- STBL begins a $1 million token buyback executed via TWAP on PancakeSwap’s STBL/USDC pool.

- The program connects STBL’s growth with USST TVL and Ecosystem-Specific Stablecoins.

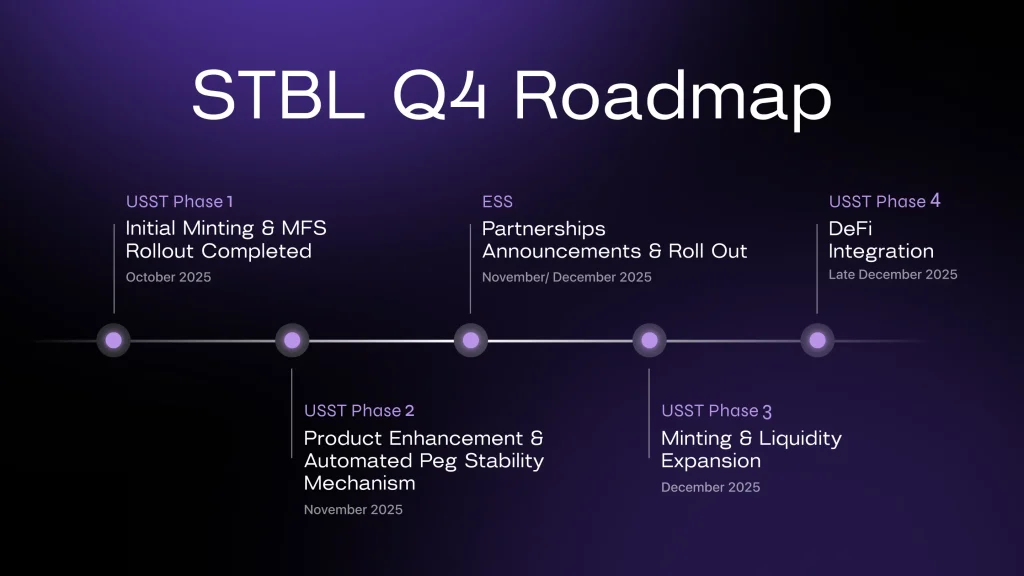

- STBL’s Q4 roadmap introduces an automated peg system and new DeFi partnerships.

STBL has started a $1 million buyback of its token, a move the project says will help stabilize its value and strengthen community trust. The announcement follows weeks of preparation and comes as part of a wider plan to build what it calls a transparent and self-sustaining stablecoin economy.

How the Buyback Works

According to the project’s statement, the buyback is being carried out using a Time-Weighted Average Price (TWAP) method on the PancakeSwap STBL/USDC pool. The process allows purchases to happen gradually over time, limiting price swings and preventing sudden shocks to liquidity.

STBL Commences $1M Buyback in USDC (Source: X)

Funding for the operation—about $1 million worth of USDC—is drawn from the team’s main treasury vault at 0xa1Dd9…DEb. Each repurchased token will later be transferred to a second address, the Buyback Treasury Vault (0xB3dd2…3bc), where it will remain locked and publicly visible.

According to the report, project representatives stated that the team will publish the final numbers once the buyback is complete. The intent, they added, is to keep every stage verifiable directly on-chain.

Why This Could Impact You

This marks the first phase of a larger framework linking STBL’s growth to that of its USST Total Value Locked (TVL) and a broader rollout of Ecosystem-Specific Stablecoins (ESS). These ESS tokens allow different blockchain projects to launch their own programmable currencies through STBL’s “Money-as-a-Service” infrastructure.

Revenue from minting, burning, and related network activity will later fund additional buybacks. The goal is to gradually shrink the supply and return value to long-term holders rather than short-term speculators.

Future rounds of repurchases, the team said, will depend on three things:

- Overall growth in USST TVL,

- STBL’s market performance, and

- outcomes of community governance votes.

Looking Ahead: STBLQ4 Roadmap

STBL’s roadmap runs deep into 2025. A significant update, due in November, will introduce a new automated peg mechanism designed to keep prices stable even during heavy market movement.

STBL Q4 Roadmap (Source: X)

Moreover, in December, the project expects to widen USST minting and expand liquidity through new partnerships, including lending and borrowing markets denominated in its native stablecoin. The buyback is being described internally as a “proof of principle”—a way to demonstrate that treasury actions can remain transparent while supporting long-term economic objectives.

STBL’s Market Response

Following the announcement, STBL’s price rose by roughly 8%, briefly hitting the $0.10 mark, but subsequently retraced to its current value of $0.088. Trading volume also edged higher, up 2% to more than $26 million, showing a modest increase in investor activity.

Even with the bounce, the token’s chart still leans bearish. STBL has dropped 20% over the past week and nearly 73% over the month, following a decline from its all-time high of almost $0.61 in late September.

STBL Price Action (Source: TradingView)

At press time, it faces resistance around $0.096, the 23.60% Fibonacci level, while short-term support sits between $0.08 and $0.07. A clean break above $0.10 would likely be needed to shift momentum back in its favor.

A Step Toward Accountability

For STBL, this isn’t just about lifting the price. It’s about showing that transparency can be structural, not performative. Every transaction—down to the last token—is traceable on-chain.

In a market still rebuilding trust after years of volatility, that kind of visible accountability might prove as valuable as the buyback itself.