- Dogecoin price drives a slow, yet steady recovery amid the formation of rising channel patterns.

- The open interest tied to DOGE records a 61% decline in the last three weeks, suggesting a significant decline in the speculative force.

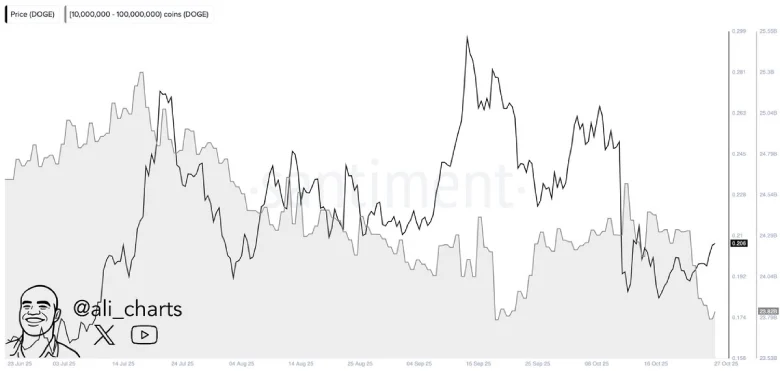

- Market analyst highlights that crypto whales offloaded over 500 million DOGE tokens in the past week, projecting selling pressure from large investors.

DOGE, the largest meme cryptocurrency by market cap, is down 2.31% during Monday’s U.S. market hours to its current trade at $0.2. While the downswing follows a slowdown in broader market recovery, the selling pressure on the Dogecoin price accelerates amid whale selling and dampened speculation. Will this coin witness a prolonged price correction?

Whale Selling and OI Collapse Weigh on Dogecoin Price Stability

Following the historic crypto deleveraging event on October 10th, the Dogecoin price has been struggling to sustain above the $0.2 level. Over the past two weeks, the coin price has been wavering around the aforementioned psychological level, indicating a lack of initiation from buyers or sellers.

Along with price, market uncertainty is also reflected through open futures tied to DOGE. In the last three days, the DOGE future OI has dropped from $5.03 billion to $1.95 billion, accounting for a 61% fall. Such a big contraction in OI is often an indication of mass liquidation or position unwinding, or traders leaving the market out of volatility fatigue.

It highlights a larger trend of reducing participation in speculating for profit, suggesting that leveraged traders are growing more cautious in the face of uncertain sentiment.

Adding to the bearish tone, on-chain data shared by the market analyst Ali Martinez showed that Dogecoin whales have offloaded nearly 500 million DOGE tokens in the past week. This large-scale distribution by the high-value holders implies a lack of confidence on the part of key market participants and serves to add to the downside risk in the near term.

Together, the amalgamation of declining futures activity with heavy selling by whales creates a significant amount of selling pressure on the asset. Unless new demand arises or a reversal in market structure occurs, Dogecoin may keep oscillating below $0.20 and hold a risk of further correction.

Dogecoin Price Poised For Key Support Test

By press time, the Dogecoin price trades at $0.2 with an intraday loss of 2.62%. Consequently, the asset’s market cap plunged to $30.36 billion, while the 24-hour trading volume is at $1.97B. A 17.5% increase in trading volume while price declines indicates the seller’s conviction is strong for further decline.

In addition, the daily chart highlights a potential death crossover between the 50- and 200-day exponential moving averages. Historically, this crossover has raised bearish sentiment in the market and coincided with a notable price decline.

Thus, with sustained selling, the Dogecoin price could plunge another 17% before hitting a suitable support from the long-awaited ascending trendline at the $0.166 mark. From March 2025, the support trendline also participated in the formation of a rising channel pattern, currently driving a slow yet steady recovery trend in DOGE.

The recent history of this chart pattern has shown that a price retest to the lower trendline has often recuperated the bullish momentum and driven a sharp surge that nearly doubled the token value.

Thus, if the support holds, the DOGE buyers counterattack for a renewed recovery.

On the contrary, if the price breaks below the lower trend line with the daily candle closing, the selling pressure would escalate and drive an extended correction towards the $0.13 mark.