According to Binance, the Bitcoin/Ether rate has now hit a 3-year low, reported at 0.03905, at press time. The last time the BTC/ETH rate sank to its lowest was on April, 10th, 2021 at 0.035576, which gradually picked its pace with the support level rounding to 0.04. Many factors might have contributed to Ethereum losing value compared to Bitcoin. The market sentiment surrounding the entire crypto community has been bearish of late. One of the many reasons is the looming rate cut on the way.

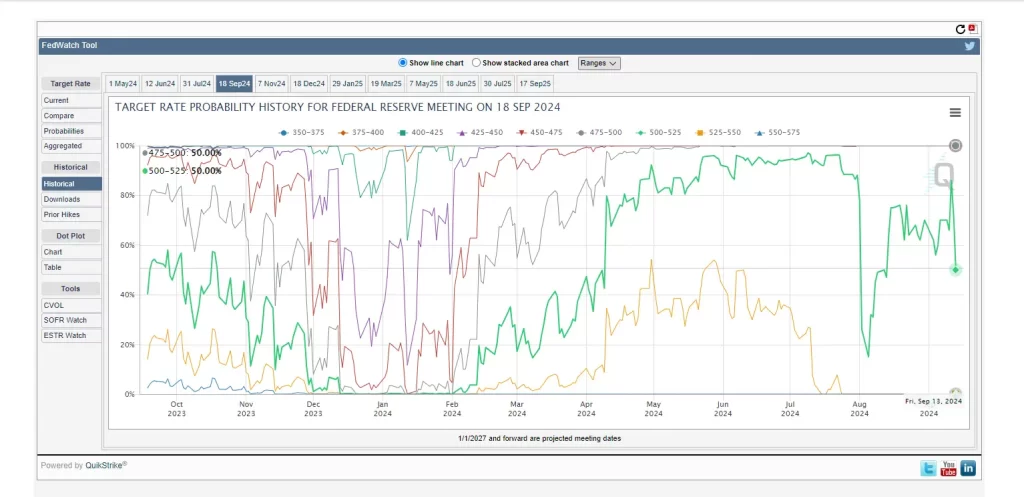

According to Polymarket votes, the odds of a 50 bps rate cut stand at 49%, while a 25 bps rate cut stands at 50%. However, Powell in late July had hinted at a rate cut likely on the table, though a number for the same was not shared. With hush-hush going about the finance markets of a likely 25 bps, the uncertainty has gripped the markets and taken a toll on altcoins. Bitcoin, on the other hand, has stood its ground due to the limelight it has been getting from institutional investors.

💥𝐕𝐢𝐭𝐚𝐥𝐢𝐤 𝐁𝐮𝐭𝐞𝐫𝐢𝐧 𝐢𝐬 𝐬𝐞𝐥𝐥𝐢𝐧𝐠 𝐄𝐭𝐡𝐞𝐫𝐞𝐮𝐦 𝐚𝐠𝐚𝐢𝐧!

Another 190 $ETH have been exchanged for nearly $500k.

Since August 30, he has sold a total of 950 ETH (over $2 million). 🧐

Earlier, the #Ethereum co-founder stated that he has not sold ETH for… pic.twitter.com/Wl2yfpEJTL

— Satoshi Sniper (@SatoshiSniper_) September 11, 2024

Another reason for Ethereum’s sinking value is related to its foundation. Ethereum Foundation’s main wallet only held $650 million worth of Ether on Sept 6th, 2024, which once held $1.3 billion of ETH in March 2022. Additionally, Vitalik Buterin ‘donating’ Ether has also sparked major concerns across the market. Since August 30, the founder has sold a total of 950 ETH, worth over $2 million.

By the look of historical market sentiments, a rate cut is drawing closer with chances of a 25 bps higher than 50 bps. While the market waits for the Federal Reserve to announce the rate cut on September 18th, a 25 bps might not be bad news – cautious optimism can signal a bullish momentum and push Ethereum’s prices higher. Moreover, interest rate cuts could propel investors to lay out money into digital assets like Ethereum for greater profit margins, which otherwise would be sitting in the banks with low returns. Further as per QCP reports, the options market has suddenly come under the spell of Ethereum. With over 20,000 contracts being bought targeting 3k levels by 27-Dec, Ethereum’s prices are likely to pick their pace up soon.