- XRP surges past the $3 mark, prompting market speculation of a bullish rebound.

- Market structure depicts XRP is trading in a discount zone compared to previous highs.

- Short liquidations reached $8.78M, far outpacing $3.01M in long liquidations.

XRP has surged back above the key $3 threshold, reinvigorating bullish hopes, especially after last week’s choppy trading. The breakout, serving both as psychological and technical resistance, led the XRP crypto to an increase of 5.3% for the past 24 hours, putting it among the day’s top gainers.

Notwithstanding this impressive recovery, the price of XRP has maintained a 2.91% loss on the week-long chart, bringing to the fore a fundamental question: Can XRP hit $5?

XRP Price Rebounds Strongly, Faces Key Fib Levels

The token started a strong recovery lift after being on a downtrend since late July. Finally, it found strong support near $2.72, which acted as a launching platform for the big recovery. This same support forms the bottom of a falling wedge, a pattern considered bullish in technical analysis.

Since the prices have broken above the wedge, the XRP price prediction shows that strength is building up on increased volume. Presently, with the price just shy of the 0.382 Fibonacci retracement at $3.08, the token has its first immediate resistance. Should a strong close occur above this level, the way gets cleared for a challenge of the 0.50 Fibonacci at $3.19.

XRP Price Chart (Source: TradingView)

In case bulls persist and push up higher, the first barrier to look at lies at $3.19, after which the next resistance can be observed virtually at the 0.618 Fib at $3.30. The trend can stretch on towards the high set at $3.66. In terms of market structure, XRP remains under a “Discount Zone” relative to its highs, a possible entry price for traders who are eyeballing undervalued assets that can rally. As we previously highlighted, the upside potential for XRP with targets set as high as $4.80 in the near term.

Even though all these technicals paint the picture of a theme that might have a promising bullish resurrection, the forecast for XRP also reflects some dangers looming in the near term. Just in case the bullish momentum fails to take charge, the token can once again go down and retest the upper bound of the wedge, which now acts as potential support. A clean bounce here would keep the bullish trend alive, but a break below this level can reopen the gates to a fresh bearish market.

On-Chain Data Hints at XRP Supply Squeeze

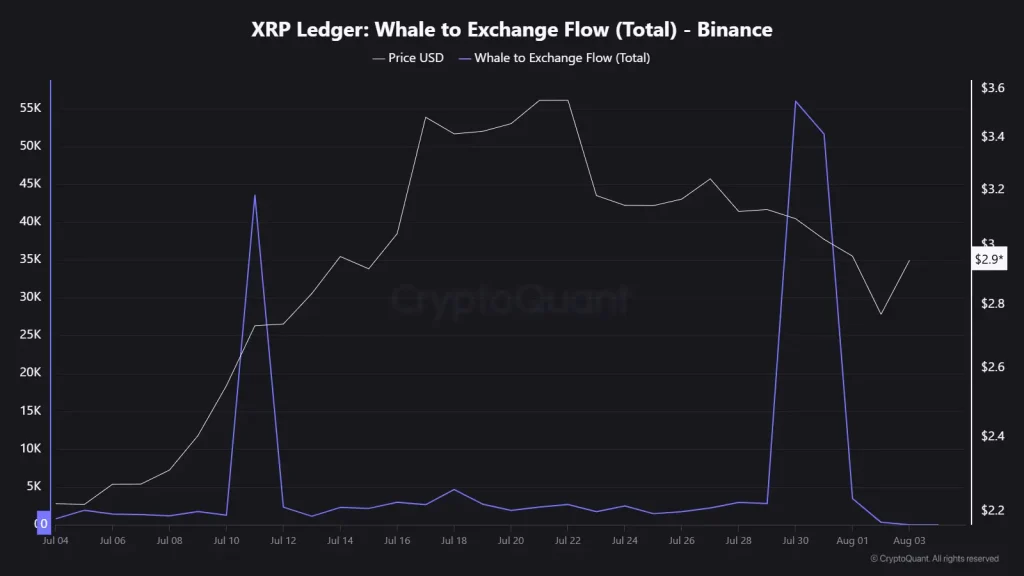

The recent break of the $3 mark by XRP is not merely a technical breakout but one that is supported by strong on-chain indicators. Binance data indicates two enormous spikes in whale-to-exchange transfers, on July 11 and July 31, with more than 40,000 XRP transferred to exchanges in each case. These inflows corresponded well with local tops and a subsequent price pullback, indicating profit-taking by high holders.

XRP Whale to Exchange Flow (Source: CryptoQuant)

However, the situation has changed. By August 4, whale activity had dropped significantly, which shows that key participants no longer saturate exchanges with supply. With the cryptocurrency currently trading at around $2.90, the declining inflow of whales indicates a possible supply crunch, a scenario that may follow a bullish trend should the demand keep increasing.

A wave of short liquidations is fueling this rally. According to Coinglass, more than $8.78 million in short positions were liquidated during this period, compared to $3.01 million in long positions. This skew is a sign of a typical short squeeze, in which the swift price action causes short sellers to unwind their positions, further driving the rally.

XRP Total Liquidation Chart (Source: CoinGlass)

Platforms such as Binance, Bybit, and Bitmex bore the brunt of such liquidations, which reaffirms the magnitude of the market shift. Together, the waning sell pressure by whales and the forced liquidation of shorts represent the increasing bullish sentiment.