Shiba Inu, the popular dog-themed meme cryptocurrency, witnessed a slight gain of 1.5% on Tuesday’s U.S. market hours. The buying pressure followed the broader market recovery amid investors’ anticipation for a quarter-point rate cut from the Federal Reserve. However, the SHIB price faces the risk of potential volatility amid a massive inflow to the exchange and whale transfers.

- The Shiba Inu price enters a short-term consolidation amid symmetrical triangle pattern formation in the daily chart.

- The open interest tied to SHIB futures recorded a sluggish trend around the $90 million mark, indicating a lack of speculative force in the market.

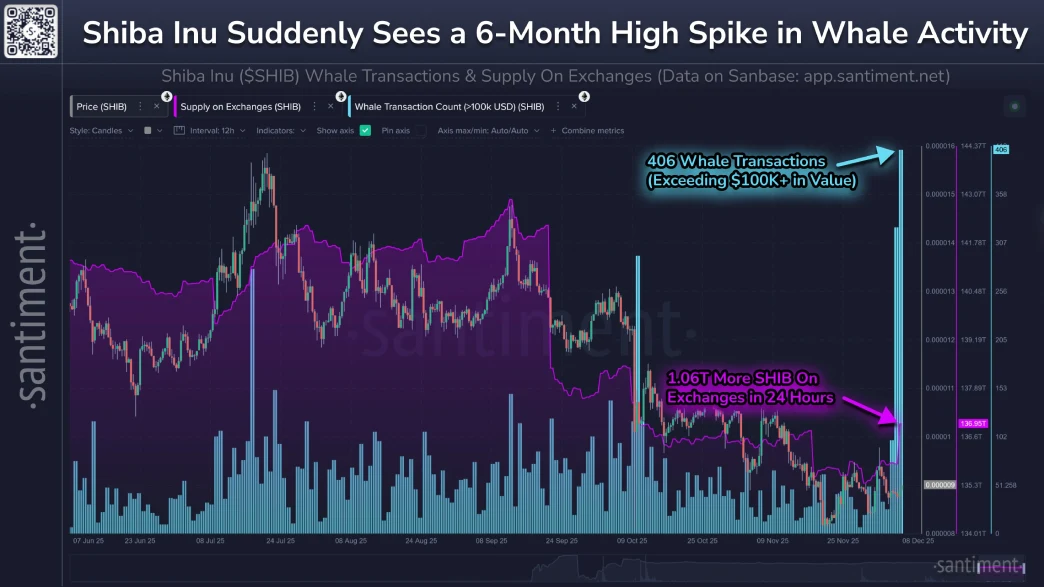

- According to Santiment data, around 1.06 trillion SHIB moved onto exchanges, pushing balances higher.

Whale Transfers Spike as SHIB Sees $1.06T Exchange Inflow

On Tuesday, December 9th, the crypto market witnessed a notable inflow, uplifting major cryptocurrencies like Bitcoin and Ethereum. As the momentum spread to the altcoin market, the Shiba price pushed to the intraday high of $0.00000905, with a 5.8% gain.

However, the recovery was short-lived, as SHIB witnessed its heaviest whale activity of the day since June 6, with dozens of transfers of over 100 billion tokens each jumping wallets in a matter of hours. At the same time, exchanges had a net inflow of 1.06 trillion SHIB, which pushed the total amount held on trading platforms to levels that were not seen in recent weeks.

The token currently ranks 24th in terms of market capitalization amongst all cryptocurrencies. Large transfers of this scale often precede periods of increased price swings, as large holders transfer their stacks in the direction of or away from venues where selling pressure can be quickly fulfilled.

In contrast to the turbulence on the spot market, the derivatives side is unusually quiet. CoinGlass data shows SHIB futures open interest has barely budged from the $90 million zone over the past two months, which means that the leveraged traders have yet to join in the action in any meaningful way.

The combination of surging whale action, increasing exchange balances, and the absence of interest from futures creates a setup where the spot supply action is changing quickly, but speculative positioning with derivatives is lagging. Price action over the next few sessions will determine if these transfers are into stronger hands or in preparation for bigger sell orders.

Shiba Inu Price Coiling for Breakout Within Triangle Formation

The ongoing correction trend in Shiba Inu price has recently stabilized above the $0.00000775 level. The lateral shift in trajectory has started consolidating between two converging trends and indicating the formation of a symmetrical triangle pattern.

The chart setup is commonly spotted within an established trend, as it allows traders to capitalize on the prevailing trend before continuation. With the recent market uptake, the ship price currently trades at $0.00000862, steadily heading towards the pattern’s upper trajectory.

A potential retest of the overhead resistance could trigger two possibilities, i.e., a potential breakout or reversal. If the conference man should reach the overhead resistance, the buyers could re-strengthen their grip over this asset and drive a bullish recovery to the $0.00001 psychological level.

However, there is a bearish alignment between the daily exponential moving averages (20<50<100<200). If reversed from the triangle resistance, the Shiba Inu sellers could attempt a bearish breakdown below the bottom trendline. The post-breakdown fall could accelerate the selling pressure and drive an extended correction below $0.0000075.

Also Read: Bitcoin at $89K as Core PCE Cools to 2.8%; Room for Fed Cuts Returns?