Ethereum (ETH) is lighting up the crypto market once again, and this time, the momentum looks both powerful and deeply rooted in on-chain fundamentals. All eyes are now on the $4,000 level, as a combination of surging interest, technical breakthroughs, and solid support zones suggests the next leg up might already be in motion.

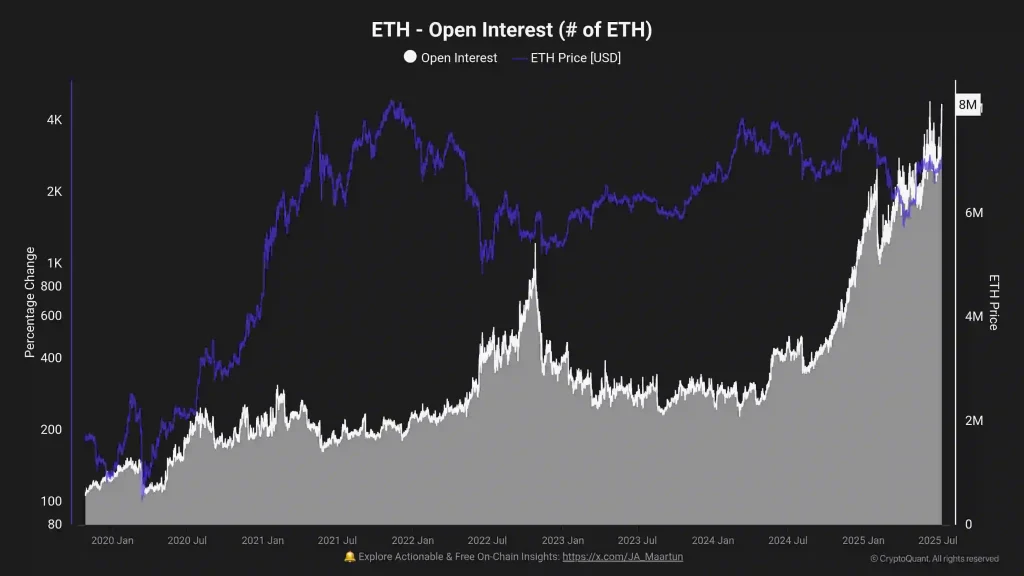

ETH Open Interest Surges to All-Time High

According to on-chain analyst Maartunn, Ethereum’s Open Interest (OI) has reached a historic peak of 8,060,259 ETH—a massive $22.37 billion. This all-time high isn’t a sudden burst but the result of a steady climb that began in early 2024.

Ethereum Open Interest (Source: X Post)

It reflects rising trader participation and growing use of leverage in Ethereum’s derivatives markets—clear signals that confidence is returning in full force. Typically, such a sustained rise in OI indicates that both institutional and retail investors are positioning for significant moves, often in anticipation of price acceleration. As market signals grow stronger, forecasts suggest the possibility of even more upward movement. You can explore our in-depth Ethereum forecast for detailed projections on what’s next.

Ethereum’s Technicals Point to Imminent $4K Push

Technical analysts are already seeing the effects. One such analyst, Crypto Rover, points out that the token’s reclaim of the $3,000 level wasn’t just symbolic—it broke through a major resistance zone that had held firm for months.

Ethereum Price Chart (Source: X Post)

With ETH now hovering above $2.9K and up 20.04% over the past week, the charts indicate that Ethereum’s price target for 2025 could include a retest of its previous cycle highs in the $4,000–$4,200 range—levels not seen since late 2021 and 2024. This shift follows an impressive rebound off the $2,000-$2,500 area, which has demonstrated resilience over an extended period of time as a proven demand area and has acted as an Ethereum bumper during the present market cycle.

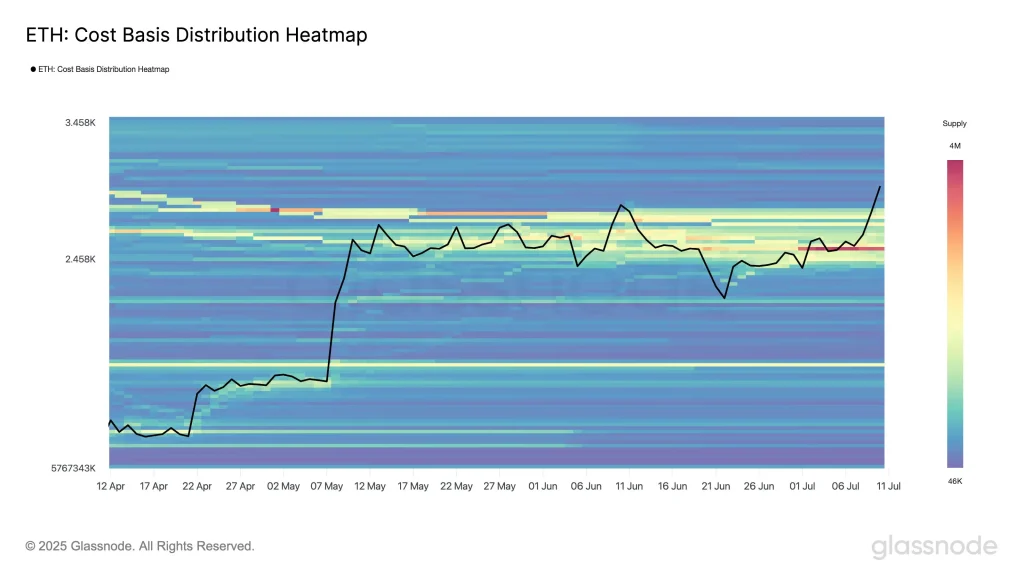

Further supporting the demand zone narrative, according to the on-chain metrics provided by Glassnode, the $2,500-2,533 zone can be referenced as one of the strongest accumulation areas in recent Ethereum history. A heatmap published on July 8 revealed that approximately 3.45 million ETH were bought in that range, making it possible that there was a solid basis of holder conviction.

Ethereum Cost Basis Distribution Heatmap (Source: X Post)

This sector has already demonstrated its value, serving as a launchpad to the current rally. As the bullish trends on both technical and on-chain fronts are gaining steam, the price action in Ethereum is also playing out with respect to investor sentiment that has not been observed in a long time. Provided that such sentiment stays on, the ascent to the price of $4,000 may not only be feasible but also potentially impending.