- PLUME slid 17% to $0.079 but rebounded as sell pressure eased, signaling renewed buyer strength.

- A decisive break below $0.080 could spark a long squeeze, driving the token toward $0.075 support.

- Short clusters at $0.088–$0.097 face squeeze risks if bullish momentum forces a breakout higher.

PLUME has shed 17% in the past week, sliding to a $0.079 floor before rebounding on renewed buyer momentum. The dip followed its August 18 Binance debut, where 150 million tokens—equal to 1.5% of supply—were distributed through an airdrop.

Heavy sell-offs quickly dragged prices from $0.1142 to $0.08018 by August 21, but market data shows most airdrop-driven exits have now cleared. This shift reduced sell-side pressure, giving buyers space to reassert control.

The recovery is already visible: the token has climbed more than 5% in the last 24 hours. The token is holding firm with a $230.22 million market cap and $77.32 million in daily trading volume, signaling strong liquidity despite earlier turbulence.

Still, risks lie ahead. A scheduled unlock of 100 million PLUME tokens in February 2026 could fuel supply inflation and weigh on mid-term price performance.

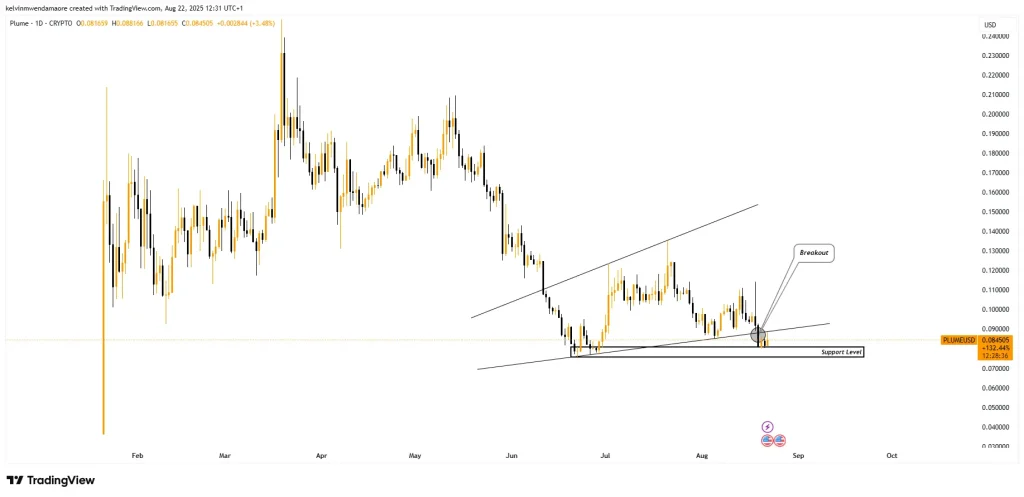

PLUME Price Action: Make-or-Break Point

The cryptocurrency is testing a crucial support zone after slipping below an ascending broadening wedge pattern that has been active since late June. The token dropped to a low of $0.079 before stabilizing within the $0.080–$0.075 range, a zone analysts now view as decisive for near-term direction.

PLUME Price Chart (Source: TradingView)

The chart shows the altcoin hovering close to the wedge’s lower arm, which has become a pivotal test. A rejection at this level could confirm a break-and-retest formation, a bearish setup that traders often see as a trigger for fresh downside entries.

If confirmed, the move could send the token back to its support range near $0.080–$0.075, with risks of deeper losses that may push prices toward new all-time lows. On the other hand, a more positive scenario remains possible if the lower wedge boundary fails to hold as resistance.

In that case, PLUME could re-enter the broadening wedge channel and shift back into consolidation. If momentum builds, the August 18 high around $0.11 stands as the first resistance level to retest, followed by $0.125.

