(Source: James Seyffart on X)

Grayscale Wins SEC Nod for Crypto Basket ETF

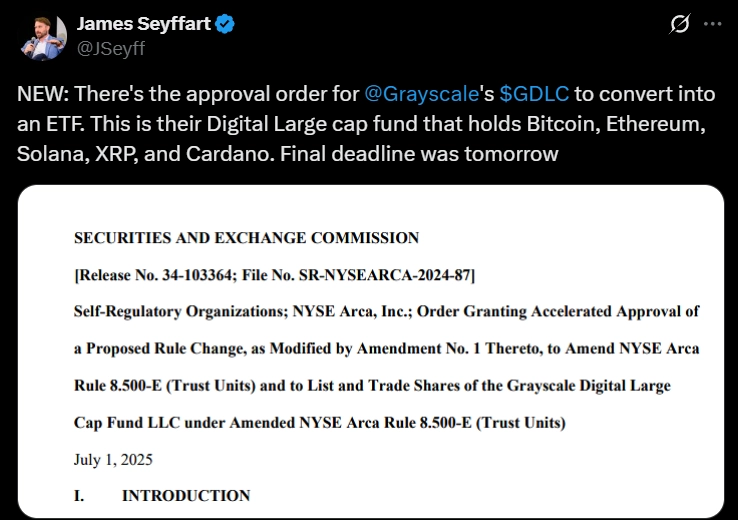

The announcement comes a day before its deadline on July 2, 2025. Recently, Grayscale has submitted a revised version of its S-3 filing to convert the GDLC fund into a spot ETF after the SEC requested issuers to submit filings with amendments.

It will provide investors with an opportunity to get diversified exposure to top cryptocurrencies in one package. With $775 million in assets, GDLC becomes the first SEC-approved multi-crypto ETF.

Some analysts believe that this approval could serve as a regulatory test case for pending XRP and Solana ETF applications facing October 2025 deadlines. The approval validates Grayscale’s first mover strategy in crypto ETFs, which also reflects growing SEC comfort with diversified digital asset products after observing the success of Bitcoin and Ethereum ETFs.

The approval chances for a Solana (SOL) spot ETF have largely increased after the SEC’s greenlighting of Grayscale’s multi-asset crypto ETF, with top analysts now estimating a 90-95% likelihood by the October 2025 decision deadline.

This increased optimism comes after SOL’s inclusion in the approved GDLC fund (comprising 3-5% of holdings) and its classification as a commodity alongside Bitcoin and Ethereum in recent SEC filings. However, regulators may still scrutinize Solana’s decentralized nature and lack of CFTC-regulated futures market before granting a single-asset ETF.

Bloomberg’s ETF experts note the SEC’s constructive engagement with issuers and Grayscale’s successful conversion set a positive stage, which hints that SOL could be next in line for approval.

“We expect a wave of new ETFs in the second half of 2025,” said James Seyffart.

The SEC is reportedly developing a standardized framework to streamline crypto ETF approvals, which allows tokens meeting specific liquidity and market capitalization criteria to bypass lengthy 19b-4 filings.

This new plan could allow issuers to secure approvals within 75 days via simplified S-1 registrations. If approved, the ETF approval process could significantly cut the current 6-8 month process.

Ahead of the first ETF launch, Solana has plunged by 6.17%, declining its value from $157 to $146 with a market cap of $78.35 billion, according to CoinMarketCap.

SOL’s price is currently moving in a downward channel pattern, which shows that sellers are still in control. Although there was a brief price jump earlier this month from higher trading volume, the overall trend remains weak. If this continues, SOL could drop toward $160 soon.

Also Read: SEC Working to Cut Crypto ETF Approval Times by Months