Key Highlights:

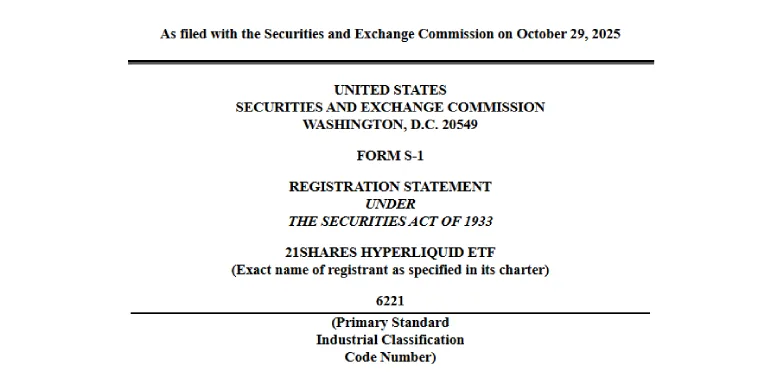

- 21Shares filed an S-1 application to launch a Hyperliquid spot ETF with the U.S. Securities and Exchange Commission today, October 29, 2025.

- 21Shares has also proposed a 2x leveraged version.

- The SEC’s faster review process signals quicker institutional access to crypto ETFs.

21Shares has submitted an S-1 application to launch the spot HYPE exchange-traded fund (ETF), asking the United States Securities and Exchange Commission (SEC) for approval to give institutions access to Hyperliquid’s native token and staking rewards. The application was filed today, October 29, 2025.

The SEC accepted the filing almost immediately, helped by the agency’s updated ETF approval process, which can now be as short as 75 days instead of 240 days (as per the previous timeline). This quicker timeline indicates a larger regulatory shift that is meant to modernize rules and meet the growing needs of crypto and investment products.

If approved, the HYPE ETF will be the first product that publicly follows Hyperliquid’s token performance via a traditional market format. The ETF product helps track the price and growth of the asset, something that was earlier possible for Bitcoin and Ethereum spot ETFs. ETFs not only provide a vehicle through which investors can invest in crypto without having to hold the crypto, but they also provide credibility, legitimacy to the crypto.

HYPE token has already climbed about 2% amidst market optimism and after 21Shares’ announcement. At press time, the price of the HYPE token stands at $49.01 with an uptick of 1.38% in the last 24 hours as per CoinMarketCap.

Additionally, the filing also includes a separate request for a leveraged 2x HYPE ETF, showing 21Shares believes demand will continue past early hype. This 2x fund would aim to deliver double HYPE’s daily return, targeting hedge funds and traders who prefer higher-risk products similar to leveraged ETFs tied to Bitcoin and Ethereum.

ETF Impact and Regulatory Focus

The main idea behind the filing is nothing but the growing demand for projects that generate yield through decentralized infrastructure. The ETF would hold spot HYPE tokens plus derivatives that are tied to staking rewards. Hyperliquid returns 97% of protocol income to token holders through regular buybacks and reward distributions.

But regulatory clarity is still an important factor. The SEC has not yet officially labelled HYPE as a commodity rather than a security, though comments from SEC research staff hint that HYPE’s decentralized design and open validator network could qualify it is as a “decentralized commodity”. This decision may come along with the approval of the ETF or before the approval.

Under the new fast-track review process that was introduced recently, states to speed up crypto-related filing. The SEC is supposed to give early comments (within 45 days), and a final decision is to be delivered within 75 days.

On this basis, it can be deduced that the ruling for the application can be expected near mid-January 2026.

Equity Perps Expansion and Market Impact

Hyperliquid’s new “equity perpetuals” are trading products that let people trade stocks and indexes 24/7. These products are becoming very popular, with about $72 million traded in a single day and $55 million currently locked in trades. Because more people are trading, Hyperliquid earns more fees, which in turn are used to buy back HYPE tokens so that the price of the token can be supported.

The risks still persist. These products act like stock trading, even though they are not regulated by authorities like the SEC, so they may attract scrutiny in the future.

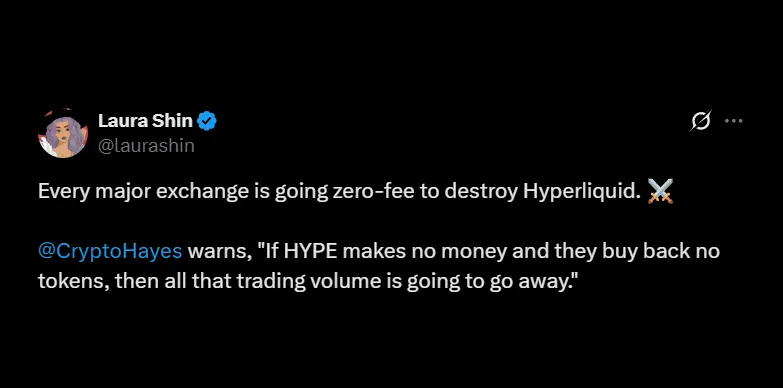

On top of all this, Arthur Hayes warned yesterday that some big crypto exchanges are now offering zero-fee trading to steal Hyperliquid’s users. If traders move aways because of free trading on other platforms, Hyperliquid will earn less in fees. This will lead to lesser token buybacks and possibly a drop in the token’s value. So basically, if the trading slows down, the entire reward system could suffer.

Also Read: Solana Faces Price Pullback Despite BSOL’s Biggest ETF Debut of 2025