Key Points:

- XRP ETFs Record $8.72M Inflows after January 7 recorded an outflow of $40M, ending the eight weeks of no inflows.

- The majority of XRP ETFs did not collapse, and the price of XRP was solid.

- The Outflows came after WisdomTree pulled its application for the XRP ETF.

XRP ETFs Record $8.72M Inflows, breaking the long run of outflows. XRP ETFs posted outflows of $40.8 million on January 7. This was a significant difference from the past, whereby the cumulative inflows had left XRP ETF assets at about $1.53 billion or about 1.16 % of the total market cap of XRP.

The major outflow was caused by the fund of 21Shares TOXR that experienced an incredible redemption of $47.25 million. This left the overall outflows negative, but the rest of the XRP ETFs, such as those of Canary, Bitwise, and Grayscale, were either somewhat positive or flat. The value transacted in the XRP ETF complex in total on the day was $33.74 million, which indicated that there was a change, but the market was not in panic mode.

In the past, outflow days on Bitcoin (BTC) and Ether (ETH) spot ETFs also occurred soon after the initial listing. Nevertheless, this continuity in demand for crypto ETFs had been among the main factors that had made it impressive in early 2026.

Do the New XRP ETF Inflows Mean a Trend Reversal?

One day redemption does not necessarily indicate a reversal of the trend in the long term. The redemption can be associated with overall portfolio rebalancing, tax modifications, or even the inventory management of market makers. Although the outflow is likely to end an impressive run, it is too soon to conclusively state that this is an indicator of the declining anticipation of XRP in ETFs.

Better still, the larger scope of XRP performance is relevant. The inflow streak of ETFs was one of the factors that prioritized the good performance of the token in early 2026. With XRP still on the upward trend as the new year commenced, the consistent inflow into ETFs helped to support the optimistic mood experienced by the market.

The flows of ETFs will remain under continuous observation by traders and analysts since they will offer a real-time image of the market sentiment. If the inflows aren’t sustained, it may exert pressure on the price of XRP downwards. Nevertheless, there are still several prudently optimistic ones, which indicate that redemptions of single funds are not the end of the good ETF performance of XRP just yet.

WisdomTree Withdrawal Signaling Market Uncertainty or Strategic Pause

As the inflows and outflows of XRP ETFs continue to be volatile, another major cause of uncertainty is the official abandonment of the application by an asset manager, WisdomTree, to have an XRP spot ETF.

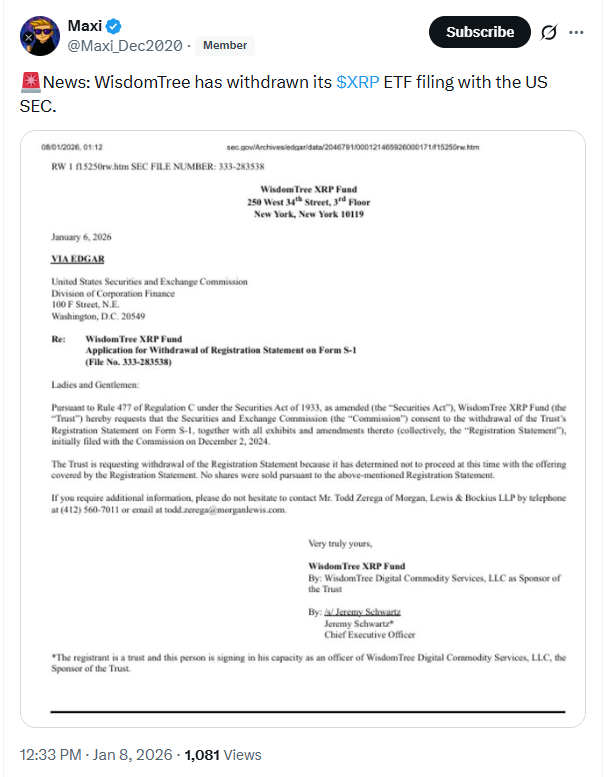

WisdomTree Digital Commodity Services decided to withdraw its S-1 registration filing of XRP ETF on January 6, 2026, and submitted a request to the U.S. Securities and Exchange Commission (SEC).

The move to suspend the product is still uncertain, as regulatory approval has been deferred as a result of the U.S. government shutdown. Though it has been evident that WisdomTree is in the process of temporarily halting its offering of the XRP ETF, it has asked the SEC to revoke the entire registration statement.

In its filing, WisdomTree has indicated that it is no longer interested in proceeding with the public offering as per the registration statement as initially filed on December 2, 2024. This announcement is a long time coming since XRP ETFs were initially set to be approved in October 2025, but were postponed. The fact that the WisdomTree XRP fund is leaving is important considering the history and size of the company, with more than $113 billion under management.

Also Read: XRP Price Faces Fresh Bear Cycle as Whale Transfer Hits 3-Month High