Key Highlights:

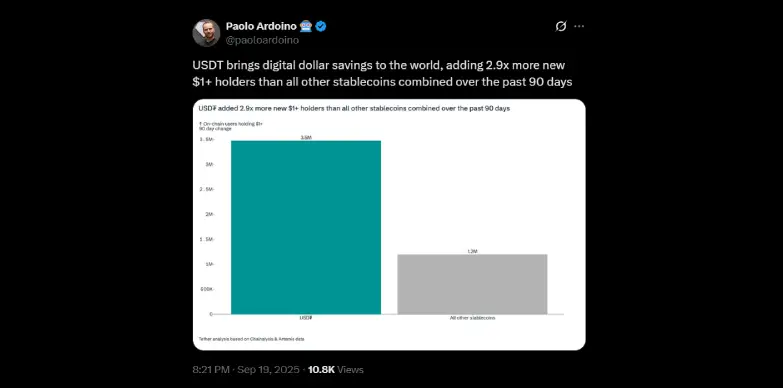

- USDT added 2.9x more $1 + holders.

- Growth fueled by retail adoption in inflation-hit economies.

- Stablecoin is evolving from a trading tool to a global digital savings tool.

Tether’s USDT is tightening its grip as the king of stablecoins, emerging as the fastest-growing on-ramp for digital dollar savings worldwide. According to the most recent on-chain data released by Tether CEO Paolo Ardoino, USDT added 2.69 times as many new holders with balances of $1 or more in the last ninety days as all other stablecoins combined.

It is evident from this enormous single figure that it has established itself as one of the best options for dollar savings in emerging markets and a larger cryptocurrency economy.

USDT Outpaces Stablecoin Rivals

USDT’s surge shows that it is pulling ahead of its rivals like USDC, DAI, and FDUSD. Wallets containing at least $1 in USDT grew significantly faster than their peers over the last three months. Tether is being used on both centralized and decentralized platforms, with deep liquidity and ease of transfers across blockchains cited by analysts as the main factors causing this momentum.

By supply, Tether currently controls over 70% of the global stablecoin market. As local currencies struggle with rising inflation, their expansion into regions such as Asia, Africa, and Latin America is providing people with a crucial route to dollar-pegged savings.

A Dollar Lifeline in Inflationary Economies

This shift has been significantly seen in countries such as Argentina, Turkey, and Nigeria, as the increasing inflation is driving people more and more towards dollar-pegged assets. With banks and forex services costly or restricted, USDT offers an easy, low-cost way to access digital dollars.

By adding nearly three times more new small-scale holders than all other stablecoins combined, USDT shows that everyday users, not just institutional traders or crypto whales, are driving its demand. This proves that people are using stablecoins less for risky trading and more as a safe pathway to store or manage their money.

Regulatory and Competitive Landscape

While Tether celebrates this achievement, the stablecoin space is under the regulator’s microscope. In the U.S., lawmakers are still debating a formal framework, weighing if issuers should operate like banks. Meanwhile, rivals like Circle’s USDC shine in U.S. institutional markets.

But on the global retail stage, especially outside developed economies, USDT is in a league of its own. Its presence across Ethereum, TRON, Solana, and Polygon keeps it accessible no matter the transaction costs. This multiplatform reach has been key in fueling adoption among users who want fast, cheap, frictionless transfers.

Beyond Trading: Toward Digital Savings Accounts

USDT’s growing role as a daily digital dollar is also sparking questions about its place in DeFi. Lending platforms, remittance apps, and payment tools increasingly treat USDT balances like mini savings accounts. For many users, holding USDT in a wallet usually replaces a traditional bank account.

Fintech startups in emerging markets are creating direct USDT rails for payroll, micro-lending, and cross-border payments. As only $1 is needed and no banks in the middle, stablecoins are being looked at as real financial infrastructure, not just trading tools.

What’s Next for the Market Leader?

USDT is on edge. It still remains a top choice when the regulators have not yet fully involved, and even when there are several coins that are trying to compete with USDT. Many of the people are using it because it is a safe way to hold digital dollar.

In the time span of three months, USDT has become more than just for trading; it is helping people keep their money safe, especially when the economy is not stable. As of now, UST is stronger than ever as a trusted digital dollar.

Also Read: BNB Price Hits $1000 Twice: Is $1900 Within Reach?