- Bitcoin price breakdown from a multi-month support trendline at $82,500, signals a risk of prolonged correction.

- Earlier spot ETF inflows helped absorb this distribution and kept prices supported near $100,000.

- BTC’s fear and greed at 14% signals extreme fear among market participants.

The Bitcoin price has witnessed a sudden sell-off this weekend pushing its price from $84,137 to $77,577. The breakdown triggered a cascading liquidation cross crypto market evaporating billions of dollars in the leveraged market. Despite the sharp sell-off crypto analyst hints the ongoing correction as an early phase of potential bear market.

BTC Slides as On-Chain Data Signals a Freeze in New Capital Inflows

Bitcoin price keeps on sliding under the ongoing pressure of distribution as on-chain data shows a bearish clear pause in the new money entering the network. The realized capitalization – a measure of the aggregate value at which coins last moved – has been essentially unchanged in the recent past and signals new inflows to a halt. In such conditions, a contracting market capitalization is a pointer away from any sustained bullish phase.

Long-term holders, who built up huge unrealized gains in the run up fueled by spot ETF demand as well as heavy corporate purchases (notably from MicroStrategy), have been gradually offloading parts of their stacks since the beginning of 2025. Earlier waves of institutional buying had propped up levels around $100,000 despite this slow selling, but that supporting flow has now evaporated.

CryptoQuant’s founder points out that MicroStrategy played a significant role in fueling the prior advance and that without a major sell-off from that entity, the type of severe 70%+ drawdowns that have been seen in the past seem unlikely: Persistent exits without balancing demand leave the trajectory open in the short term.

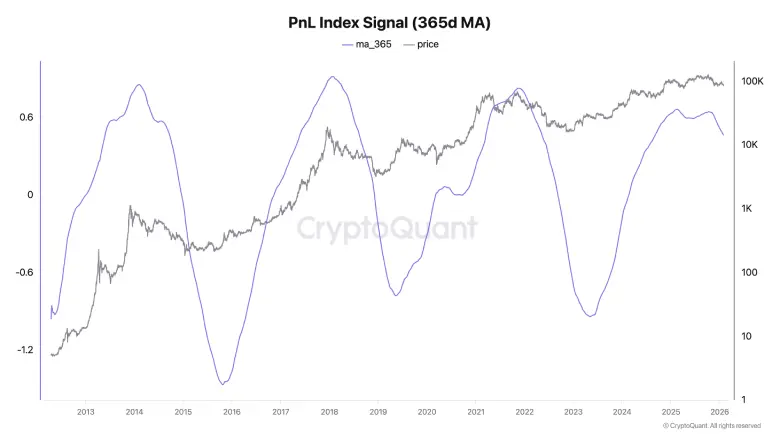

The smoothing of the 365-day moving average PnL Index (which shows the profit/loss movements of wider holders) shows historical cyclical patterns and is presently associated with lower momentum. This kind of setup is good for a range-bounded broad move as opposed to a dramatic vertical move.

Here’s why Bitcoin Price May Lose Another 30%

Bitcoin Price has lost about 37-40% from its cycle high of just over $126,000 in October 2025 and the coin has recently been trading in the mid-to-high $70,000s to low $80,000s range as February 2026 begins. This level of correction puts the present adjustment in the first part of historical bearish phases, hardly indicating the end of the bear market!

Looking at previous cycles shows consistently deeper retracements to form cycle lows:

- The 2011 run-up concluded with a plunge of some 93%.

- The period 2013-2015 was a massive 85% drop from peak.

- From 2017 to 2018, prices dropped some 84%.

- The 2021-2022 bear market saw a 75% decline.

Such patterns show that moderate pullbacks such as the current one often precede more significant losses before any real recovery can set in. Market maturation has resulted in some decrease in the intensity of drawdowns from one cycle to the next, which is indicative of increasingly greater participation and liquidity, but extreme corrections are a fixture and will not go away.

Cycle analysis suggests a likely bottoming between 60% and 70% below the all-time high which is consistent with observed historical behaviour where the presence of less severe early declines is followed by longer and more severe contractions. The current stage is more an extension of these earlier stages of adjustment than a terminal low.

Also Read: Lighter Rolls Out Lighter EVM to Support Ethereum-Compatible Smart Contracts