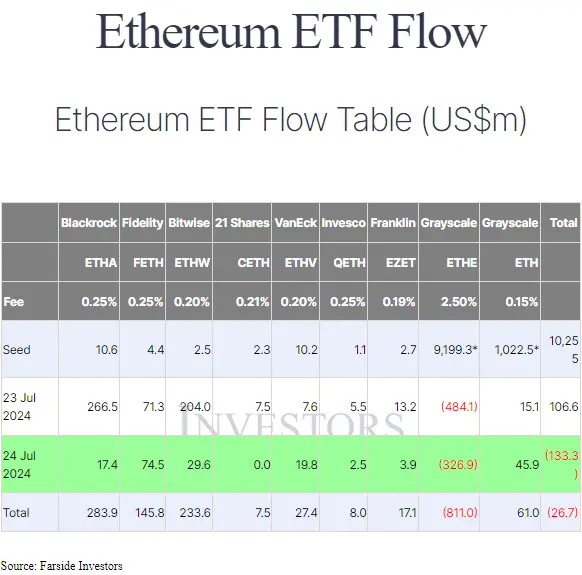

With a first-day trading volume of over $1.1 billion, the newly launched Ethereum ETFs added $10.2 billion in assets under management. On the first day, Grayscale’s Ethereum Trust (ETHE) led the race with a volume of $469.7 million traded. One reason for this dominance is that Grayscale converted its Ethereum closed-end fund, which it began offering in 2017, into an ETF. However, the biggest surprise came in Grayscale, which saw a whopping $484 million outflows. ETF analyst Eric Balchunas of Bloomberg mentioned his surprise, astounded at how much money poured out of Grayscale Ethereum Trust on day one.

In contrast, BlackRock’s iShares Ethereum Trust (ETHA) saw significant inflows of $266 million, followed by Bitwise with inflows amounting to $204 million, while Fidelity saw $71 million. This positions BlackRock as a formidable challenger in the Ether ETF space. ETHA’s successful launch is reminiscent of BlackRock’s Inaugural Bitcoin Fund (IBIT), which quickly outpaced Grayscale’s Bitcoin Trust (GBTC) within a few months, thanks to substantial investor confidence and cash infusions.

In January, Grayscale’s Bitcoin Trust (GBTC) saw less than $100 million in outflows compared to the Ethereum ETFs’ first day of trading. This was a significant moment as investors, who had been locked into the trust since its inception in 2013, could finally liquidate their shares. Initially, GBTC traded at a premium, but starting from February 2021, it traded at a deep discount, reaching record lows of almost 50% in December 2022. The outflows from ETHE are primarily driven by Grayscale’s high fees of 2.5%, compared to competitors charging 0.25% or less, making the competing funds more attractive to investors, as predicted earlier.

For BlackRock to replicate its Bitcoin ETF success with its Ether ETFs, it must maintain high trading volumes and ongoing investor support. BlackRock will need to attract additional institutional investments to leverage its significant market influence and internal assets. Key determinants incorporate sustained governing endorsement, skillfully devised marketing strategies, and resilient affiliations.

Given ETHA’s robust debut, BlackRock is well-situated to test and potentially outpace Grayscale’s Ethereum Trust (ETHE). The pivotal query remains: Will BlackRock continue surpassing Grayscale and redefining the Ether ETF landscape, further cementing its top spot in the crypto ETF market race? With ETHA’s strong start, maintaining interest and drawing new capital will be necessary for BlackRock to extend its early lead and capitalize on the promise of blockchain technology and decentralized applications. The company’s experience and broad range of options can serve it well, but competitors will apply intense pressure as the sector evolves.