Ethereum ETFs are taking the financial world by storm, providing investors a fresh avenue to get exposure to Ethereum. As global regulatory convergence makes a way, it can allow people to access real-world assets on top of blockchain in an unparalleled manner. According to Paul Brody, EY Global Blockchain Leader, the ETF market is predicted to be worth hundreds of trillions in growth opportunities in the long term. Brody said that with Ethereum ETF, many other cryptocurrencies like Spot Solana ETF might be on their way.

The Ethereum spot ETF is intended to track the cost of Ethereum straightforwardly, giving financial specialists an advantageous approach to get the presentation to the cryptocurrency without needing to hold the resource itself. This ETF is huge in the crypto market as it broadens admittance to Ethereum ventures, potentially attracting a more extensive scope of institutional and retail financial specialists. Grayscale, a driving speculation firm in the crypto space, recently reported its cutting-edge Ethereum spot ETF with the most astounding expense among its equals. This article investigates why Grayscale charges such a cost premium for its item and what this means for the crypto space.

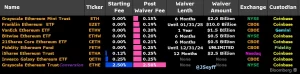

UPDATED Table of Ethereum ETFs and their fees that are set to launch next week. Grayscale’s $ETH will now be the lowest cost ETF at 0.15% pic.twitter.com/UjoaHvHegH

— James Seyffart (@JSeyff) July 18, 2024

Is Grayscale Fees Justified?

The fee structure of Ethereum spot ETFs shifts enormously between various issuers. While most contenders offer expenses from 0.19% to 0.25%, Grayscale’s Ethereum spot ETF has a hefty 2.5% charge. Grayscale, famous for its Bitcoin Trust, has built a strong notoriety. However, the considerable expense it charges for its Ethereum spot ETF requires a more profound investigation. When Grayscale CEO Michael Sonnenshein was asked about the high fees charged for ETFs in a CNBC Television interview, he quickly referred to the newfound support Grayscale has had after winning the lawsuit against the SEC. Sonnenshein further referred to Grayscale’s industry-leading position due to its secure custody solutions and tracking records. These premium services separate Grayscale from the pack, which may be why its charges are higher than its competitors. Despite the considerable price, Grayscale has been para-fitted well to leverage its strategic position and extensive services into a significant part of the prospective Ethereum investment sector.

But is this premium fee a consequence of Grayscale’s “premium” brand, or are there more tangible reasons supporting these higher fees?

Several characteristics that set it apart from its counterparts have contributed to the high fee of a 2.5% management charge for Grayscale Ethereum spot ETF, which Grayscale manages. Asset manager as well Grayscale – First of all, Grayscale is a premium offerings fund with some quality services like secure custody solutions, high liquidity, and a record of 10 years of experience in operational success. Institutional-grade security and reliability, the inclusion of these elements ensures institutions that prioritize most heavily for security over cost are considered. Investors derive material value from Grayscale, including access to market-leading liquidity, minimal spreads, and deep pools of trading volume. Grayscale has a decade of experience managing significant crypto funds and is one of the most well-known names. For example, it has a considerable stake in its Digital Large Cap Fund and DeFi Fund.

Can Grayscale Maintain Its Dominance?

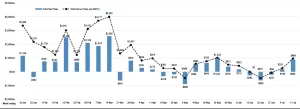

Grayscale’s Ethereum Spot ETF, which boasts high fees, appears challenged by the imminent growth of cheaper competitors. Notably, previous trends in the ETF sector have always seen a surge in inflows for more affordable alternatives, considering that investors always strive to minimize their expenses to maximize their gains. For example, the mutual fund sector transitioned from cheaper Vanguard index funds, taking over active high-fee funds, as more and more investors preferred the low-cost Vanguard option. Grayscale’s Bitcoin Trust registered high inflows initially until its competitors issued cheaper Bitcoin ETFs, prompting some investors to pull out and reinvest in the low-fee options. If other companies issue Ethereum spot ETFs, investing at a lower fee, the entities could capture a significant portion of Grayscale’s market share. Historical data suggests that investors are likely to choose cheaper alternatives, leading to variations in inflows and outflows in the Ethereum ETF sub-industry.

Grayscale May Have to Reevaluate Its Pricing Model

Grayscale may have to rethink its high fee differential as market competition and investor interest change. While The Grayscale Ethereum ETF Mini Trust offers a more cost-effective option of a management fee of 0.15% as management fees, it follows a different structure from Ether SPOT ETF. The Spot ETF requires more active management to track the actual Ethereum spot price closely, so higher fees are also warranted here. But, we have the $403 million and $361 million Bitcoin funds launched by BlackRock and Fidelity, respectively, in 2020. According to a Bloomberg report, the Grayscale Bitcoin ETF kept bleeding out, seeing nearly $87 million left as recent as July 12th. Those numbers underscore the market’s increasingly strong taste for more affordable offerings, irrespective of the brand. To continue its leading market position and dominance, Grayscale may be forced to rethink its fees to align with changing industry standards, keeping the company relevant for budget investors.