Key Highlights:

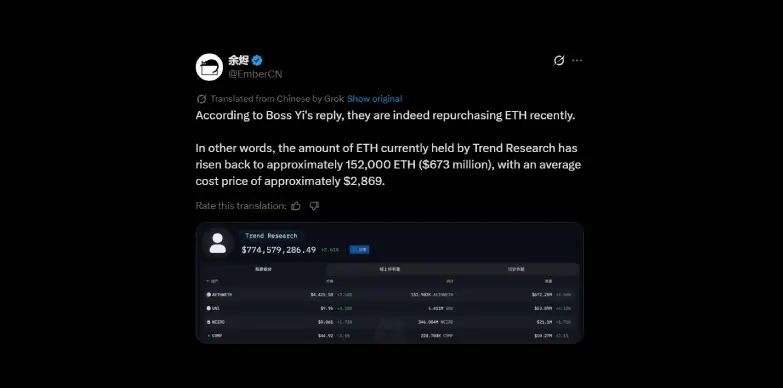

- Trend Research has increased its Ethereum holdings to 152,000 ETH.

- The firm used ETH as a collateral on Aave to borrow stablecoins and enabled liquidity for ETH repurchases.

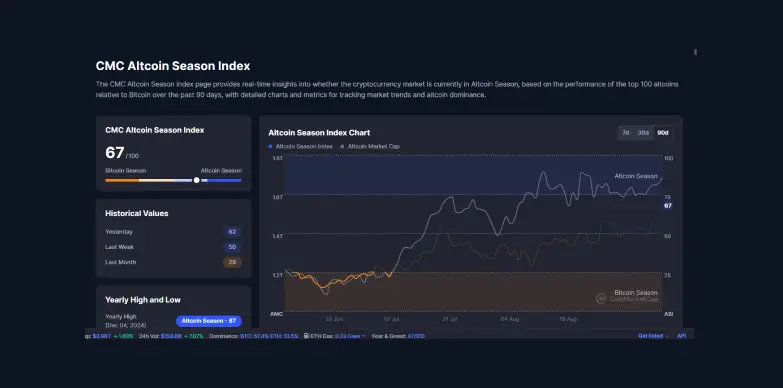

- The Altcoin Season Index rose from 29 to 67 in September 2025.

Trend Research has increased its Ethereum (ETH) holdings to 152,000 ETH, which is worth around $673 million. This development has come at a time when the Altcoin Season Index has hit its highest level this year, which indicates that the strengths (price gains, trading activity, and investor confidence) across Ethereum and other major altcoins are increasing.

Leveraging DeFi and CEX to ETH Accumulation

According to on-chain analyst EmberCN, it has been noted that Trend Research has recently used two new wallets to buy 43,377 ETH, which are worth about $192 million. Just a week earlier, the firm had also managed to pull 34,000 ETH out of Binance and then also took another 9,377 ETH from the exchange.

These steps are seen as smart liquidity management moves because Trend Research did not sell its ETH to raise cash. Instead, it used ETH as a collateral on Aave and borrowed stablecoins. This move gave them extra liquidity and made sure that their original ETH remained untouched. The company kept rotating these funds back into Binance and were securing more and more ETH. In this way, the firm managed to preserve and expand its core holdings without losing exposure to Ethereum’s price growth.

The firm, Trend Research, has earlier built up a big position of 182,000 ETH at an average price of around $2,250. When ETH surpassed the $3,000 mark in July, the firm sold 74,000 ETH to lock in profits and lower its risk. After that sale, its balance had been stagnant for a while and stayed at 108,000 ETH. With the latest buying, the founder of the firm has confirmed that their holdings are now back up and have hit the 152,000 ETH mark, with a new average cost of $2,869 per ETH.

This strategic accumulation has come at a time when the price of per ETH is trading above the $4,300 mark. At press time, the price of the token stands at $4,415.57 with an uptick of 2.27% in the last 24 hours as per CoinMarketCap.

Altcoin Season Index Soars: What This Means

As Trend Research has made a comeback, ETH positioning coincides with a market-wide surge in altcoin sentiment. This September, the Altcoin Season Index, a key metric that indicates how altcoins are performing when compared to Bitcoin, climbed from 29 to 67, which simply indicates that the money is now flowing into non-Bitcoin cryptocurrencies at a faster rate.

While Ethereum is technically labelled as an altcoin, its size and influence within the industry and the market often places it in a separate category of its own.

This sharp rise in the index indicates that there is a broad risk-on mood, with traders, funds and institutions putting more money into altcoins. As the largest altcoin, ETH benefits both from its own demand and from the overall growth of the sector. Trend Research’s move to increase its holding also indicates a strong confidence in this cycle and in Ethereum’s role in driving DeFi, NFTs, and tokenization.

Strategic Implications for Ethereum and Market Sentiment

Trend Research’s recent move indicates how big players approach crypto trading. They buy ETH in large amounts, providing their vote of confidence in the long-term strength of the token, especially as more and more money starts moving into altcoins. Using Aave to borrow against ETH lets them access liquidity without selling their holdings, a way through which the firm manages their risks and keep their exposure to the cryptocurrency. These large withdrawals and repositioning also affect the market sentiment, which creates stronger support levels as other traders start noticing these moves.

The combination of renewed whale accumulation and the onset of altcoin season has the capacity to spark further bullish sentiment for Ethereum, if current trends hold or intensifies.

Also Read: Cardano Price Breaks 5-Week Correction with Bullish Flag Pattern