On Tuesday, the cryptocurrency market experienced low volatility trading as investors’ sentiment remained uncertain following the violation of the ceasefire deal by Iran and Israel, which U.S. President Donald Trump announced the previous day. However, the XRP price managed to maintain its bullish momentum and bounce over 2.5% to reach $2.12. The buying pressure can be attributed to a bullish outlook in the derivative market, bolstering the price of a key resistance breakout.

XRP Futures Market Shows Signs of Deleveraging

Over the last 24 hours, the XRP price bounced from $1.962 to $2.21, registering a 13% gain. The buying pressure was triggered by the potential ceasefire between Israel and Iran, announced on Monday by Donald Trump.

However, the bullish momentum was short-lived for the majority of major cryptocurrencies, as the two countries violated this ceasefire the very next day.

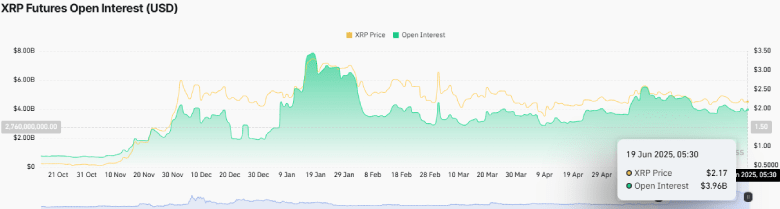

Thus, the XRP futures open interest showed a continued decline, signaling a deleverage trend from market participation. From the mid-May high of $5.52 billion, the OI value has declined to $3.73 billion, representing a sharp drop of approximately 32.4%.

This drop suggests that traders are gradually unwinding their leveraged positions due to increased market uncertainty.

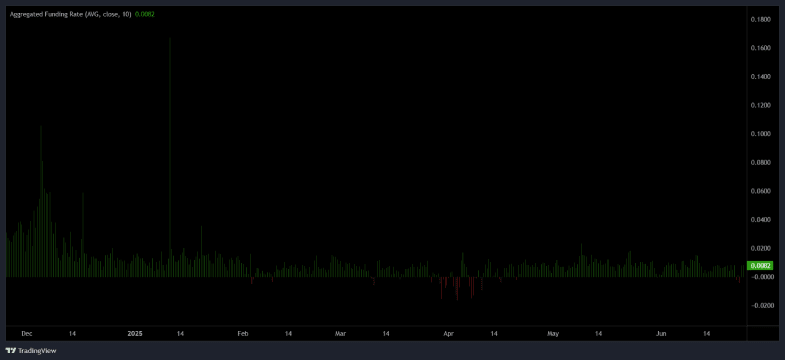

While the weak OI data signals a sluggish trend ahead, the XRP funding rate signals that the market sentiment returns to positive. According to CoinAnalyze data, the metric has recently bounced to 0.0082%, indicating the buyers are willing to pay a premium to hold their long position.

A sustained positive funding rate may signal a renewed appetite for upside exposure, potentially driving the price higher for the next breakout.

XRP Price Nearing Major Breakout From Flag Pattern

Amid the recent market upswing, the XRP price showed a notable bounce to the $2.18 mark, and its market cap boosted to $128.64 billion. This bullish upswing invalidated a bearish breakdown from the $2.05 monthly support and 200-day exponential moving average of June 21st, while forcing the liquidation of the hasty short-sellers of the market.

As the open interest data highlights a weak momentum in the near future, the XRP price could hover above the 200-day EMA to regain demand pressure. If successful, the coin buyers could drive a 5.7% surge and challenge the long-coming resistance trendline of the bull-flag pattern.

Since January 2025, the correction trend in Ripple cryptocurrency has resonated within the pattern’s two covering trendlines. Historically, this pullback has allowed buyers to replenish bullish momentum before the next leap.

Thus, a potential breakout from the overhead trendline will accelerate bullish momentum and drive an initial surge to $2.6, followed by $3.

Also Read: Chainlink Gains Traction as Mastercard Deal Opens On-Chain Access for 3 Billion Users