Key Highlights:

- Bitwise’s BSOL ETF recorded about $56 million in trading volume on its first day.

- Grayscale’s Solana ETF has received approval from the SEC.

- Western Union is set to launch a stablecoin on the Solana blockchain.

Solana is said to be gaining strong attention from big institutional players and major companies this week. Bitwise Asset Management launched its Solana Staking ETF (ticker: BSOL) on the New York Stock Exchange yesterday, October 28, 2025, and it recorded $56 million in first-day trading volume. This is one of the biggest ETF debuts seen in 2025 so far.

Simultaneously, the U.S. Securities and Exchange Commission also approved Grayscale’s Solana Trust ETF, allowing it to be officially listed and traded. This will increase regulated investment choices for Solana. Additionally, Western Union plans to launch a stablecoin on Solana, and this move highlights its fast transactions and ability to scale.

Even with these big announcements, Solana (SOL) is experiencing a short-term dip in price due to overall market volatility.

Bitwise BSOL ETF Sets 2025 Record

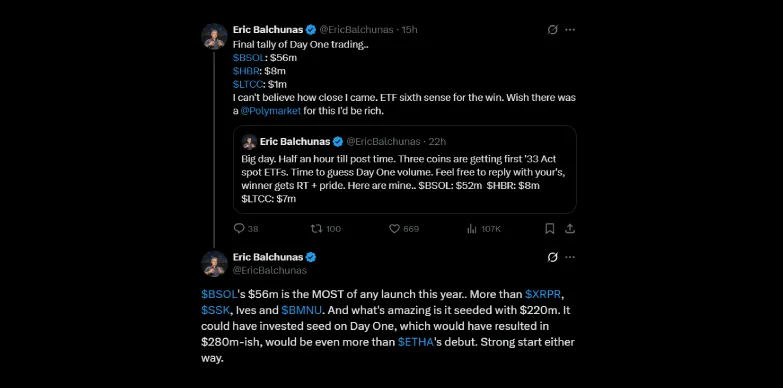

The BSOL ETF’s first-day trading volume of $56 million makes it the biggest ETF launch of the year across crypto and traditional markets, as highlighted by senior ETF analyst at Bloomberg, Eric Balchunas. As we all know, ETF provides investors with a regulated exposure to Solana’s native token and also help them earn staking rewards. All of this without needing to store tokens themselves.

Bitwise Chief Investment Office Matt Hougan called the ETF “the missing part of the puzzle,” as it lets investors gain staking yield and price growth within a compliant structure. The product connects decentralized finance concepts with traditional investing, making it attractive to both institutions and everyday investors.

Grayscale GSOL ETF Gains SEC Nod

On the other hand, Grayscale’s Solana Trust ETF has also received SEC approval for listing and registration. The ETF gives U.S. investors direct exposure to SOL through a regulated exchange-traded product. This process makes access easier and removes the need to handle token storage. This approval is also a sign that regulators are becoming more comfortable with proof-of-stake cryptocurrencies, as ETF provides investors safer, official ways to invest.

Western Union’s Solana Stablecoin Initiative

At Money 20/20, Western Union’s CEO Devin McGranahan stated that Western Union will launch a stablecoin on Solana as the network is fast and cheap. He even said that they reviewed various other networks and then decided on Solana as it was the best fit. The stablecoin will first be used internally for moving money efficiently, and then later on, it will be made available for the public for global transfers.

SOL Price Dips Amid ETF Launch and Market Pressure

Even though there is positive news surrounding the blockchain, the price of the token has dropped. The token is trading somewhere around the $196 mark and is down by about 1.5% in the last 24 hours, over 3% for the last 7 days. This dip that is observed is mainly because of profit-taking and market uncertainty.

At press time, the price of the token stands at $196.60 with a dip of 1.77% in the last 24 hours as per CoinMarketCap.

Analysts also highlight that strong institutional activity does not lead to immediate price jumps during volatile periods. While a recent golden cross signalled earlier momentum, volatility has paused the rally. Hence, experts believe that this is a temporary pullback and that long-term growth is on its way, and this growth will be supported by rising institutional adoption and continued development on the blockchain.