Ripple CEO Brad Garlinghouse announced today that the company is dropping its cross-appeal against the US Securities and Exchange Commission (SEC), with regulators expected to do the same.

If this happens, this development will effectively end the three-year legal battle that has shaped cryptocurrency regulation in America.

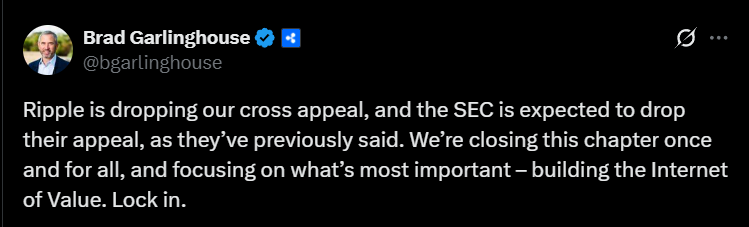

(Source: Ripple CEO Brad Garlinghouse on X)

Brad Garlinghouse posted on X (formerly Twitter), saying, “We’re closing this chapter once and for all, and focusing on what’s most important – building the Internet of Value. Lock in.”

Ripple Drops Appeal After Judge Rejects Settlement Motion

The decision comes a day after District Court Judge Analisa Torres denied both parties’ motions for an indicative ruling, rejecting their attempt to settle the case through private negotiations.

In her October ruling, Torres remarked that court judgments serve public interest and cannot be circumvented through backdoor deals. The ruling opened two options for Ripple, according to Stuart Alderoty, Chief Legal Officer of Ripple.

“With this, the ball is back in our court. The Court gave us two options: dismiss our appeal challenging the finding on historic institutional sales—or press forward with the appeal. Stay tuned. Either way, XRP’s legal status as not a security remains unchanged. In the meantime, it’s business as usual,” he affirmed.

Legal experts view the appeal withdrawals as confirmation of Judge Torres’s landmark July 2023 ruling that:

- XRP itself is not a security

- Ripple’s institutional sales violated securities laws

- Exchange sales to retail investors were compliant

While Ripple still faces penalties for its institutional sales, the resolution removes the cloud of uncertainty that has hung over XRP since the SEC’s December 2020 lawsuit.

Brad Garlinghouse’s post about dropping the appeal has spread euphoria in the community, soaring XRP’s price by 1.40% on the hourly chart. At the time of writing, XRP is trading at around $2.14 with an impressive market capitalization of $126.82 billion.

The resolution sets important precedents as Congress considers new crypto legislation, which proves that existing laws can adapt to digital assets without stifling innovation.

As the legal battle approaches to end, Ripple can now fully focus on its cross-border payment solutions and central bank digital currency projects across more than 10 countries. The SEC, meanwhile, can shift their focus on addressing the regulatory challenges and opportunities presented by the crypto asset market.

The Ripple ecosystem has witnessed an extraordinary series of events this June, which marks what appears to be a transformative period for the company. In an unexpected twist, Ripple’s typically silent co-founder, Arthur Britto, broke years of social media silence with a cryptic post on X, sending the XRP community into a frenzy of speculation.

Also Read: Trump-linked World Liberty Financial to Join CoinMarketCap