XRP, the cryptocurrency associated with global payment company Ripple, dropped over 2% during Thursday’s market session. This downtick aligns with the broader market sell-off as Bitcoin reverts sharply from the $110,000 resistance, and the United States-imposed tariff continues to add pressure. Despite mounting bearish momentum, the XRP price shows resilience and holds its $2.2 for a potential breakout. Is a major rally underway?

XRP Price Eyes Bullish Breakout From Flag Pattern

On Friday, July 4th, the crypto market witnessed a sudden sell-off, following Bitcoin’s dip of over 2% to $107,400. A major transfer of 80,000 BTC from eight Satoshi-era wallets was likely triggered by a breakdown, as market speculation feared a potential sell-off. The bearish momentum further accelerated as the United States threatened a 17% tariff on European Union food exports.

As a result, the majority of major altcoins, including XRP, recorded a notable downtick in their intraday chart. With an over 2% loss, the Ripple crypto shows an evening star reversal candle at the resistance trendline of a long-awaited wedge pattern. In such previous reversals, the coin price fell over 30-47% before finding bottom support.

However, the 50-and-100-day exponential moving averages currently hold the price above the $2.2 level. The additional support from these EMAs could help bolster XRP in rechallenging the overhead. A successful flip of the resistance into potential support will signal the continuation of the prevailing uptrend.

The post-breakout rally could push the asset to $2.65, followed by an extended leap to $3.

On the contrary, if the coin price breaks below the 200-day EMA slope at $2.1, the selling pressure could accelerate and drive a breakdown to $1.8 midline support.

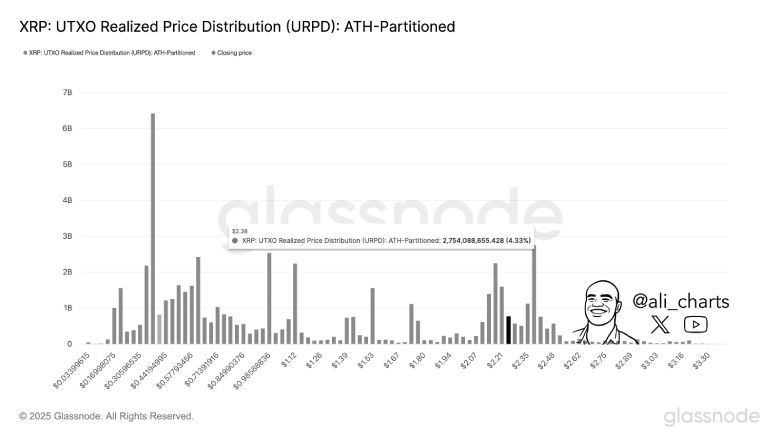

On-Chain Data Shows $2.38 as a Major Barrier

While the technical chart highlights major resistance at $2.3 due to the confluence of the descending trendline, the on-chain data shows another barrier that buyers must look out for.

In a recent tweet, market analyst Ali Martinez highlighted that the XRP price could face a major resistance level at $2.38. Data from Glassnode’s UTOX realized price distribution (URPD) reveals that over 2.75 billion XRP, representing 4.33% of the total supply, was last moved at this price point. This suggests that a significant concentration of holders are waiting for a breakeven and could exit their positions once the price hits this level.

Therefore, the overhead supply region could halt the aforementioned flag breakout move and bolster the short test.

The Ripple crypto could test the breached trendline as support before continuing the recovery trend.