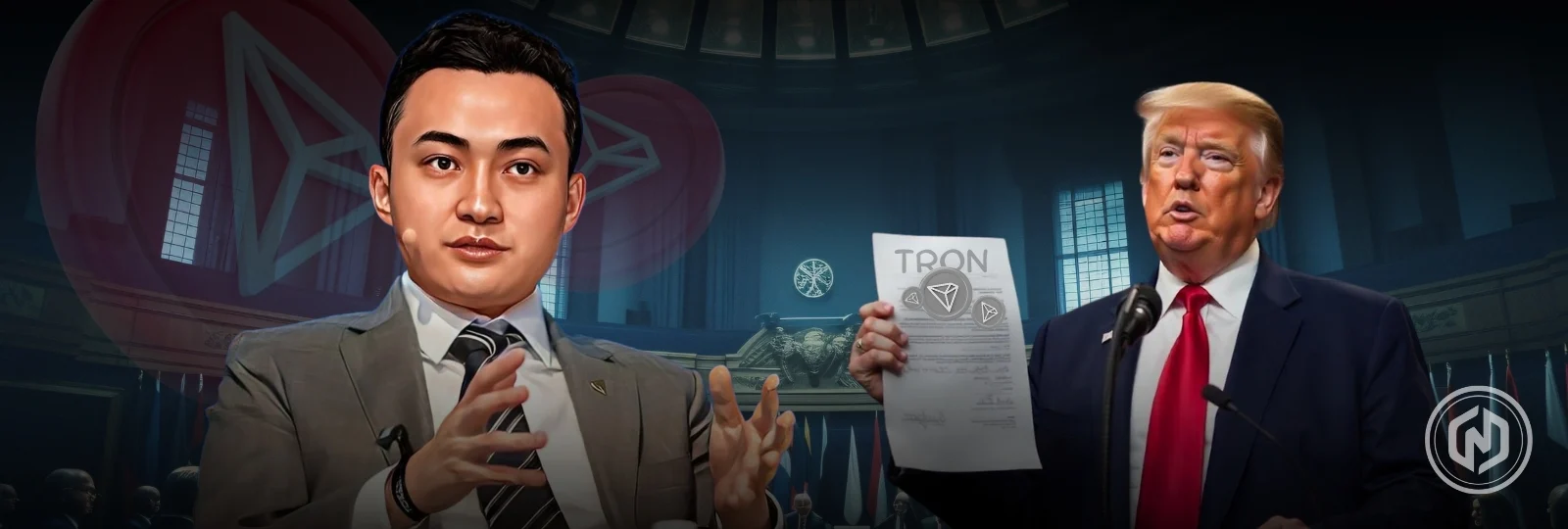

Key Highlights

- TRON founder Justin Sun was blacklisted by Trump-backed World Liberty Financial.

- Sun took to X to confront the WLFI team as he was an early-stage investor in the project.

- Experts like Quinten Francois decoded the incident and revealed what went wrong with Sun.

On Thursday, the TRON DAO wallet address associated with Justin Sun was blacklisted on the WLFI token contract by the World Liberty Finance (WLFI) team, and the funds in the wallet were blocked. This decision followed rampant speculation that Sun had sold a substantial number of WLFI tokens at the HTX crypto exchange, which had led to an increasing level of dissatisfaction among the community with the project.

TRON’s Justin Sun Speaks Up On WLFI Saga

As on-chain data at the time indicates, the wallet (0x5AB261…) had bought 3 billion WLFI tokens in the project ICO. Out of this exceeded allocation, 600 million tokens were released and 54 million WLFI, valued at about $11 million then, transferred to newly created wallets. World Liberty Finance has prevented additional transfer of the remaining tokens through the blacklisting of the TRON DAO wallet.

To the World Liberty Financials team and the global community,

As one of the early major investors in World Liberty Financials, I have contributed not only capital but also my trust and support for the future of this project. My goal has always been to grow alongside the team…

— H.E. Justin Sun 👨🚀 (Astronaut Version) (@justinsuntron) September 5, 2025

The ruling came after an accumulating rumor that Sun, creator of TRON and investor in HTX, had been offloading WLFI tokens, ruining market confidence and helping the token gradually lose its price.

In response, Justin Sun issued a public statement on X, disputing the team’s actions and defending his role as an early investor. “As one of the early major investors in World Liberty Financials, I have contributed not only capital but also my trust and support for the future of this project,” Sun wrote. “However, during the course of operations, my tokens were unreasonably frozen. As one of the early investors, I joined together with everyone—we bought in the same way, and we all deserve the same rights.”

Sun added that freezing investor assets was damaging to the credibility of the project: “Tokens are sacred and inviolable—this should be the most basic value of any blockchain. I call on the team to respect these principles, unlock my tokens, and let’s move forward together toward the success of World Liberty Financials.”

Experts Weigh In On The Matter

Community figures and analysts have voiced their concerns about the token’s launch and circulation. Quinten Francois, host of the crypto channel Coin Compass, noted inconsistencies between the reported circulating supply and the heavy trading volume at launch.

“Just think about it: the only $WLFI tokens that should have been in circulation were the 5B from the community, right? That’s 5% of the total supply,” Francois wrote on X. He added, “Add to that 1.6% of the total supply that the WLFI team gave to exchanges ‘for liquidity and marketing’. That’s 6.8% that was actually in circulation.”

Francois observed that despite WLFI’s $1 billion valuation at launch—priced at $0.20 per token—its price steadily declined even though most community holders were not selling. “It looked robotic. It made me suspicious… it was clear the community was actually not even selling. So it had to be the few other entities that owned a lot: exchanges and Justin Sun,” he argued.

Francois alleged that Sun, who controls 3% of the WLFI supply, might have attempted to bypass vesting restrictions. “Sun owns 3% of the total supply—of which only 20% would be unlocked at launch and the remaining 80% stayed locked. But because of his little trick with HTX he potentially wanted to sell his entire 3% and tried filling the gap with ‘a small amount’ he sent there.”

He further claimed that both Sun and exchanges were likely selling from the moment WLFI became tradable. “Sun got caught red-handed, selling tokens of HTX users to get out of his 80% invested tokens and his address got frozen. Once again, retail gets played with, while some ‘major forces’ just run away with everything,” Francois wrote.