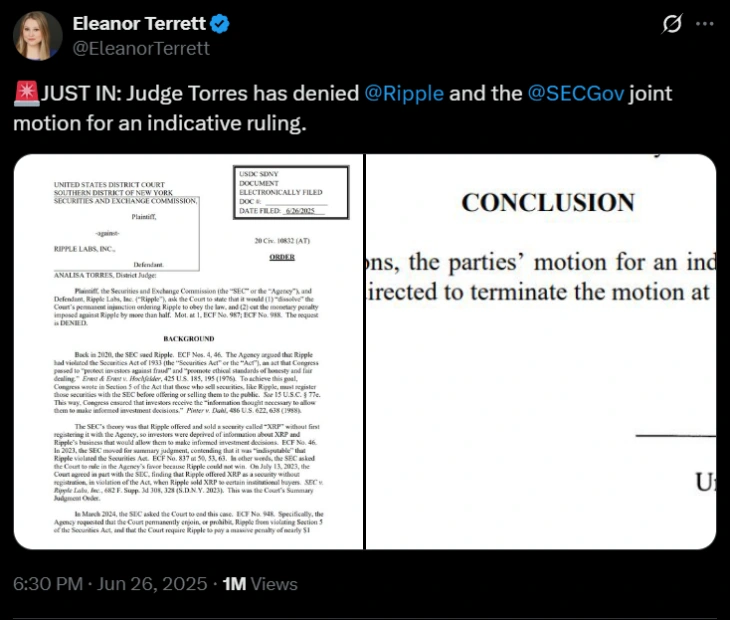

On June 26, District Judge Analisa Torres denied the joint motion requesting an indicative ruling to settle the protracted case between Ripple and the U.S. Securities and Exchange Commission. The decision has sparked disappointment in the XRP community, resulting in a decline of approximately 1.65% (hourly) in its value at the time of writing.

(Source: Eleanor Terrett on X)

Court Says No to Secret Ripple-SEC Deal

In denying the motion, Judge Torres revealed that private settlements can not override a court’s final judgment, which serves the public interest. She firmly stated that the parties lack the authority to circumvent the court’s ruling through mutual agreements, noting that Ripple and the SEC have failed to justify such an exception.

Judge Torres said: “The parties do not have the authority to agree not to be bound by a court’s final judgment. They have not come close to doing so here.”

In her statement, she gave two options to both parties to avoid the judgment. They can either withdraw their appeals and accept the court’s decision or proceed through the appeals process to contest it.

Stuart Alderoty, Chief Legal Officer at Ripple, posted on X, stating, “With this, the ball is back in our court. The Court gave us two options: dismiss our appeal challenging the finding on historic institutional sales—or press forward with the appeal. Stay tuned. Either way, XRP’s legal status as not a security remains unchanged. In the meantime, it’s business as usual.”

This ruling shows that judicial determinations hold precedence over private arrangements, which ensures that legal outcomes remain accountable to the public rather than just the involved parties.

In July 2023, the court ruled that XRP itself is not a security, meaning it does not automatically fall under strict SEC regulations like stocks or bonds. The digital token does not inherently qualify as a security under the Howey Test.

However, the court found that Ripple’s past sales of XRP to institutional investors (like hedge funds) were unregistered securities offerings because buyers expected profits from Ripple’s efforts.

On the flip side, public sales on exchanges were not considered securities transactions because there was no direct promise of profits from Ripple.

XRP Plunges by 3.19% as Ripple Holder Ratio Drops 50%

XRP has plunged by 3%, dropping its value $2.20 to $2.13, according to CoinMarketCap.

A new report from crypto exchange Bybit revealed that the number of Ripple (XRP) holders on its platform fell from 5% to 2.42% in the first half of 2025. Despite this short-term drop, the overall trend shows that XRP holders have grown over a longer period.

While the Ripple holder ratio fell by 50% in H1 2025, long-term data shows an upward trend.

Also Read: SEC’s Hester Peirce Hints at Potential Approval of In-Kind Redemptions for Crypto ETFs