Key Highlights:

- Sam Bankman-Fried (SBF) has released a document which suggests that the exchange was never insolvent but it faced a temporary liquidity issue.

- ZachXBT criticized SBF for changing the narrative and for sharing misleading claims again.

- This situation may now call for clearer rules on crypto handling in bankruptcy.

Former FTX CEO Sam Bankman-Fried (SBF) has circulated a document today, October 31, 2025, which has got the entire crypto community talking, especially the FTX creditors. This document was shared through social media platform X (formerly known as Twitter), and with this document, SBF is it is challenging the narrative around FTX’s collapse. According to the shared report, the exchange was not actually insolvent, but instead it suffered a temporary liquidity issue.

The document is also questioning the handling of the bankruptcy process and suggests that customer funds may have been sufficient to cover creditor payouts. The report alleges that customer assets could have fully covered creditor repayments, indicating that the issue was liquidity and not insolvency.

The document further claims that 98% of the FTX creditors have received a notable 120% compensation, with the estate settling around $8 billion in claims and paying $1 billion in legal fees, while still retaining an estimated $8 billion in reserve.

SBF’s Report Paints FTX Collapse as Mismanaged “Liquidity Crisis”

From the report, which is authored and circulated by none other than SBF, it seems like the former FTX CEO is trying to reframe the narrative around FTX’s implosion, arguing that the bankruptcy management team allowed the company’s value to dissipate and delayed creditor repayments for three years.

SBF further states that the exchange was never insolvent, and blames incompetence for shaking the confidence of the users and creating unnecessary losses for the business and the users.

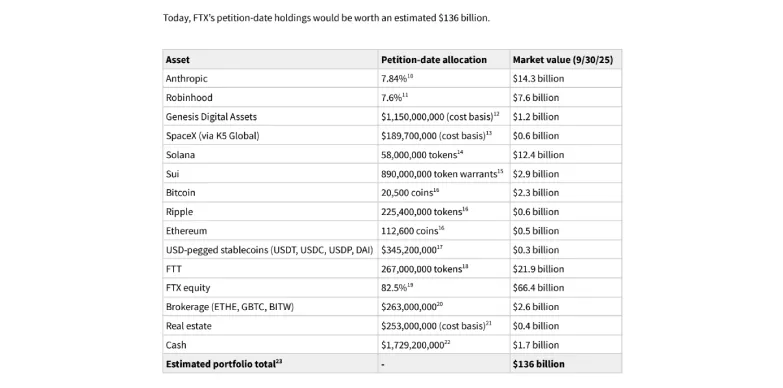

The report also stated that FTX’s underlying value, calculated at present-day market values, would have been worth $136 billion in total by the end of September 2025. This amount is much larger than the debts FTX had reported when it filed for bankruptcy.

A summary of the major holdings has been depicted in the picture below:

This number is based on today’s market prices, which are very different from the much lower valuations used when creditor claims were calculated in late 2022.

Fallout for Creditors: Compensation Based on 2022 Crypto Prices

ZachXBT, a well-known blockchain investigator, replied to SBF’s report on X with a sharp critique. The blockchain investigator highlighted with his comment that the compensation to the FTX creditors is being calculated according to cryptocurrency prices at the exact time of bankruptcy (November 2022), rather than at their much higher levels today. As a result, users whose claims were denominated in assets from the FTX platform, including BTC and SOL have suffered great losses.

For example, Solana’s dramatic price surge over the past three years is entirely excluded from repayments, meaning that claim holders are only reimbursed the much lower 2022 value of their crypto, keeping aside the appreciation.

ZachXBT pointed out that even though the value of many FTX assets have gone up, the extra money will not be given to the creditors, it will stay with the bankruptcy estate and go toward legal and administrative costs. He also mocked SBF’s claim that customers are now better off, saying the rise in value of certain tokens and venture investments is just “coincidence.”

In the end of his tweet, the investigator criticized SBF directly and said that he has not changed in prison and is still spreading the same misleading claims.

Legal Fees, Remaining Assets and Criticism of Bankruptcy Management

The report also highlights that about $1 billion has already been spent on lawyers and restructuring fees, which has led to criticism that the bankruptcy process is helping professionals get paid rather than helping the affected users.

Even though the estate still holds roughly $8 billion in assets, long delays in repayments and lack of transparency around asset sales have gotten on the nerves of the creditors and broader crypto community. This clashes with SBF’s version of events, where he is now blaming the current management for destroying value.

Now that there has been a significant appreciation of the funds, the question arises about how the recovered funds will be distributed. With the estate with far more than when users filed their claims, the situation may call for clearer rules on handling crypto in bankruptcy.

Also Read: XRP ETF Could Go Live by November 13 as Canary Files Updated S-1 Registration