The Nasdaq-traded company, previously called Mill City Ventures, SUI Group Holdings Limited, announced that it had plans to increase its SUI token reserves significantly this week. The company reported that it currently has 101,795,656 tokens after the acquisition of approximately 20 million SUI, which pushed its treasury market value past $344 million as of Wednesday. It led to a 5% increase in the SUI price, which hit $3.38 after the announcement.

All About SUI Group’s Latest Token Accumulation

“Since the initiation of our SUI treasury strategy in late July, we have expeditiously accumulated over 100 million SUI, underscoring our conviction in the transformative potential of the SUI blockchain and its critical role in the future of decentralized finance,” stated Stephen Mackintosh, Chief Investment Officer (CIO) of SUI Group.

He added, “We plan to continue to seek accretive capital raises to make additional purchases of discounted locked SUI and, in turn, increase our SUI per share to generate value for our shareholders.” The fact that SUI Group is the only publicly traded company that officially has an agreement with the Sui Foundation has made it possible to purchase tokens at a discount. This agreement is a result of the Sui private placement deal of $450 million, which established the company as the official SUI treasury.

In addition to its crypto holdings, the firm announced that it had about $58 million in cash to acquire more. Furthermore, the firm’s SUI is being staked, which earns an approximate 2.2% yield. As of the latest release, the estimated daily yield is around $20,000.

Closely linked to the buying activity of SUI Group has been the market response. The emergence of publicly listed digital asset treasuries (DATs) has attracted renewed investor interest as a way to provide equity exposure to blockchain projects. This type of practice has been observed by advocates of Solana and Toncoin, with stock market-linked exposure to ecosystem growth created through the token purchases of listed entities.

What’s Next For Sui Price?

Technically speaking, the price behavior of SUI indicates the reinforcing bullishness. Since mid-July, the token has been accumulating in a falling wedge pattern and was trading at approximately $3.32 on Thursday. The market technicians point out that this form of structure usually precedes a breakout. Sui price has been holding above $3.08, close to the 50% Fibonacci retracement line, which supported the price earlier in the week, before a 6% two-day recovery.

With this upward momentum, analysts are monitoring any decisive close on the upside above $3.65, which is the core resistance point that is the apex of the wedge. This action would be a step in the direction of retesting the late-July peak of $4.44. The Relative Strength Index of the daily chart is at 44 and is approaching the neutral 50 level, indicating the bearish momentum is slowing down. Meanwhile, the Moving Average Convergence Divergence indicator indicates that red histogram bars shrink as the MACD lines move towards each other, indicating the likelihood of a bullish crossover in the forthcoming sessions.

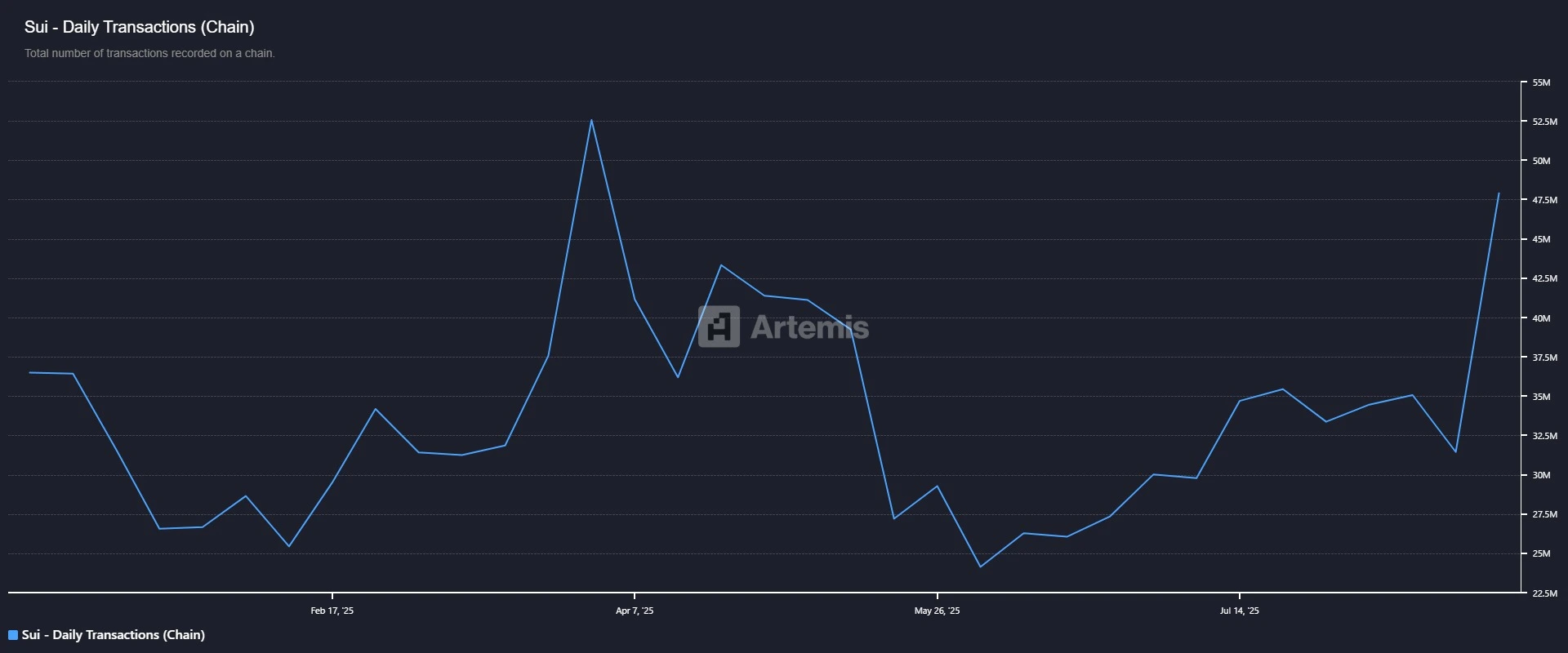

On-chain activity has strengthened the optimism around Sui price. Artemis terminal data indicated weekly transactions on Sui had reached a record high of $47.9 million in the last week of August, the highest level of weekly purchases since April. The growth is attributed to the rise of user activity and revitalized network activity.

Other catalysts are the results of ecosystem development by Sui. The Threshold Network continued its work with the Bitcoin integration with the launch of Phase 2 of tBTC, after the successful Phase 1 results. Bitcoin ownership had already climbed to 20% of Total Value Locked in Sui in the early period, with $10 million of tBTC provided on Alphalend and over 2.8 million being deposited in liquidity pools. Phase 2 has further driven momentum in Bitcoin-based decentralized finance (DeFi) on the network with its launch, which offers additional drivers of activity.

Also Read: Galaxy Digital Tokenizes Nasdaq-Listed Shares on Solana Blockchain