- XRP price concludes a two-month correction trend amid a bullish breakout pennant pattern.

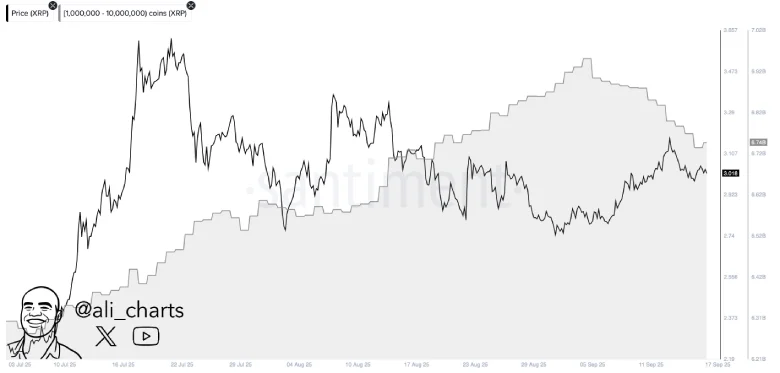

- Market Analyst highlights that crypto whales have offloaded around 200 million XRP in the last two weeks.

- Retail and leveraged traders expanded exposure, while large holders reduced positions.

On Wednesday, September 17th, the crypto market witnessed a bullish rebound as Fed Chair Jerome Powell announced a 0.25% rate cut at the September policy meeting. The move aligned with market anticipation for easing monetary policy, which bolstered Bitcoin’s price above $116,000 and the majority of altcoins, including XRP, with intraday gains. The rising XRP price recently triggered a breakout from a key continuation pattern, signaling an opportunity for a higher rally.

XRP Derivatives Market Signals Bullish Conviction

Over the last two weeks, the XRP price has witnessed a significant recovery, climbing between 2.70 and 3.07. This 14% price increase pushed the asset’s market capitalization to $184.4 billion.

Traders attribute the rise to market optimism ahead of the Federal Reserve policy meeting in September, as the likelihood of an interest rate drop supported risk-taking in digital assets. The price movement of XRP was replicated in the derivatives market, where futures open interest grew from $7.37 billion to $8.95 billion. The OI rose by 21%, indicating the new capital inflows and speculative activity.

Bullish sentiment was also encouraged by funding dynamics. The OI-weighted rate of the funding remained steadily positive at 0.0105%, indicating that long-position holders were willing to pay premiums to maintain their leverage. This continued optimism usually portrays a great conviction by the bullish traders.

Meanwhile, on-chain behavior showed opposing trends among the large holders. According to the report of market analyst Ali Martinez, whale wallets have sold about 200 million XRP during the past two weeks. The retail and leveraged traders increased their exposure during the distribution by major investors, implying a change in ownership concentration.

The interaction of spot gains, increasing derivatives activity, and whale outflows provides a complicated market background. Although larger optimism is attributed to macroeconomic policy has enhanced short-term momentum, the interplay between institutional-level sellers and retail-based futures demand could trigger a bearish turnaround.

XRP Price to Target $3.6 Amid Pennant Breakout

On September 11, the XRP price gave a bullish breakout from the resistance trendline of a bullish continuation pattern called a pennant. Theoretically, the chart setup is characterized by a long ascending trendline, which reflects the dominating uptrend in the market, followed by a short pullback within two converging trendlines to recuperate the exhausted bullish momentum.

As the macroeconomic development in the U.S. market caused an initial volatility in the crypto market, the XRP price showed a short pullback to $2.95 last weekend. However, the price rebounded quickly with a substantial surge in trading volume and currently trades at $3.08.

The coin price, holding its position above the 20- and 50-day exponential moving averages, reinforces the continuation of the prevailing price rally. These EMAs also act as a suitable support zone to drive a continued uptrend.

Now the XRP coin stands just 1.5% short of challenging the immediate resistance level at $3.12. A bullish breakout from this barrier could further accelerate the market buying pressure and bolster XRP to chase $3.38, followed by $3.66.

On the contrary, if the sellers continue to defend the $3.12 resistance, the XRP price could prolong its consolidation trend in the short term.

Also Read: STBL’s Price Surges 470%, Is the Rally Here to Stay?