Key Highlights:

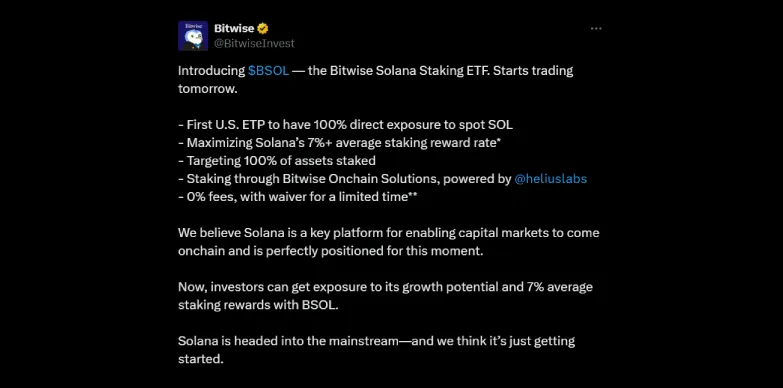

- Solana jumps from $193 to $203 after Bitwise announces launch of Solana Staking ETF (BSOL).

- BSOL offers 0% fees initially and direct staking rewards.

- Analysts see $210-$212 as a key resistance for SOL’s next move.

Solana has managed to gain after the long-awaited approval and launch of Bitwise’s Solana Staking ETF (BSOL). The rally was observed just after Solana had dipped to around $197 before bouncing back. The crypto community had been waiting for this moment for months now and this approval is set to trigger a wave of new token ETF approvals, transforming what began as a quiet government shutdown into a surprise ETF launch spree.

At press time, the price of the token stands at $203.18 with a gain of 2.07% in the last 24 hours as per CoinMarketCap.

This gain is considered to be modest when compared with historical cryptocurrency price movements. It also signals that optimism around the token has increased, and there is a possibility of institutional involvement as well.

Price analysis shows that ETF launches often spark confidence and anticipation in the market, even when short-term volatility stays limited. Sources note that open interest in Solana’s derivatives market stayed mostly steady, with most of the short-term price action coming from spot trading during the ETF announcement period.

Solana’s ETF Moment Arrives in Style

Bitwise’s Solana Staking ETF (BSOL) begins trading on the NYSE today, October 28, 2025. The product is fully backed by spot SOL and is designed to stake all assets in-house through Helius infrastructure. The fund will not be charging a management fee for the first $1 billion over three months, which is a major incentive, as investors will rush toward the first U.S. product directly earning Solana’s block rewards, which average over 7% yield. Its regular fee will later be 0.20%.

On the other hand, the REX-Osprey SSK Solana ETF charges a 0.75% fee and is futures-based, which means that it does not hold real Solana tokens but tracks their future prices. This can sometimes cause the performance to lag behind the actual market.

BSOL stands out because it includes staking, which lets the investors earn rewards directly through the ETF product, something that usually requires crypto know-how and manual setup.

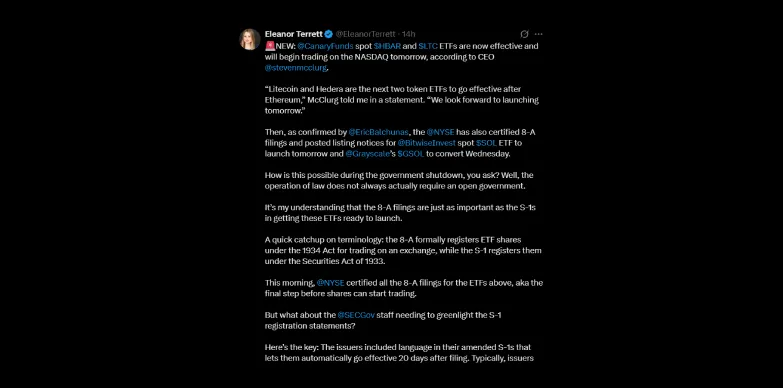

How ETFs Got Approved Despite the U.S. Government Shutdown

Even though parts of the U.S. government were closed (which includes the SEC) the ETF approvals still happened because there’s a legal rule that allows them to move forward automatically.

Under normal circumstances, the SEC has to review and sign off on ETF applications. But if the agency is not active, a rule allows these applications (called the S-1 filings) to automatically get approved 20 days after submission as explained by crypto journalist Eleanor Terrett on X (formerly known as Twitter).

Similarly, for stock exchanges, another type of document is submitted, which is known as the 8-A filing that officially allows ETF shares to be listed and traded.

The ETF “Boom”: HBAR and Litecoin Join In

The ETF wave does not end with Solana. Canary Fund’s spot HBAR and Litecoin ETFs have also received regulatory approval and will start trading on Nasdaq on the same day as Solana and this news has been confirmed by Eric Balchunas, senior ETF analyst at Bloomberg.

Analysts believe that these launches will make blockchain exposure more accessible for both retail and institutional investors, as these vehicles are regulated and are brokerage-friendly. Since these ETFs include direct staking, investors can earn on-chain yield while also supporting the network security and decentralization, which is a move beyond passive holding and helps strengthen the overall ecosystem.

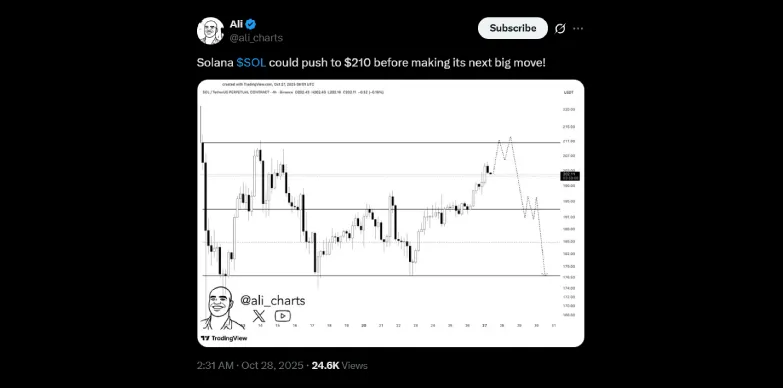

Solana Eyes $210 Resistance Before Its Next Move

According to the chart that has been provided by X user ali_charts, $SOL could experience a resistance level near $210-$212.

Solana recently bounced back from $194 and is now trading above $200. If it breaks past $210, the price could rise toward $218-$232. But if at all it fails, it might drop back near $200. This point is seen as a major test that will decide whether Solana continues its rally or pauses for a pullback.

Also Read: Solana Price Holds Key Support as VanEck Updates Staking ETF Filing