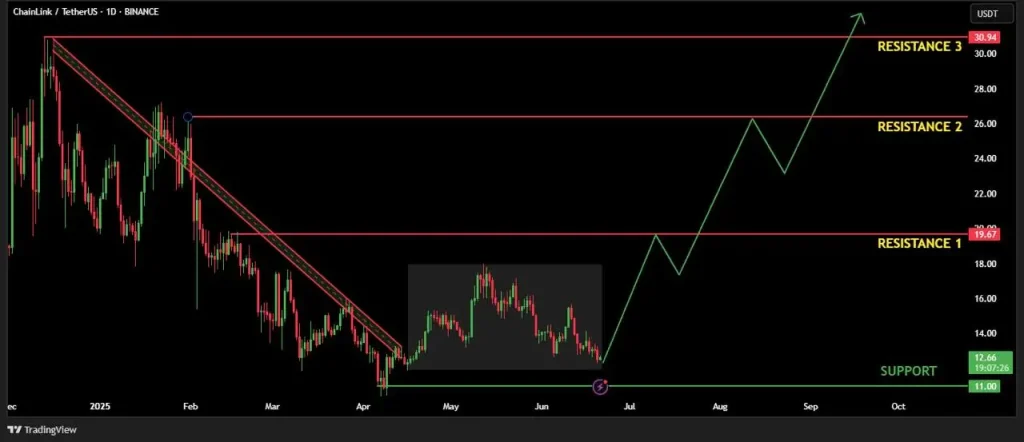

Chainlink is making waves again—this time with more than just a price spike. According to analysts at Santiment, LINK’s recent 11% rebound is backed by more than market hype. The number of non-empty wallets just hit an all-time high of 769,380, adding nearly 8,000 new holders (+1.05%) in the past month alone. But the real signal, they say, is hidden in who’s not moving.

Data shows a 17.3% drop in LINK wallets active over the past year—a sign that most holders are sitting tight. This isn’t a red flag. Santiment sees it as a green light. Historically, when fewer wallets are active and the average investor is down (as shown by the negative MVRV ratio), it often marks a low-risk entry zone before prices climb again.

LINK Price Chart (Source: X Post)

On June 23, 2025, LINK closed at $13.38 after hitting lows of $12.82, marking a strong bounce back above the $13.30 mark. Analysts point out that this recovery, paired with a steadily rising holder base, signals growing confidence in the project’s long-term value, even while short-term trading remains cautious.

LINK’s Calm Before the Storm? Analyst Charts Bullish Path

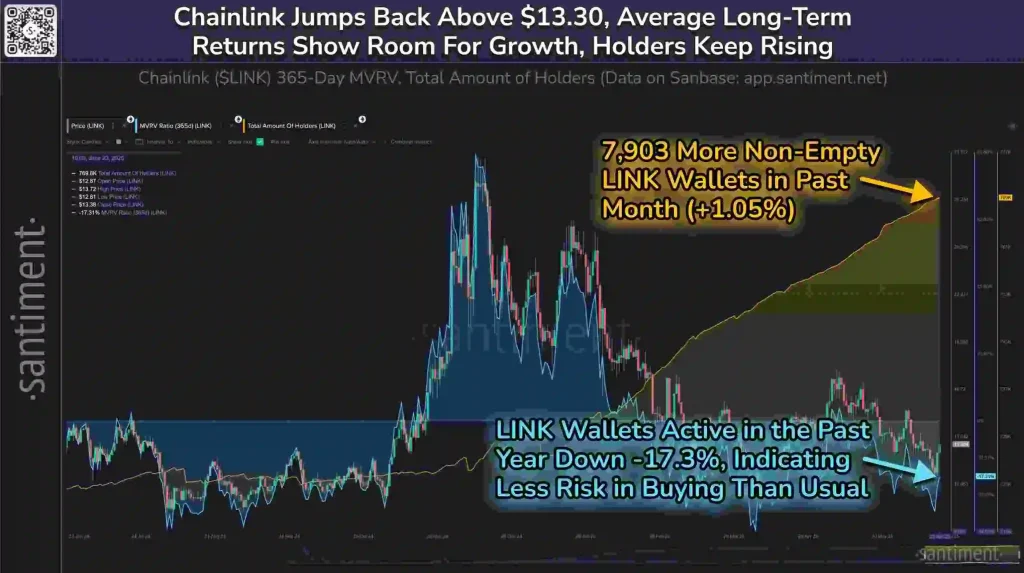

From a technical angle, crypto analyst Henry believes LINK’s tide is turning and fast after months of drifting in silence. According to his latest chart, the cryptocurrency has finally shattered its long downtrend and is now settling into a phase that traders often call “the calm before the breakout.”

Henry points out that the token has built a solid base just above $11, bouncing recently above $12. On his radar: a potential climb through resistance levels at $19.67 and $25 and possibly to $30.94. That would be more than double its current price, and this outlook aligns with recent Chainlink price prediction analyses suggesting a bullish long-term trajectory.

LINK Price Chart (Source: X Post)

“The downtrend is broken,” Henry noted, emphasizing the quiet accumulation happening now. He believes smart money is already positioning, while retail traders remain distracted by the lack of movement.

His chart outlines a simple story: sideways consolidation, three clean resistance targets, and a strong support base below. In short, it’s a setup that seasoned traders dream about. Henry warns, though—don’t chase it. “Don’t go in FOMO,” he says. “Go with my setup.”

While nothing in crypto is ever guaranteed, the numbers are aligning in Chainlink’s favor: rising adoption, quieter hands, and an undervalued signal based on wallet behavior. For savvy watchers, this might be more than just a bounce—it could be the build-up before the breakout.