Key Highlights:

- Stellar and IBM announced a partnership, and XLM surged above $0.33 mark.

- Scopuly called XLM a “buy-the-dip” near $0.33, targeting $0.37-$0.42.

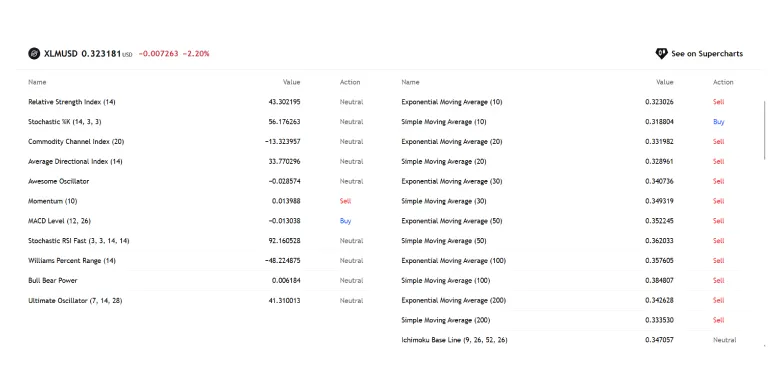

- Current data shows RSI at 43 and most moving averages flashing a sell signal.

The day started out strong for Stellar as there was a renewed optimism around its partnership with IBM that also sparked early buying. The price of the token after this announcement rose (for a very short period of time) above $0.33, but the rally did not last long as sellers started to book profits. Once the profit booking began, the price of the token dropped down to $0.325 by the end of the day.

IBM and Stellar: Transforming Cross-Border Payments

IBM’s partnership with Stellar focuses on using Stellar’s blockchain to power IBM’s global cross-border payment network, which was previously known as IBM World Wire. The system leverages Stellar Lumens (XLM) and stablecoins to allow fast, low-cost, real-time transactions between financial institutions, streamlining remittances, B2B settlements, and currency exchanges.

For IBM, the collaboration will increase its role in blockchain-driven services, with which it can build next-generation payment infrastructure. It also allows IBM to offer global banks and corporations a smooth as well as a transparent way to settle transactions, which cuts off the intermediaries. Also, IBM benefits by expanding its blockchain software services, running validator nodes, and providing value-transfer APIs to institutional clients.

For Stellar, it is being said that this move will increase institutional adoption and will drive higher on-chain transaction volumes and total value locked (TVL), which jumped 80% to $150 million in Q2 2025. This also strengthens XLM’s position as a trusted bridge asset for real-world payments and attracts more fintech enterprise users to the Stellar ecosystem.

On a bigger scale, the IBM-Stellar collaboration reinforces blockchain’s growing role in global finance. It builds trust among regulators, validates blockchain’s efficiency and compliance potential, and sets a strong example for other crypto networks that are aiming for such integration as well.

Partnership Fuels Early XLM Rally, But Profit-Taking Cuts Gains

Stellar Lumens (XLM) saw a strong early rally after IBM partnership plans were announced. After the announcement, XLM quickly jumped above the $0.33 mark as traders reacted to the news with optimism, expecting more demand for the token as IBM expands its blockchain services. However, the excitement did not last long. As the prices approached key resistance levels, many of the traders began taking profits, leading to a swift pullback, and XLM ended up falling to $0.325 mark.

At press time, the price of the token stands at $0.3251 with a dip of 1.93% in the last 24 hours as per CoinMarketCap.

Scopuly Flags ‘Buy-the-Dip’ Zone as Stellar (XLM) Accumulates

Even though there are a few bearish signals, confidence around Stellar (XLM) has started to improve near the $.33 level. Scopuly, a popular platform that tracks Stellar, shared on social media platform X (formerly known as Twitter) that XLM might be offering a good ‘buy-the-dip’ chance right with possible price targets between $0.37 and $0.42.

In the tweet, Scopuly also highlighted that whales appear to be accumulating XLM as technical indications such as RSI and exponential moving averages point towards oversold conditions. However, according to TradingView data, Stellar’s RSI is around 43, which means that the market is neutral, not strongly bullish or bearish either. Most moving averages from the 10-day to the 200-day range are indicating a sell signal, except for the 10-day simple moving average, which shows a small buy signal.

These numbers suggest that the selling pressure is still stronger overall. The $0.30 level remains an important support zone, as there is a possibility that the buyers could step in again. However, as of now, the trend is definitely not bullish, and traders should be on the lookout for further developments.