Key Highlights

- The Solana team has shared a revenue report, revealing impressive growth in 2025 in different sectors

- In the report, the application built on the blockchain has earned $2.39 billion in revenue, up 46% year-to-year for a new ATH

- SOL has witnessed around 6% surge on a daily chart as Morgan Stanley revealed filing for Bitcoin and Solana ETFs

On January 6, the team behind the Solana blockchain shared a report on its revenue, assets, and trading, revealing an impressive financial growth and network activity.

Application Revenue and Network Performance Achieve New Heights

(Source: Solana on X)

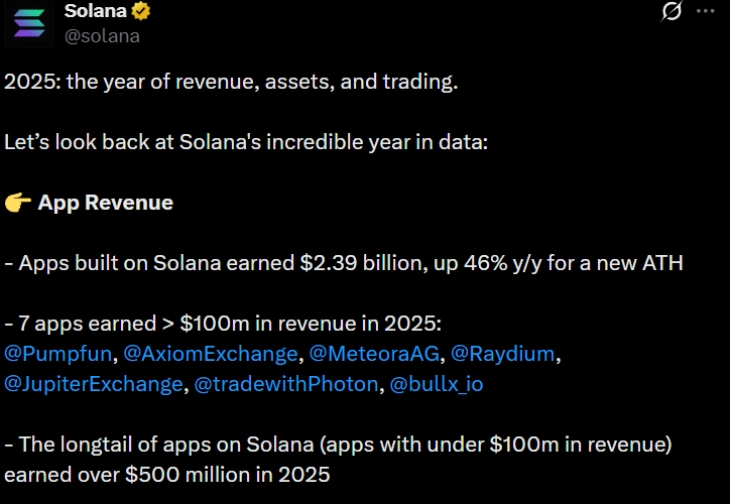

According to the post on X (formerly Twitter), applications built on the Solana network generated a record-breaking $2.39 billion in revenue during 2025. This figure shows an impressive 46% increase from the previous year. Leading this charge were 7 major applications that each earned over $100 million.

These top earners include Pump.fun, Axiom Exchange, Meteora, Raydium, Jupiter Exchange, Photon, and BullX. Apart from these, the entire ecosystem has also grown significantly, with smaller applications earning a collective $500 million.

Solana’s main network also witnessed impressive performance and efficiency throughout the year. Network revenue, or REV, skyrocketed to $1.4 billion. This is an incredible 48-fold increase over just 2 years. Along with this, user adoption also surged, with unique active wallets averaging 3.2 million per day, a 50% yearly increase.

The network processed 33 billion non-vote transactions while maintaining affordability, with the average transaction fee dropping to $0.017.

Digital Assets and Decentralized Exchange’s Trading Volume

Decentralized exchanges (DEXes) on Solana facilitated $1.5 trillion in trading volume, a 57% annual increase. Raydium led all DEXes with $347 billion in volume, followed by Orca ($241 billion), Humidifi ($184.7 billion), and Meteora ($182 billion). Apart from this, trading between SOL and stablecoins set a new record at $782 billion. DEX aggregators, like Jupiter Exchange, which processed $812 billion, were responsible for $922 billion in total volume.

The total supply of stablecoins on Solana more than doubled year-over-year by closing 2025 at a new all-time high of $14.8 billion. Apart from this, a staggering $11.7 trillion worth of stablecoins was transferred across the network.

The year also saw the successful introduction of tokenized equities, which reached a $1 billion supply. Bitcoin-based activity also grew explosively, with trading volume hitting $33 billion, which is a five-fold increase. Furthermore, the amount of Bitcoin represented on Solana doubled to $770 million.

The Growth of Specialized Trading and Launchpads

Professional trading platforms have a standout year, earning $940 million in revenue. Axiom Exchange, Photon, and BullX each earned over $100 million, with Axiom capturing 31% of the total pro trading volume of $108 billion.

In the memecoin and launchpad sector, platforms like Pump.fun, Bonkfun, and Believeapp generated major activity, where launchpad revenue doubled to $762 million by supporting the creation of 11.6 million new tokens.

Solana Jumps Over 5% as Morgan Stanley Files for SOL ETFs

🚨BREAKING: Morgan Stanley, with $6.4T in assets under management, has filed an S-1 registration for the Morgan Stanley @Solana Trust ETF with the 🇺🇸 US SEC. pic.twitter.com/s4q9HKUTUq

— SolanaFloor (@SolanaFloor) January 6, 2026

On December 6, the SOL token witnessed a sharp increase, rising around 6% to trade between $133 and $142.99. This sharp price increase comes from a major institutional development.

The main factor behind this price surge was a filing from banking giant Morgan Stanley. The firm submitted S-1 registration statements to the U.S. Securities and Exchange Commission for both spot Bitcoin and spot Solana Exchange-Traded Funds (ETFs). This filing shows Morgan Stanley as the first major U.S. bank to seek regulatory approval for its own proprietary cryptocurrency ETFs.

The proposed product, named the Morgan Stanley Solana Trust, is created to directly track the spot price of SOL. In the future, the filing shows that the trust may stake a portion of its Solana holdings. This means the fund could earn rewards, which would then accrue to its overall net asset value, offering a potential yield to investors.