- Synthetix price outperforms crypto assets in post-liquidation rally amid a sharp surge in network activity.

- Open interest tied to Synthetix futures recorded a +300% surge in the last 48 hours, indicating increasing bets on SNX’s potential price trajectory.

- SNX price drives sharp recovery amid the formation of a cup and handle reversal pattern.

SNX, the native token of a decentralized finance (DeFi) protocol, Synthetix, dropped 13.1% on Tuesday, October 14. The selling pressure aligns with a broader market pullback as Bitcoin struggles to hold above the $115,000 floor, signaling the risk of a continued correction looming. While the majority of major altcoins, including SNX, followed similar momentum, the Synthetix price shows potential for a rebound amid strengthening network activity and speculative force in the derivatives market.

Synthetix Network Logs Record On-Chain and Futures Activity

On October 10th, the crypto market witnessed a massive sell-off and the largest liquidation in its history afterU.S. President Donald Trump imposed an additional 100% tariff on goods from China. The news-driven sell-off and cascading liquidation pushed the Synthetix price to a low of $1.44 before it made a drastic comeback.

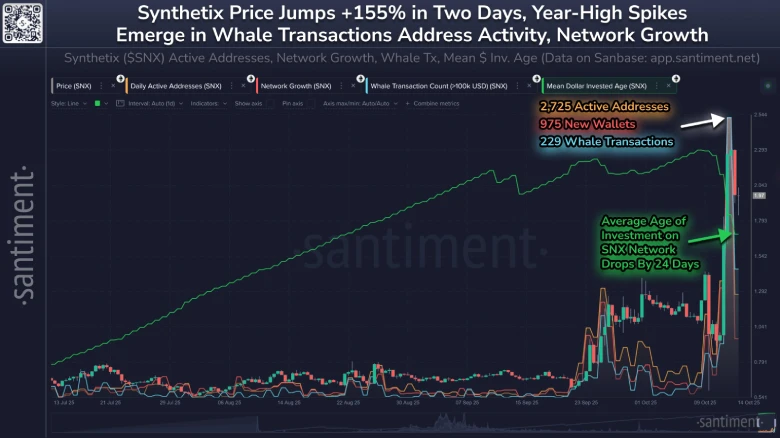

Since last weekend, a majority of major cryptocurrencies have been struggling to hold key support; the SNX coin rebounded 405% to hit a $2.58 peak. The recovery coincided with a sharp increase in the user activity of the Synthetix network. Data revealed 2,725 active addresses interacting with the protocol within a day and 975 new wallets coming on-chain in the same period.

Large holders were also unusually active, with 229 transactions above the $100,000 mark recorded in a single day—one of the busiest whale days this year on the network. Blockchain analytics showed that little-used cryptocurrency SNX tokens started moving, as the average holding age fell by about 24 days over the course of the week, suggesting that more aged supplies were coming back into circulation.

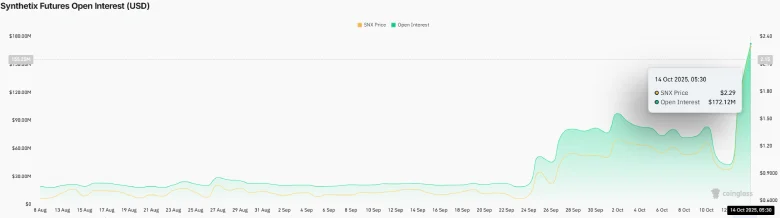

Despite the intraday downtrend, derivatives traders have driven more and more exposure. Figures from Coinglass show Synthetix futures open interest increasing dramatically from $42.6 million to $172.2 million—a 303% increase in positioning. The boom in the contracts with leverage comes despite the fluctuation of spot prices, indicating an increasing appetite for volatility in the wake of the tariff-driven market shock.

As the broader sentiment remains unstable, network and trading data point to heavy repositioning within the Synthetix ecosystem, with both speculative and structural shifts playing out simultaneously.

Synthetix Price Faces Final Pullback Before a Major Breakout

The daily chart analysis of Synthetix price shows the recent price recovery came after a long accumulation below the $1 mark over the past seven months. This rally now displays the potential formation of a traditional reversal pattern called Cup and Handle.

With today’s intraday loss of nearly 12%, the SNX coin is likely to enter the post-rally correction, a.k.a., the handle formation of the setup. With sustained selling, the coin price could tumble another 12% to test the 38.2 Fibonacci support level at $1.77 or a deeper correction to the 50% retracement mark at $1.53.

In an optimistic scenario, a potential retest to these levels would recuperate the exhausted bullish momentum in Synthetix’s price and bolster buyers to challenge the neckline resistance of $2.3. An upside breakout from this resistance would accelerate the recovery momentum and drive a major change in trend.

On the contrary, if the sellers continue to defend the $2.3 resistance, the coin price will prolong its sideways momentum.

Also Read: S&P and Chainlink Partners to Offer Stablecoin Ratings