On Monday, the stock market took a nosedive as all three significant stocks, the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite ended in correction territory from recent highs. Fearing a U.S. recession, a new rise in unemployment, and other factors triggered across-the-board losses globally, and the crypto industry was not spared. Bitcoin dropped 17.5% to $50,239, and Ethereum fell 23%, about $2,230. That steep drop is a chilling example of how global financial markets are linked during economic turmoil. However, as of Tuesday, the value of Bitcoin increased to $55,050.63 (at press time) during the market’s revival. This has irked investors’ new interest regarding how low/high Bitcoin can go in a week.

Crypto analyst and on-chain expert Ali Martinez predicts a bearish momentum where the prices for Bitcoin can go down to $51,000. In his analysis, Martinez invoked a rising wedge subject, generally watching for bearish patterns either reversing an uptrend or continuing a downtrend. The daily price has formed a rising wedge pattern of higher highs and lows. An upper boundary resistance offers the layer of protection, projected between $56K and $ 57K. In contrast, on the flip side, but with a two- or three-layer offer, that arena supports around $55K, trending vertically.

As per Bitcoin predictions, BTC could see a short-term move to the upside with $62-63k in sight, while any regression beneath this lower trendline would likely send us back closer to $51k. The rising wedge indicates that we are in a bearish continuation so that the long-term trend may be the downside.

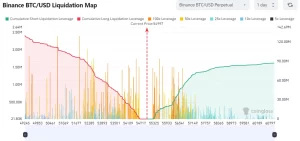

Bitcoin is at a very delicate place now, with incredibly high stakes! That has led to the potential for forced selling of long trades from traders who leveraged on them, and any drop below around $53,500 could induce a mass liquidation. This selling pressure could set off a downward spiral as the devaluation prompts more selling and further depresses prices; nevertheless, if the price rises above circa $55k. This can lead to a short squeeze – higher prices force shorts out, pushing the cost further up.

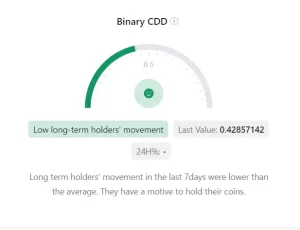

On-Chain Analysis indicates ‘HODL’

Given the Binary CDD, a movement metric for long-time holders, the movement has been low in the last 24 hours, even with the current spree. Although long-term holders’ coins have remained dormant as of late, their steadfast conviction in Bitcoin’s future success must not be underestimated.

As Michael Saylor, the Executive Chairman of Microstrategy and the owner of $11.96 billion worth of BTC, tweeted, “HODL.” Investors should live by it.

Moreover, all the bigwigs, including BlackRock, Grayscale, and Fidelity, only buy more during dips. With the U.S. Treasury already possessing approximately 203,239 BTC tokens, one thing is for certain: Bitcoin is part of the mainstream and will not soon disappear after the United States Government finally makes (discusses) its mark on stockpiling with having a Strategic Reserve.

Based on all the technical analysis and on-chain data, a repeat of what happened one week ago, down to $49K, would be the next best guess for where Bitcoin is heading as long as retail investors come back, given that institutional investors seem unaffected by the recent market sentiment. Alternatively, we could see it recover up towards that same previous high watermark at around $60K if confidence returns or institutional investors buy more of the dips.