Introducing Bitcoin Spot ETFs in 2024 was the first major structural revolution in accepting cryptocurrency in mainstream finance. These financial instruments have allowed institutional and retail investors to participate in the Bitcoin market with fewer problems (and in a regulated way), which has resulted, among other things, in an increase in liquidity. These activities have influenced market dynamics and trading strategies. The Mean Exchange Inflow Sell Signal is the indicator with a track record of struggling in Q1 2024 as these new ETFs are coming online.

Mixed Flows For Bitcoin Spot ETFs

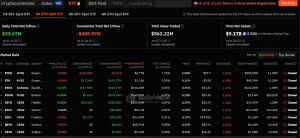

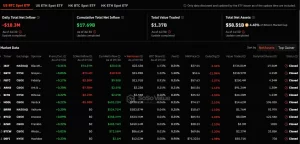

On July 30, Bitcoin spot ETFs saw some action worthy of grabbing notice with recent market conditions. The total net outflow was $18.30 million, signaling a decline in investor sentiment’s confidence. Grayscale Bitcoin Trust ETF (GBTC) experienced a significant net outflow of $73.60 million yesterday, with cumulative net outflows of $18.94 billion, a first in its history. On the flip side, BlackRock’s Bitcoin ETF (IBIT) made a big appearance as one of the most significant accumulators on net inflow for the day, totaling $74.87 million. The inflow raised IBIT’s overall historical net take-in to $20.01 billion, a clear indicator that investors increasingly love what BlackRock is cooking up regarding investment options.

Diverging Ethereum Spot ETF Trends

Ethereum spot ETFs were most hit hard by these movements. On July 30, the combined net inflow to these ETFs came in at $33.67 million. The outflow with the most eye-popping was Grayscale’s Ethereum Trust ETF (ETHE), which saw a $120 million net withdrawal on top of its massive historical net redemption total of $1.84 billion. On the other hand, Grayscale’s Ethereum Mini Trust ETF (ETH) increased with a $12.36 million inflow on Monday. It has seen an accumulated historical net inflow of $181 million since its launch in November 2021. The Ethereum ETF (ETHA) from BlackRock yielded the biggest inflows, daily netting $118 million, showing strong interest among investors. FETH, Fidelity’s Ethereum ETF, had the second-highest net inflow of $16.36 million.

Performance Post-Spot BTC ETF Launch

A fresh chance to look for the effects of Spot BTC ETFs on market indicators is the post-launch phase of these instruments, which ranges from January 10, 2024, through March 31, 2024. The Mean Exchange Inflow (Spot Exchange) on an hourly chart had over 33 crossover values exceeding more than 7. A sell signal is successful if the price of BTC falls more than 1% within 48 hours. However, of those 33 signals, only two failed to hit their target successfully (93.9% accuracy rate). Investors might want to watch out as a high Mean Exchange Flow might precede a significant drop in Bitcoin future prices.

Declines statistics

Average declines—The average decline among 33 sell signals was -3.2%, and the average among 31 successful signals was slightly higher at -3.38%.

The most significant decline – the largest -was 9.73% on March 5, 2024.

Declines ranged—the decline of successful sell signals ranged from -1.05% to -9.73%; minor declines—there were 10 out of 33 sell signals, or 30.3%, with declines between -1.05% and -1.95%.

Analyst Perspective

Different flows in Bitcoin and Ethereum ETFs show a market sentiment that is complex and constantly changing. The hold exerted by BlackRock over Bitcoin and Ethereum ETFs would imply increased demand for its products, which it likely owes to having a large market presence and strategic positioning. In total, Bitcoin spot ETFs hold a net asset value of $58.51 billion with an ETF net ratio accounting for 4.48% – proving how big market share these financial instruments already have managed to secure in the markets. At the same time, Bitcoin spot ETFs’ historical cumulative net inflow volume arrived at $17.69 billion over a longer period, revealing investor confidence.

On the other hand, outflows seen in long-established trusts like Grayscale’s ETHE offset inflows into new or less-invested-at ETFs, suggesting Ethereum faces a mix-bag. The divergence could signal a change in investor strategies or how the market perceives those vehicles as valued and their future growth potential. Moreover, Grayscale seems to be in muddy waters. Especially after the 2.50% management fee for Spot Ether ETF, a large sum concerning the cost of its competitors, investors have made a clear choice and shifted to BlackRock.

We will continue to see a reduction in Bitcoin’s volatility as its market cap increases and potentially its prevalence among institutional investors. Growing market cap and further institutional involvement should translate into less volatile markets with much-reduced price flouncing.