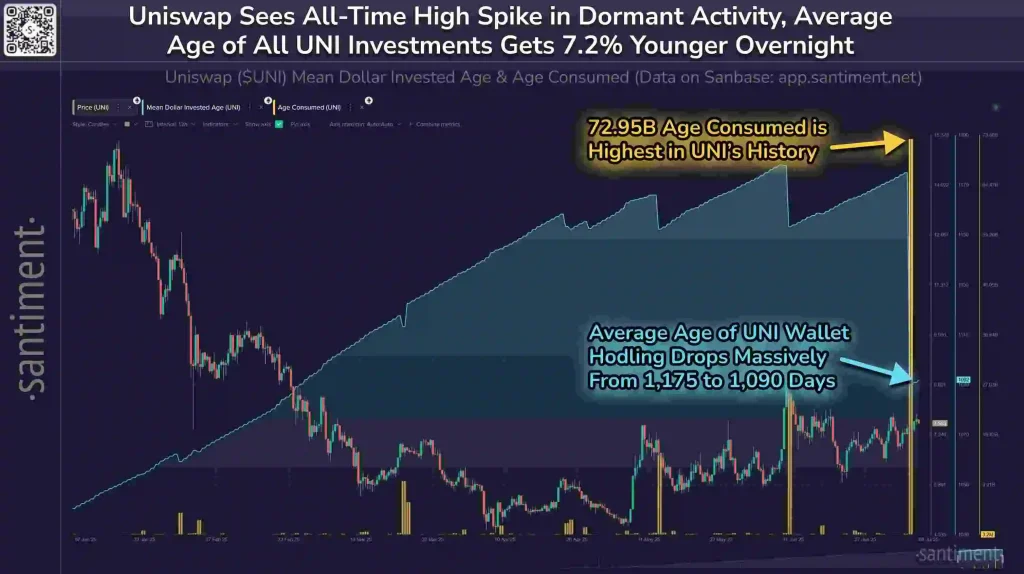

According to analysts at Santiment, a historic surge in dormant UNI token activity has shaken the network, with 72.95 billion in “age consumed” recorded in a single move. That’s the highest in Uniswap’s history. For those less familiar with the term, “age consumed” refers to the volume of tokens moved multiplied by how long they’ve been sitting idle.

In short, some of the oldest, dustiest tokens in the ecosystem just came back to life. What does that mean? Long-held UNI tokens—some untouched for over three years—were suddenly transferred, suggesting that major holders are re-engaging.

Uniswap Mean Dollar Invested Age and Age Consumed Chart (Source: X Post)

As a result of this spike, the average age of UNI wallet holdings dropped sharply overnight, from 1,175 days to just 1,090 days. That’s a 7.2% drop, indicating a mass migration of older tokens back into active circulation.

While this doesn’t guarantee a price rally, history shows that these kinds of movements often signal a new wave of on-chain activity—and sometimes, price growth. It’s already having an impact. Since June 22nd, Uniswap’s market cap has jumped by 21%, aligning closely with the surge in dormant token movement.

Analysts at Santiment believe this could mark a new phase of momentum for the DeFi token, especially as older investors potentially reposition themselves or prepare for further developments. Adding fuel to this optimism, liquidation data from CoinGlass points to a potential short squeeze underway.

Uniswap Liquidations Chart (Source: CoinGlass)

As Uniswap’s price climbed to $8.33, over $1.52 million in short positions were wiped out across major exchanges—led by Binance and OKX—while long liquidations remained minimal at just $82.6K. This sharp imbalance suggests that bearish traders were caught off guard by the sudden price surge, triggering forced buybacks to cover their positions.

Uniswap Stares Down $8.20 in Bid for Bullish Breakout

Analyst Crypto Rand has highlighted a key technical development for Uniswap (UNI), noting that the cryptocurrency is once again testing critical resistance at the $8.20 level. According to Rand, a confirmed breakout above this zone would signal a complete bullish reversal for UNI, following weeks of accumulation and steady upward movement.

The 3-day chart indicates how UNI is consolidating right below the resistance band after clearing several lower levels. Together with the recent on-chain activation of idle tokens and the recorded short liquidations totaling $1.52M, a breach of $8.20 could condense a more robust uptrend.

Uniswap Price Chart (Source: X Post)

Should the bulls successfully reverse the $8.20 resistance to sound support, it may spark a swing change in the market as never before witnessed since the sharp decline of UNI earlier this year. As Crypto Rand illustrates in his analysis, such a breakout may be the first step to even greater prices, and $12 is making itself apparent, and even beyond $16 in the case of intensification of bullish power.

With on-chain confidence inching towards the technical set-up, the stars are lining up to provide a rally that even the positively inclined traders have yet to imagine.