- XRP price gave a decisive breakdown below the support trendline of $2.6.

- The crypto market witnessed the biggest liquidation in history, with over 1.5 million traders liquidating $19.13 billion in 24 hours.

- Exchange change shows a leverage retest in XRP’s derivative contracts as open interest plunged to $1.92 billion.

On October 10th, the XRP price plunged nearly 55% to hit a $1.25 low before reverting to the current trading price of $2.20. The crypto market witnessed a sudden, unexpected crash across the majority of major digital assets as Bitcoin plunged to $110,000 and Ethereum fell to $3,500. The pullback likely initiated with Trump’s tariff threats against China, triggering a global risk-off sell. The falling price started a liquidation cascade, providing a major breakdown in XRP price.

XRP Price Crashes 55% in a Day as $129M Liquidations Surge

Over the past week, the XRP price was already lagging behind the general bullish sentiment in the crypto market. From the recent swing of $3.09, the token price witnessed a sharp pullback to the current trading price of $2.2, registering a fall. The pullback also wiped out a notable chunk of its market capitalization, which is now around $140 billion.

A major contributor to this fall was recorded on Friday, when the price dropped almost 55% to reach a $1.25 low before reverting. The sudden move sent a wave of liquidations through leveraged positions. Data from Coinalyze showed that long positions took the majority of losses, with around $129.1 million worth of contracts liquidated, compared to an estimated $14.4 million in short liquidations.

The cooling sentiment affected the derivatives market as well, with open interest in both perpetual and futures contracts shrinking from a high of about $3.4 billion to $1.92 billion; that is, a 43% reduction in total speculative exposure. Funding rates also turned strongly negative at -0.084, indicating increasing bearishness of traders rebalancing after the sell-off.

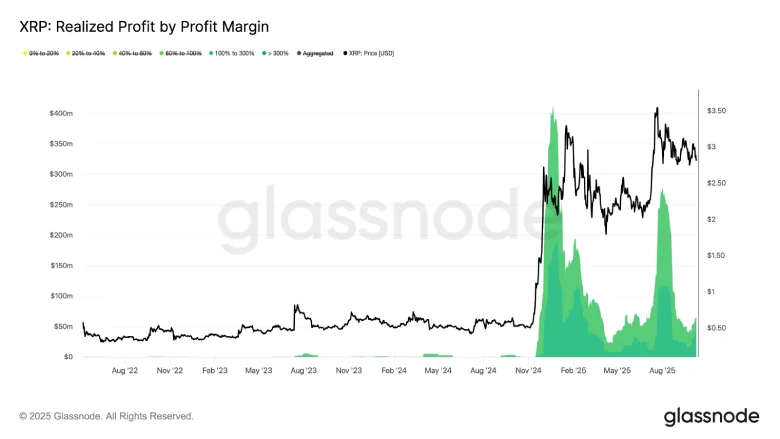

On-chain data from Glassnode also showed changes in the behavior of long-term holders. Investors who had purchased XRP at sub-$1 prices were seen securing gains after the token price broke through the $2 mark, netting gains of more than 100%.

Analysts identified two strong phases in the realization of profit, one during December 2024 and the second in July 2025. These events seem to have depleted much of the up-and-coming energy that had been driving the asset’s strong performance up until that point.

With volumes still high and volatility still present, the current market structure of XRP is one of a transition phase of position unwind and diminished speculative leverage, suggesting a market recalibration after months of accumulation and exponential price growth.

XRP Price Crashed Below Bullish Support

Over the past three weeks, the XRP price witnessed a steady correction trend within the formation of a descending triangle pattern. A persistent downslope in the trendline has steadily pushed the price lower from $3.66, while a firm horizontal support at $2.687 managed to prevent deeper correction.

However, with today’s massive sell-off, the XRP price provided a decisive breakdown below the bottom support and plunged to $2.33. The coin price also lost the 200 exponential moving average, reflecting a major shift in market sentiment.

From now on, the XRP price is anticipated to enter a relief rally and retest the $2.64 load as potential resistance. If the sellers continue to defend this floor, the current correction could prolong and chase the $2 psychological level.

On the contrary, if the potential retest manages to reclaim the $2.7 level, the XRP price could attempt to recuperate the bullish momentum.