On Monday, July 14, the crypto market witnessed weakening bullish momentum after a week-long inflow. The major cryptocurrencies, such as Bitcoin and Ethereum, show the rising selling pressure with a long-wick rejection candle in their respective daily charts. While a majority of major altcoins face a risk of notable correction, the SUI price holds major support amid the increasing trend in total volume locked (TVL). Will the uptrend resume?

DeFi Capital Inflows Signal Growing Confidence in SUI Ecosystem

Since last week, the SUI price has shown a notable recovery from $2.8 to a recent high of $4, projecting a growth of 41.6%. A major factor to support this recovery was the market speculation on ‘Crypto Week,’ during which the U.S. House of Representatives is set to debate a series of crucial crypto-related bills.

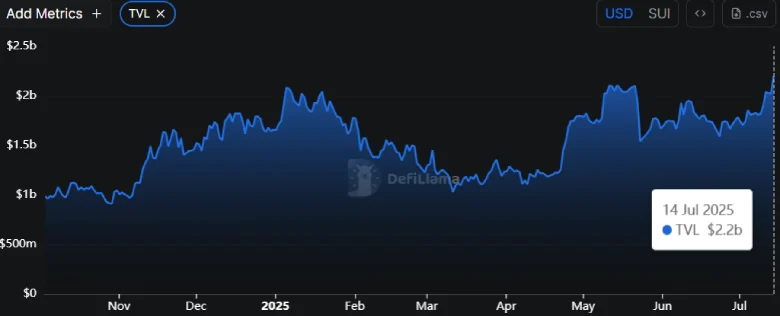

Along with the price rally, the total value locked (TVL) on the SUI network bounced from $1.8 billion to a new high of $2.2 billion, accounting for a 22.2% gain.

This surge in TVL indicates a strong influx of capital into SUI’s DeFi ecosystem, reflecting increased user participation and trust in the network’s protocols.

The synchronized growth of price and TVL implies that the ongoing recovery trend is backed by real on-chain utility rather than speculative momentum. If the trend continues, the SUI coin would attract natural demand pressure to support a prolonged and sustainable price rally.

SUI Signals Major Breakout from Triangle Pattern

A deeper analysis of Sui’s daily time-frame chart shows the recent recovery provided a decisive breakout from the resistance run of a symmetrical triangle pattern. Since early January 2025, the contrast has been resonating actively within the two converging front lines of the channel pattern.

Typically, this consolidation within the two trendlines allows buyers to recuperate the exhausted bullish momentum before the next takeout. Thus, the recent breakout signals the end of a major accumulation and sets the potential for a renewed recovery.

However, as the broader method signals a post-rally pullback, the SUI could show a slight retest of the pattern’s downsloping trendline as bullish support.

If the support holds, the coin price could resume its bullish trajectory with another 15% and chase the initial target of $4.3.

However, if the potential retest reenters the triangle support and breaks the support of $3.6, the bullish thesis will get invalidated.