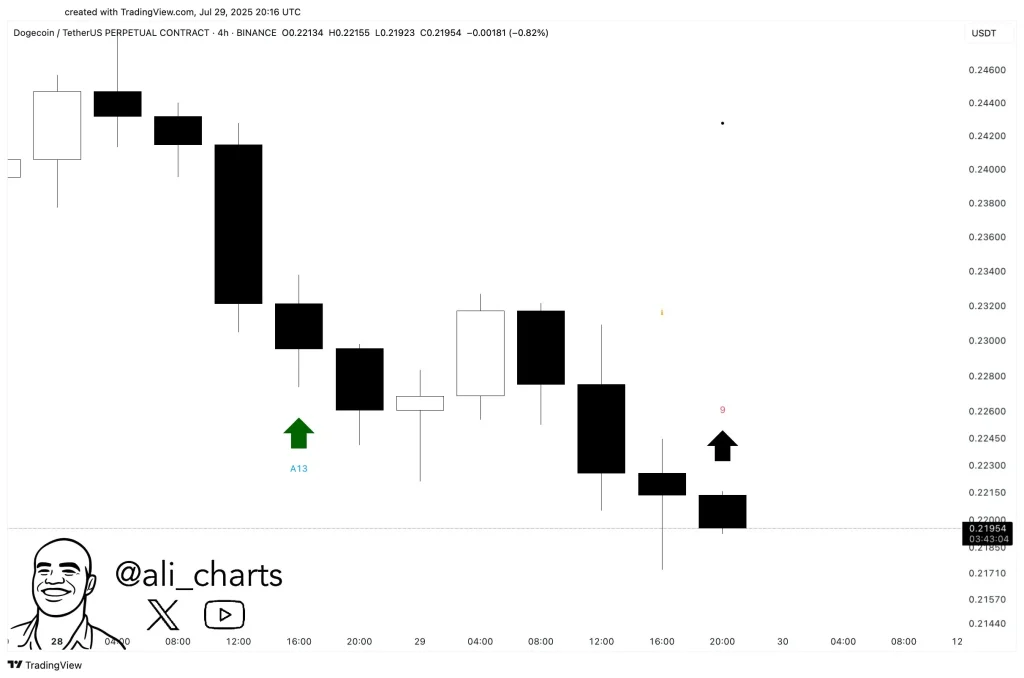

Dogecoin (DOGE) may be preparing for a short-term price rebound as a technical buy signal appears on the 4-hour chart. On July 29, crypto analyst Ali Martinez noted that the TD Sequential indicator printed a “9” buy setup near the $0.22 level.

According to the TradingView chart Martinez shared, this pattern could suggest a possible shift in momentum after several days of downward movement. TD Sequential has often been employed to spot potential turning points of price trends.

DOGE Price Chart (Source: X)

In this instance, the signal came after the token lost its price of $0.287 and dropped to approximately $0.217, which was equivalent to a loss of roughly 24%. The 9-count, as perceived towards the low edge of the range, is viewed as a possible pointer to seller fatigue and could indicate the initial days of a recovery.

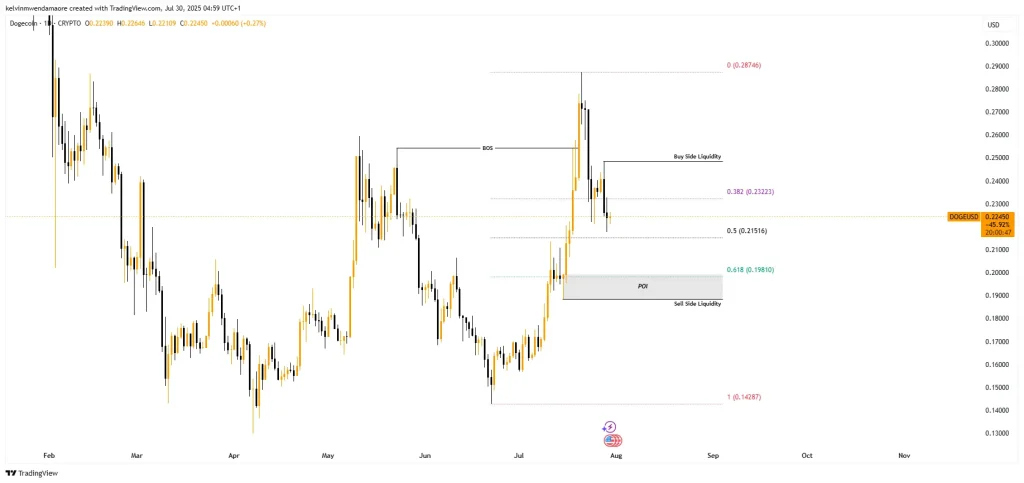

Key Levels to Watch

As of press time, DOGE trades around $0.224, just between two critical Fibonacci levels. The 0.5 level at $0.215 is acting as a safety net, while the 0.382 level at $0.232 represents near-term resistance. If the price closes below the 0.215 level on the daily chart, it may suggest continued downward pressure.

DOGE/USD Price Chart (Source: TradingView)

This might give the token a chance to explore the next support around the 0.618 level, which stands within the $0.198-$0.188 range. Concurrently, a daily close above the 0.382 Fib level may indicate renewed buying interest. This kind of breakout could open up the possibility of the cryptocurrency retesting the $0.30 zone.

However, the recent price action within these Fib zones indicates a neutral bias, where no side is in complete control. This type of sideways act is commonly observed preceding a bigger move, particularly when the traders are building stakes.

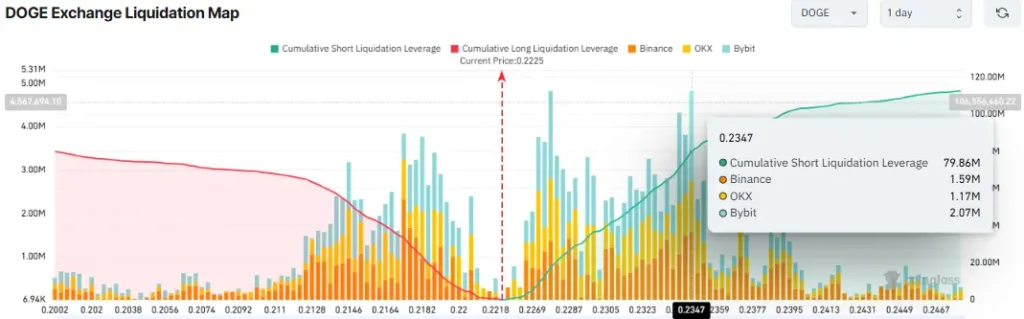

Massive Liquidations Set DOGE Up for Volatility

Dogecoin’s on-chain data continues to build a bullish case, though short-term caution remains. According to Coinglass, the cryptocurrency is currently priced around $0.2225, placing it near a large short liquidation cluster around the $0.2347 zone. At this level, over 79.86 million DOGE in short positions are exposed across exchanges like Binance, OKX, and Bybit.

DOGE Exchange Liquidation Map (Source: CoinGlass)

This puts DOGE in the vicinity of a significant bullish trigger. A close above this region would trigger a short squeeze that could propel the token’s price towards the 0.30 zone. On the other hand, caution is advised. Long liquidation pressure is building near $0.2173, where more than 33.46 million DOGE in leveraged longs are at risk.

Maintaining support above this level remains essential for preserving the current bullish structure. Yet, if the meme coin slips below it, it could activate downward pressure, possibly sending the token toward $0.198-$0.188 or even lower.