- XRP price shows a bearish reversal within the formation of a daily channel pattern.

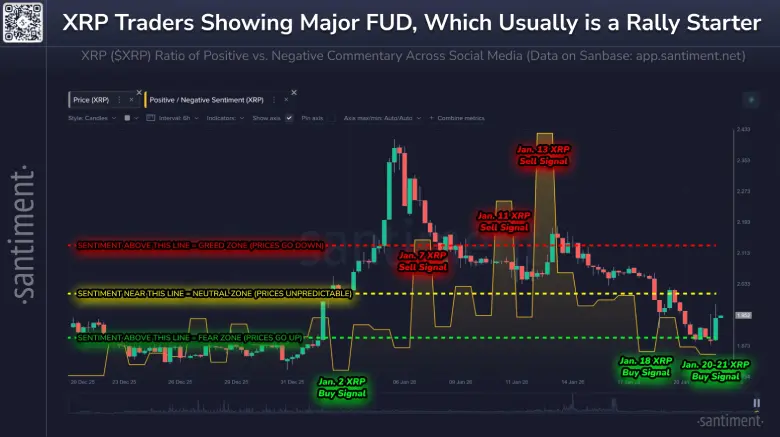

- Santiment data classifies current XRP sentiment within an “extreme fear” range.

- The momentum indicator RSI at 41% shows bearish market sentiment, which reinforces continued correction in price.

XRP, the native cryptocurrency of the XRP Ledger, is down 1.65% to trade at $1.91. This downtick is again influenced by geopolitical tension as U.S. president Donald Trump warns of major retaliation European sales of U.S. bonds and securities. The falling XRP price has pushed market sentiment to extreme fear which historically acted as a precursor for bullish recovery. Will the coin price regain the $2 mark?

XRP Sentiment Slides Into Extreme Fear as Price Drops Below $2

Social media monitoring tools show a significant change in sentiment around XRP to the negative over the past few days. The number-five token in market capitalization has lost close to 19% of its value since peaking around January 5, 2026. As of late January, trading levels are near $1.93 as there is continued downward pressure.

Analytics platforms tracking online conversations, including Santiment, put current sentiment deep in what they call an “extreme fear” category. This is down to a profusion of pessimistic comments, primarily from the ranks of retail participants rather than the institutional voices. Charts that combine the price action with sentiment ratios reveal the balance between positive and negative comments diving dramatically into lower zones – zones that correlate with reversals in the past cycles, where widespread selling exhaustion sets in.

Key periods marked include bearish spikes around January 7, 11 and 13, followed by tentative recovery hints around January 18 and 20-21. The pattern is such that retail expectations tend to go against later price movements, with excessive pessimism sometimes preceding stabilization or gains. Observations continue to follow this divergence as January 23 progresses.

XRP Price Enters Bear Cycle Within This Channel Pattern

The daily chart analysis of XRP price shows a V-top reversal from $2.41 resistance. This downswing, backed by increasing trading volume indicates high-conviction sellers are driving the price movement.

Interestingly, the bearish reversal is positioned at the resistance trendline of an active falling channel pattern. Since July 2025, the coin price has reversed thrice from the pattern’s resistance trendline and twice from the bottom trendline, indicating its strong influence on XRP price.

Historical data shows that the previous two reversal from the resistance trendline accelerated selling pressure in this altcoin and led to continued correction toward the bottom trendline. The XRP price is currently positioned below the daily exponential moving averages (20, 50, 100, and 200) as they show a notable downtick, indicating the path to least resistance is down.

Thus, the XRP price shows a higher possibility to continue its downward trend for another 40% before retesting the lower trendline at $1.14. That said, the buyers have an opportunity to counter attack at nearby support of $1.78 and $1.56 as marked in the chart below.

Until this chart setup is intact, the XRP price would continue its ongoing correction trend. Therefore, the coin buyers must target breakout above the upper boundary of the channel pattern to regain sustainable recovery momentum.

Also Read: Bitcoin Sentiment Weakens to Fear as Downtrend Risks Persist