Key Highlights:

- STBL sets October 10 and 24 for Ethereum minting and staking module launches.

- Project introduces USST stable token and YLD yield NFT backed by RWAs.

- $1M monthly buyback and burn program planned to start from October 31.

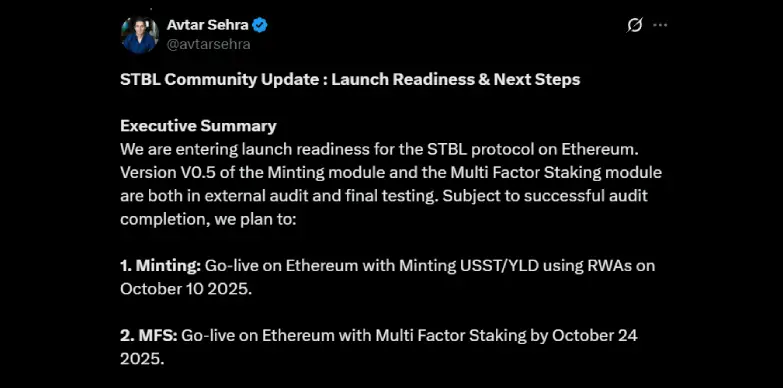

The STBL protocol is ready for a big step this month as it enters the launch readiness phase. The protocol is planning to introduce its minting and staking modules on Ethereum. In a recent post on social media platform X (formerly known as Twitter), found and CEO Avtar Sehra shared key updates on key timelines, rollout goals, and token supply plans as the project gets closer to its ecosystem supported by real-world assets (RWAs).

Upcoming Product Launches

According to the roadmap that has been laid out by the founder and the CEO, the first major product that is to be released is the Minting module. The release is set for October 10, 2025. Version V0.5 is currently undergoing external audits and live testing, preparing to introduce USST and YLD as core on-chain assets.

The process starts when the users obtain supported real-world asset (RWA) instruments like USDY and OUSG, with BENJI and BUIDL to follow. Through the STBL dApp, these RWAs are locked to mint:

USST– a fungible stable token that represents principal, built for wide DeFi use.

YLD– a yield-earning NFT that is linked to RAW, available only to approved, whitelisted holders.

By splitting principal (USST) from yield (YLD), USST stays easy to use across DeFi, while yield payouts remain within regulatory rules. A user guide and app link is said to be shared at the time of the launch.

Multifactor Staking Launches October 24

After the minting launch, the STBL Multifactor Staking (MFS) module is set to go live on October 24, 2025. The system will bring in advanced staking options, which will also include cross-asset use. With this move, holders will be able to move STBL from BNB Chain to Ethereum through Wormhole and then lock their tokens for yield. A new amplified staking feature will let the user co-stake the freshly minted USST with STBL, giving them higher staking rewards.

Institutional Mint Program

Once the public minting and staking go live, STBL will launch its Institutional USST Mint Program. The main aim of this launch is to expand USST supply at scale. Institutional minter will back issuance using USDY and iBENJI, which will strengthen RWA integration.

The minted USST will be allocated strategically:

Some of them co-staked with STBL in the staking module, and the rest of them will be held as collateral for future ecosystem partnerships.

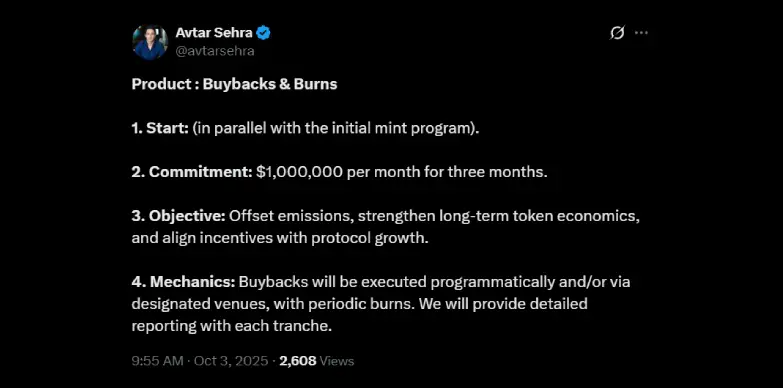

Buybacks and Burns

STBL will also spend $1 million per month on buybacks for three months starting from October 31, 2025. The main aim behind this move is to support token economics. The bought-back tokens will then be periodically burned. In this way, long-term deflation will be created, and token emission will be balanced. Reports for each batch will be shared to maintain transparency.

Token Supply and Circulation

According to the post, STBL has also confirmed its supply management of the tokens. Token unlocks for the ecosystem, treasury, and market making will happen gradually but they will not enter the circulation. For Q4, under 5% of unlocked tokens are expected to be used, and with buybacks and burns, the net circulating supply will probably decrease.

Partnerships and Ecosystem Stablecoins

STBL is working with regulated partners and making sure that it is following rules and regulations. Its long-term goal is to have a multichain system of stablecoins that are all supported by USST as a common reserve. Several of these stablecoins are already said to be being built with institutional partners.

Security, Compliance and Risk

Security is a key requirement for the launch. Both minting and staking smart contracts are being independently audited and will be launched only if they pass. After launch, STBL is said to carry out security monitoring continuously, public bounty programs, and clear incident-response plans.

On compliance, STBL says separating principal and yield follows rules like the EU’s MiCA and the US GENIUS Act. YLD is only for approved users, while USST can be used freely across DeFi.

Liquidity Strategy for USST

STBL will also use a few selected AMM pools and professional market-makers. The main aim of this move is to keep the liquidity strong and stable. It is also said that part of minted USST will fund reserves and liquidity on major platforms. Dashboard and on-chain addresses will be shared to track these programs. Collateral will follow a high-quality investment policy that prioritizes liquidity, credit strength, and maturity risk.

Marketing and Community Engagement

Through the said changes, it is clear that development and commercial partnerships have been the main focus here, but STBL has also understood the need to strengthen its market presence. To do so, the team will also be hiring a senior marketing lead, bringing in an external PR partner and updating the website and product documentations and run coordinated community AMAs, dashboards, and launch content.

Data, Transparency, and Reporting

Starting from Q4, STBL is set to release a transparency report regularly along with live dashboards that will show the RWA composition, USST supply metrics, YLD balances and yields, STBL staking performance, protocol revenue flows, and buybacks and burns with on-chain records.

User Roadmap at Launch

At launch, users will follow six main steps, acquire approved RWAs (USDY, OUSG, BENJI, BUIDL), lock them in STBL dApp, mint USST and eligible YLD, optionally bridge STBL from BNB to Ethereum, stake STBL for rewards and use USST across DeFi platforms as integration grows.

With all these features, STBL is setting up its October Ethereum launch as a foundation of its long-term growth, with plans to position USST as a reliable and sustainable DeFi reserve layer.

Read More: Pump.fun Token Price Soars Past Key Support: What’s in Store?