Key Highlights

- BitMine Immersion announces the acquisition of 110,288 Ethereum tokens, acquiring 2.9% supply of the total circulating Ethereum tokens

- The company decided to capitalize on the dip in the cryptocurrency market after facing massive liquidation

- According to experts, whales are taking charge and helping Ethereum to recover from its catastrophic fall

On November 10, BitMine Immersion, the leading Bitcoin mining company, announced the growth in its Ethereum holdings, revealing that the company purchased 110,288 Ethereum tokens in the last week.

BitMine Immersion Expands Ethereum Treasury Amid Crypto Market Dip

In the official press release, the company revealed that it is now holding around 2.9% of the supply of ETH. This purchase comes amid the dip in the Ethereum price after massive liquidation in the cryptocurrency market.

“The recent dip in ETH prices presented an attractive opportunity and BitMine increased its ETH purchases this week,” Thomas “Tom” Lee of Fundstrat, Chairman of BitMine, stated in a press release. “We acquired 110,288 ETH tokens over the past week, 34% more ETH acquired compared to the week prior. This pushed our ETH holdings to 3.5 million, or 2.9% of the supply of ETH. We are now more than halfway towards our initial pursuit of the ‘alchemy of 5%’ of ETH. Additionally, BitMine increased our cash holdings to $398 million from $389 million.”

This aggressive Ethereum purchase is putting BitMine at the top of the leaderboard of Ethereum treasuries. At present, BitMine is the biggest private Ethereum holding company with 3,505,723 ETH at $3,639 per token price. Apart from this, the company also holds 192 Bitcoin (BTC), $61 million stake in Eightco Holdings, and unencumbered cash of $398 million.

This enormous Ethereum holding makes it the second biggest crypto treasury, right behind Michael Saylor-led Strategy (formerly Microstrategy). Strategy is the biggest Bitcoin holding company with 641,692 Bitcoin in its treasury, with a market capitalization of $67.83 billion, according to the official website.

Lee stated in the post, “This past week, BitMine and the Ethereum Foundation hosted an event at the revered NYSE building, hosting many financial institutions for a summit. To me, it is evident that Wall Street is very interested in tokenizing assets onto the blockchain, creating greater transparency and unlocking new value for issuers and investors. This is the key fundamental story and supports our view that Ethereum is a super cycle story over the next decade.”

Ethereum Price Rebounds after Catastrophic Crash

The announcement from BitMine comes amid the slight recovery in the cryptocurrency market, which lifted Ethereum’s price. On Monday, Ethereum soared by 1.08%, increasing its value from $3,486 to $3.560, according to CoinMarketCap.

While this surge is tiny compared to the recent fall, where ETH’s price crashed sharply from $4,355 to as low as $3,198, some experts believe that this could be a positive start for a new week.

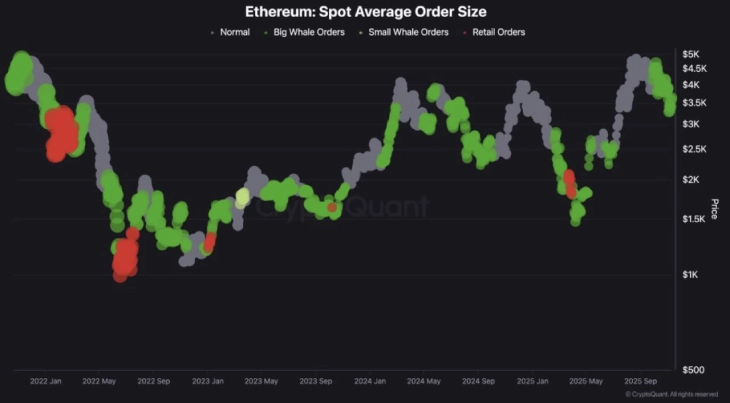

(Source: cryptoquant.com)

According to a user on X (formerly Twitter) named Prime X, Ethereum whales have finally started taking charge and buying dip at $3,200. The post suggests that if the $3,000-$3,400 range continues to provide support, the next target for Ethereum could be $4,500-$4,800. Ethereum is currently rebounding precisely at its critical support zone, the 200-day moving average.

The cryptocurrency market is showing positive momentum today, after Bitcoin has also surged 1.77%, soaring to $105,302 with an impressive market capitalization of $2.1 trillion. This minor surge in BTC has also triggered correlation with altcoins like Ethereum, XRP, and Solana. However, the Fear&Greed index is still stuck at 29.

After back-to-back massive liquidations in the crypto market, the University of Michigan’s consumer sentiment index lowered to 50.3 in November, which was a big fall from 53.6 in October and below expectations of 53.2.

The surge in Ethereum comes ahead of the Fusaka upgrade on the blockchain network, which is expected to take place on December 3, according to the Ethereum Foundation.