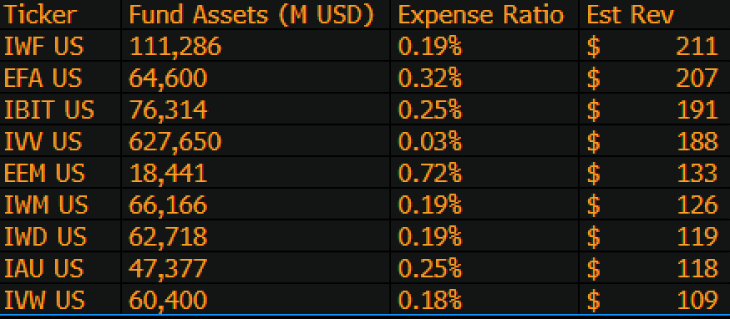

BlackRock’s Bitcoin ETF ($IBIT) has reportedly become the firm’s third-highest revenue-generating ETF among its 1,197 ETFs and is just $9 billion shy of claiming the top spot.

This is a staggering achievement for an ETF that launched only 1.5 years ago. For comparison, the long-established $IWF currently holds first place. The rapid rise highlights Bitcoin ETFs’ growing dominance in BlackRock’s portfolio.

BlackRock’s Bitcoin ETFs Outpace S&P 500 Fund Revenue

(Source: Eric Balchunas On X)

Wall Street giant BlackRock is now generating more revenue from its spot Bitcoin ETF ($IBIT) than from its signature S&P 500 fund ($IVV). The $IBIT fund, launched in January 2024, has brought in an estimated $191 million in annual fees, outperforming the $188 million generated by the much larger $IVV.

This milestone is particularly striking given the vast difference in assets under management (AUM). While $IBIT holds $75 billion in Bitcoin, $IVV manages $623 billion, over eight times more. The key difference lies in the free structure: $IBIT charges 0.25%, while $IVV’s ultra-low 0.03% expense ratio reflects its role as a passive index fund.

$IBIT’s rapid rise shows Bitcoin’s growing institutional demand. As the largest spot Bitcoin ETF globally, it has consistent inflows thanks to both retail and institutional investors. Meanwhile, Bitcoin’s bullish momentum, helping BTC surge to $109,131, further fuels demand.

Bitcoin ETF Inflows Hit Record Highs as Institutional Demand Grows

Bitcoin ETFs are seeing massive investor interest, with U.S. spot funds attracting over $4.7 billion in just 15 straight days of inflows. Leading the charge is BlackRock’s iShares Bitcoin Trust (IBIT), which pulled in $3.77 billion during this period. It makes up a staggering 81% of total inflows.

BlackRock’s ETF now holds $76.3 billion in Bitcoin, which shows strong institutional trust. While IBIT thrives, other ETFs like ARKB and Grayscale’s GBTC saw minor outflows.

The last week of June alone brought in $2.22 billion, with BlackRock’s IBIT securing $1.31 billion. Fidelity’s FBTC and Ark’s ARKB also saw strong inflows, proving Bitcoin ETFs are now a major force in finance.

Under the U.S. President Donald Trump’s pro-crypto administration, institutions are actively pushing capital into crypto ETFs. Institutions avoid the complexities of direct Bitcoin ownership by using regulated ETFs like BlackRock’s IBIT.

These Bitcoin ETFs trade like stocks on traditional exchanges like (NYSE/Nasdaq), allowing quick entry/exit without slippage common in crypto markets.

Also Read: US SEC Placed Temporary Stay on Grayscale’s Multi-crypto ETF