Key Highlights:

- Ripple has announced partnership with Africa’s Absa Bank.

- The collaboration will provide secure, compliant custody for tokenized assets across South Africa.

- Ripple is expanding its global custody footprint into emerging markets.

Ripple, a well-known cross-border payment service provider, has entered the African markets through a strategic partnership with South Africa’s Absa Bank. The main aim of this partnership is to transform digital asset custody and payment solutions on the continent. The announcement was made on Ripple’s official X (formerly known as Twitter) account today, October 15, 2025.

This is the first partnership in the African continent and it indicates that Ripple is adamant on providing its services in the emerging markets. The partnership fits Ripple’s wider global expansion strategy, which includes key collaborations across Europe, Asia, Latin America and the Middle East.

The Ripple-Absa partnership will use Ripple’s advanced digital custody technology so that it can meet the growing demand for safe storage of digital assets, including cryptocurrencies and tokenized assets. Absa Bank, which is one of Africa’s leading banks, will provide customers with secure and scalable custody solutions that follow proper compliance rules. With this partnership, it will help explore digital assets as a new growth opportunity, supporting Africa’s wider digital transformation and clearer regulatory environment.

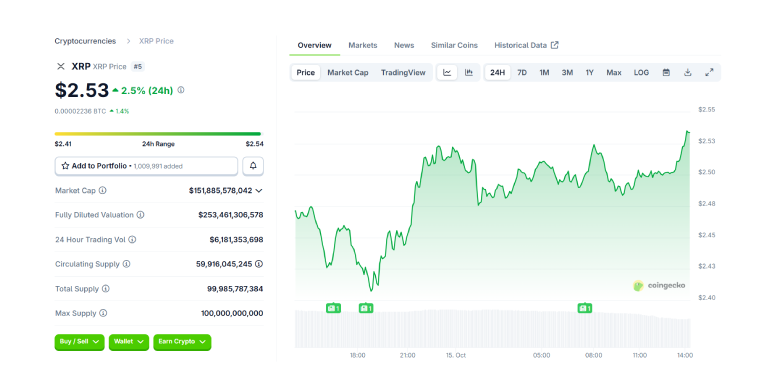

As this announcement was made, the XRP token experienced an uptick in its price. At press time, the price of the token stands at $2.53 with an uptick of 2.5% in the last 24 hours as per CoinGecko.

Ripple’s Global Expansion Strategy

Ripple’s move into Africa is a part of its carefully planned global strategy, which includes over 100 partnerships with banks, fintechs, and payment providers worldwide. Important collaborations include BBVA in Spain, BNY Mellon in the U.S., SBI Holdings in Japan, and Dubai Land Department for real estate tokenization. These partnerships show how Ripple uses blockchain in traditional finance, providing cross-border payments, stablecoins and safe custody solutions that follow local regulations.

Ripple recently got over 60 international licenses, which makes it even more trusted and able to operate widely. In early 2025, the company settled its longstanding SEC case, confirming that its token XRP is not a security. This improved its reputation in the market and helped it form more and more partnerships around the world. The company is now said to be applying for a U.S. national banking license to offer various services such as regulated stablecoins and secure custody for institutions.

Partnerships in Africa and Regional Growth

Ripple has not constrained itself with custody services in Africa. In early 2025, it has also partnered with Chipper Cash, a leading African fintech company that serves more than five million users in nine different countries, and launched its USD-backed stablecoin RLUSD in the African markets. With this move, the company’s aim was to make cross-border payments faster and support financial inclusion.

Absa Bank’s Broader Digital Initiatives

As stated above, Absa’s partnership with Ripple is a part of its wider digital transformation plan. The bank has been investing in digital payments and fintech to meet Africa’s growing demand for modern, secure, and inclusive financial services. Recent steps include working with Network International to upgrade payment processing and launching solutions like fleet and commercial prepaid cards, digital wallets, and self-service platforms to give customers more control and security.

The collaboration is also said to support Absa’s goal of promoting entrepreneurship and financial inclusion. Through its programs, the bank helps small and medium-sized enterprises (SMEs), especially youth and women-led businesses, gain access to funding, digital tools and market opportunities. For example, its $5.5 million entrepreneurship partnership with Universities South Africa aims to solidify Africa’s entrepreneurial ecosystem, showing Absa’s commitment to wider economic growth.

Also Read: ApeCoin is Back, OpenSea x Yuga Reunion Fuel Market Run