Key Highlights:

- XRP ETF experiences its first outflow since its launch.*

- Major outflows hit 21Shares TOXR while Bitwise XRP recorded inflows.

- Total assets remain substantial with strong historical inflows.

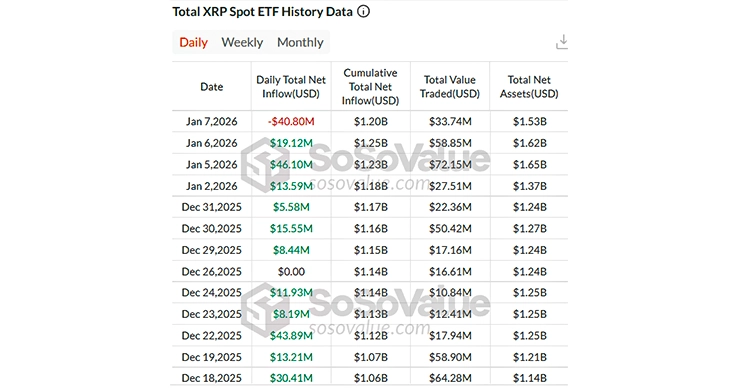

XRP spot exchange-traded funds (ETFs) saw their first ever money outflow on January 7, 2026, losing $40.8 million, as per SoSoValue data. This is huge because after having steady inflow since inception of the XRP ETF, this is the first time that the product has experienced an outflow. This suggests that the investors may be getting more cautious about the crypto market.

The total value is now $1.53 billion with XRP holding a 1.16% share and total past inflows at $1.2 billion overall historically.

Historic First Outflow Details

The 21Shares XRP ETF (TOXR) was hit the hardest, with investors pulling out $47.25 million in a single day. Because of this, its total net outflow over time increased to 8.18 million, wiping out part of the gains it had made earlier.

On the other hand, the Bitwise XRP ETF (XRP) moved in the opposite direction. It recorded a small one-day inflow of $2.44 million, keeping its overall historical inflows strong at around $288 million.

This split shows that investors are not reacting the same way to all XRP ETFs. While many investors continue to trust and invest in Bitwise, 21Shares appears to be facing heavier withdrawals. This could be due to general market uncertainty or investors choosing to lock in profits after recent price highs.

Context of Prior Inflow Streak

Before this outflow, XRP spot ETFs had seen only positive money flows since they launched in November 2025. As recently as January 6, the funds attracted $19.2 million in fresh inflows.

The Franklin XRP ETF (XRPZ) led the day with $7.35 million which was followed by the Canary XRP ETF (XRPC) with $6.49 million. At that point, total assets across XRP ETFs stood at $1.62 billion.

December 2025 was one of the strongest month for XRP ETFs. It was observed that investors added $499.9 million during the month. This inflow helped push the XRP ETF beyond $1.14 billion. This indicates a strong interest from the investors as XRP’s price recovered and moved above the $2 mark.

Speaking of XRP price, the price of the token currently stands at $2.12 with a dip of 5.87% in the last 24-hours as per CoinMarketCap. Just yesterday, January 7, 2025, the price of the token was hovering around $2.4 mark with an uptick of almost 13%.

Until now, the talking point for XRP ETF was lack of any outflows. On the first day of its launch, the product had observed an inflow of $243 million. There had been instances where the buying interest was even stronger than what Bitcoin and Ethereum ETFs saw.

Implications for XRP Market

This outflow had come at a time when XRP is facing higher price swings, with total assets slipping from recent highs near $1.65 billion. The 1.16% net asset ratio also shows that the actual holdings are still small when compared to total assets, which could make prices even more sensitive to money moving in or out.

Even so, total past inflows of $1.2 billion are far bigger than the outflows, which points toward a continued long-term interest despite this pause.

Investors may see this as short-term profit booking after XRP’s recent rally, also shaped by wider economic factors.

Bitwise’s inflows point towards selective investor confidence, while the outflows from 21Shares could put pressure on its assets if the trend continues.

There is a possibility that XRP’s on-chain activity and Ripple’s continued progress, can help attract fresh inflows again. With total assets at $1.53 billion, even small recoveries could help steady overall market sentiment.

Also Read: XRP Surges 12% as ETF Inflows and Supply Drop Fuel Rally