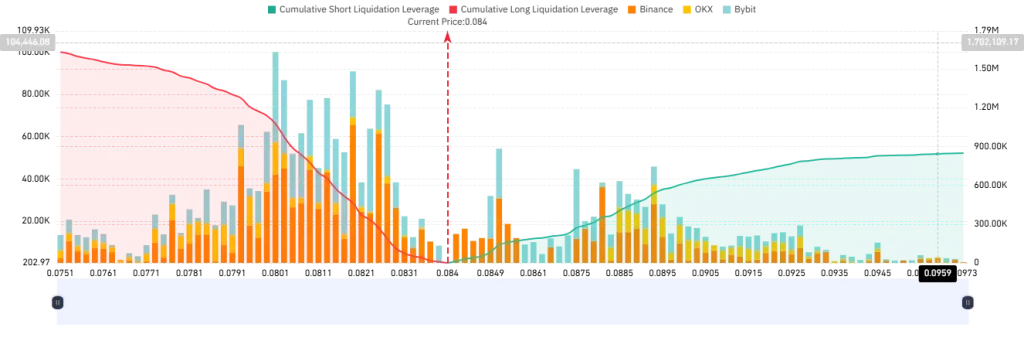

PLUME On-Chain Data Signals Market Uncertainty

From an on-chain perspective, the token is navigating a tense inflection point, with liquidation clusters signaling possible sharp moves in either direction. The token is currently trading near $0.084, a level that sits between major liquidation zones for both bulls and bears.

PLUME 1-Day Liquidation Map (Source: CoinGlass)

In the short term, a cluster of long liquidations worth about $1.07 million surrounds the $0.080 zone. Analysts warn that a break below this range could trigger a long squeeze, forcing leveraged buyers out and driving the price back toward the all-time low near $0.075.

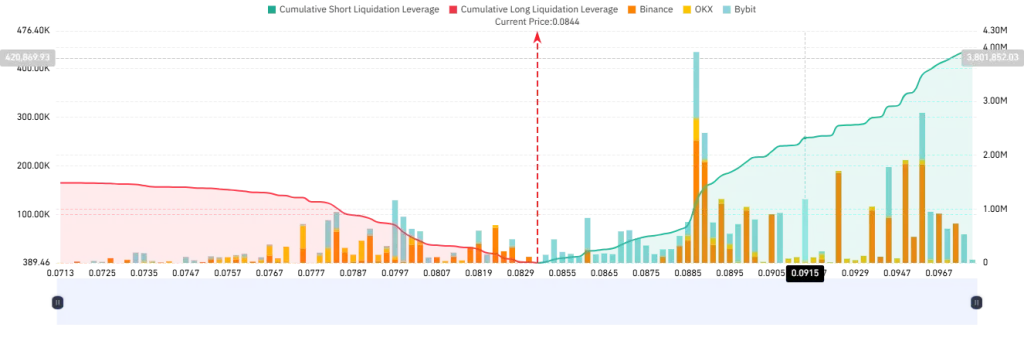

Such a move would signal renewed bearish momentum and highlight weak support for the token. On the other hand, the longer-term picture paints a more bullish scenario. Short positions totaling $1.14 million are concentrated near $0.088, while a larger $3.91 million in positions sit around $0.097.

PLUME 30-Day Liquidation Map (Source: CoinGlass)

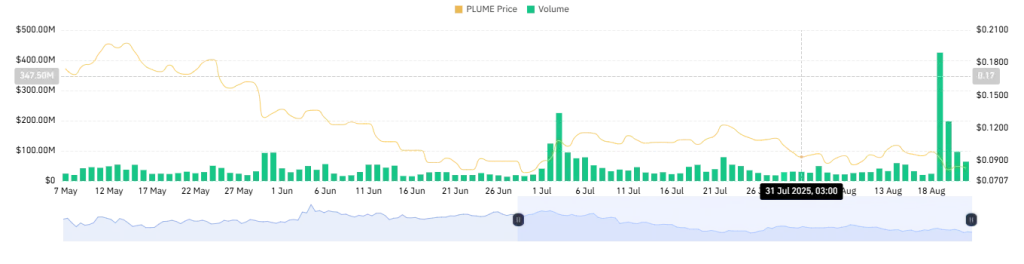

A break above these levels could spark a short squeeze, pushing the cryptocurrency toward the $0.11–$0.12 resistance range or even higher if momentum accelerates. The derivatives market is also signaling caution. Trading volume has plunged from an all-time high of $425.29 million on August 19 to just $64.19 million currently.

PLUME Derivatives Volume (Source: CoinGlass)

This steep decline highlights reduced participation and suggests that traders are waiting for a decisive move before committing further capital. With volatility now muted, PLUME’s next direction hinges on whether bears regain control or bulls force a breakout.